Four Stocks to Watch for a Big Move

Companies / Company Chart Analysis Jun 03, 2010 - 02:54 AM GMTBy: Mike_Stathis

I don’t make it a habit of analyzing short interest data. However, I always check the data when I initially scan a security because it can help when analyzing the charts.

I don’t make it a habit of analyzing short interest data. However, I always check the data when I initially scan a security because it can help when analyzing the charts.

Of course, if I want to design an entry/exit strategy, it becomes very important to know the short interest and the short interest ratio of the security in question.

The short interest is simply the percentage of outstanding shares that are currently short. The short interest is usually quoted in terms of the float, or the number of shares currently available for trading.

The short interest ratio (SIR) estimates the time it will take short positions to cover their shorts based on the average trading volume. It is reported in days.

You can calculate the SIR by the following simple equation:

Number of Shares Short

Short Interest Ratio = ---------------------------------------

Daily Average Trading Volume

Over the past few days, I managed to run across four stocks that stuck out like a sore thumb due to their high short interest ratio, all of which appear (on the surface) to be fundamentally sound.

If a company is sound, why would investors take short positions?

Investors take short positions for a variety of reasons. Sometimes you can determine why the stock has a large short position. Other times, there are no clear reasons because it will depend on the investment strategy of the funds that have taken short positions.

While there are numerous reasons investors take short positions, the four most common are:

- To bet on an earnings disappoint, downward guidance or revision

- Extreme overvaluation

- To hedge other positions in the portfolio

- As part of a long/short strategy (which can also include number 3)

When there is no obvious reason for a large short position, I have found that it is often due to extreme overvaluation or a large run up in shares. The higher a stock rises, the more optimism has been priced into the stock. And if it disappoints, shares could tumble.

Of course there are many other reasons why short interest can be high.

When analyzing short positions, you should also look for the duration of the short interest as well as the trend of decreasing or increasing short shares. In other words, you want to know how many shares have been short over the past 6 or 12 months.

This data is normally not available for free unless you have been tracking the stock. There are several services you can subscribe to receive this data, although it may not be worth the cost unless you are a very active trader and short frequently.

On the other hand, regardless of the situation, it is rare for the short interest to be high if the company is a megacap, like Microsoft (although large caps on occasion can have a large short interest ratio)*

* A specific case that comes to mind was that of Tyco. This was previously a company hailed by virtually every fund and money manager on Wall Street. Many called it the next GE. However, in early 2002 at a price of $55, I made the call that it would collapse after studying the trailing 12-month short-interest data. My determination was also based on suspicions of massive accounting fraud. Over the next seven months, shares collapsed to around $12.

When a stock has a large short interest ratio, it (often) means those who have taken a short position expect the stock to decline due to some event. Sometimes, investors simply pile onto the shorts due to a follower effect.

However, just because the short interest ratio is high does not mean the stock will fall hard. If something unexpected happens that causes the stock to rise, the shorts will rush to cover their position (or close the short). This will create an accelerated buying spree that will often cause they stock to soar. This is of course known as a short squeeze because the shorts get squeezed out of their position.

Thus, some investors buy stocks than have large short interest ratios, hoping for a short squeeze. Of course, sophisticated investors don’t blinding go long hoping for a squeeze. They most often have other information that leads them to believe that the shorts have misinterpreted or exaggerated their analysis.

A short squeeze is more frequent with small or micro cap stocks, especially when the float is small.

There are many things that can cause a stock to rise. First, the shorts might be wrong. Instead of a big earnings miss, the company might report a huge upside. But even a rising stock market can cause they stock to rise. However, when funds short a stock they usually adjust for potential market movements so as to offset this possibility. This can be accomplished in many ways. I don’t want to stray off of the topic so I won’t go into that.

In this article I am going to briefly discuss these stocks.

I will follow up with an analysis of each, identifying the best candidate for a short in the June issue of the AVA Investment Analytics newsletter.

