Gold Rises in Yen on Japanese PM Resignation; Premiums for Physical Bullion Rising Again

Commodities / Gold and Silver 2010 Jun 02, 2010 - 07:04 AM GMTBy: GoldCore

Gold rose again yesterday on safe haven demand due to falling stock markets after growing concerns about the impact of the oil spill in the Gulf of Mexico and continuing concerns about contagion in the eurozone. Gold initially rose in Asia before giving up those gains and falling as low as $1218/oz in early European trading.

Gold rose again yesterday on safe haven demand due to falling stock markets after growing concerns about the impact of the oil spill in the Gulf of Mexico and continuing concerns about contagion in the eurozone. Gold initially rose in Asia before giving up those gains and falling as low as $1218/oz in early European trading.

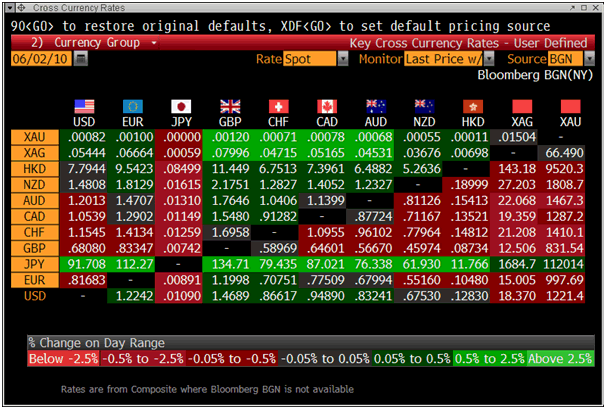

Gold is weaker in all currencies today, except the Japanese yen which has seen its safe haven currency credentials questioned after the Japanese Prime Minister, Hatoyama, resigned. He is the fourth Japanese prime minister to resign in four years. Gold is currently trading at $1,222/oz and in euro, GBP, CHF, and JPY terms, at €997/oz, £832/oz, CHF 1,410/oz, JPY 112,060/oz respectively (see Cross Currency Table below).

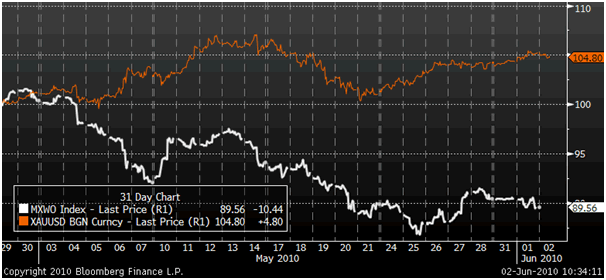

Gold and the MSCI - 30 Day (Daily).

The Nikkei fell and Asian equities were mixed but European indices have fallen sharply as Europe's sovereign debt woes continue to undermine confidence. The month of May and start of June has seen gold's safe haven properties realised and its inverse correlation with equities has again been clearly shown. While gold is up by nearly 5% in the period, the benchmark global indices, the MSCI, is down by more