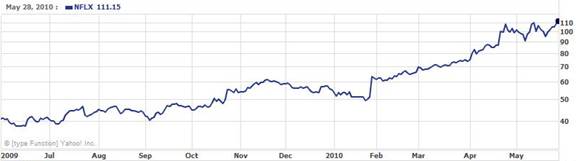

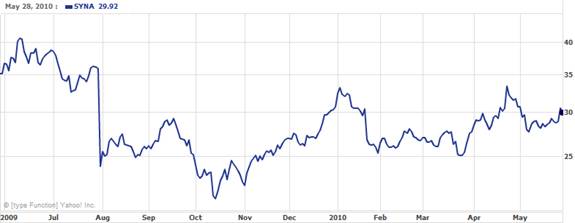

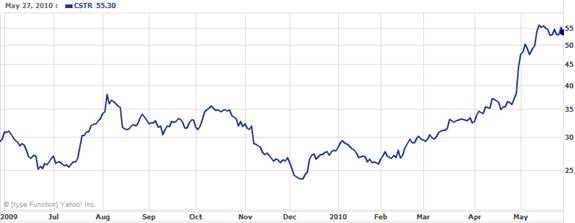

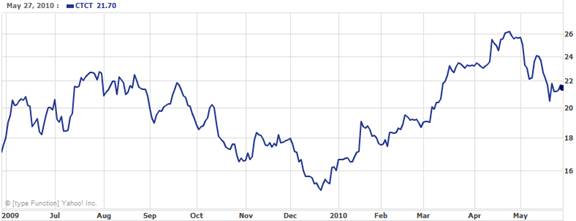

The four stocks with large short interest ratios are Netflix (NFLX) at 27.5%, Synaptics (SYNA) at 44%, Coinstar (CSTR) 24.9%, and Constant Contact (CTCT) at 30.1%.

One could argue that each firm is strongly positioned within their respective industries. In fact, you could even argue that each is an industry leader. This is one reason why I found it noteworthy that each had a large short interest.

So what I plan to do is give you a brief commentary on each one and let you decide whether you want to play the short or the squeeze, or maybe just do nothing at all and watch what happens.

Netflix, Inc. (NFLX) is in the driver’s seat of the video rental industry. Great management, a formidable strategy, superior cash management and brilliant execution took this once small business and made it into a multibillion powerhouse in less than 15 years.

You might want to read a recent article I wrote which discussed predictions I made a few years ago regarding NFLX and Blockbuster. http://www.avaresearch.com/article_details-556.html

Synaptics, Inc. (SYNA) is the world leader of interface solutions for digital devices. Chances are high that your laptop computer uses Synaptics touch pad. Synaptics also provides touch pads for smart phones, MP3s, video and many other devices.

If you happen to follow this stock, you might recall shares collapsed overnight a few years ago after Apple announced it would not be using Synaptics any longer. Historically, SYNA has had an off and on relationship with Apple.

Coinstar, Inc. (CSTR) rose to prominence first with its coin vender machines which count your coins and issue you a receipt which can be redeemed for cash or a voucher at various retail outlets across America. Despite the rapid growth of these kiosks, the company remained out of the investment limelight.

Then, management rolled out a new kiosk that proved to be disruptive to the video rental industry at a time when Blockbuster was facing huge competitive pressures from Netflix. These kiosks of course are known as RedBox. For the price of $1 (plus tax) per 24-hour period, you can rent out movies conveniently located at the entrance of popular retail chains such as Walgreens, Albertsons, Krogers, etc. In the early stages, Red Box offered a limited selection of movies that appealed to consumers. Eventually, management struck deals with production companies to obtain newer releases and more popular titles.

Constant Contact, Inc. (CTCT) is an email marketing service provider that allows companies to grow and maintain a list of online users, send out newsletters, announcements, conduct surveys and many other tasks at a flat monthly rate that depends on the number of emails in the customers’ database. This is an industry that has grown rapidly since the passage of the CAN SPAM laws took effect. Today, there are dozens of these companies, but CTCT is the largest.

Note that all four of these stocks have one thing in common to note. They are all Nasdaq stocks. Knowing this in itself implies certain cause-effect relationships.

While the presence of a large short interest ratio is by itself no guarantee that shares will fall, the chances that shares will be volatile are fairly high depending up the time frame.

I will finish this analysis in the June issue of the AVA Investment Analytics newsletter, along with many other topics. For a partial sample of past newsletters see here.

http://www.avaresearch.com/article_details-500.html

By Mike Stathis

www.avaresearch.com

Copyright © 2009. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher. These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.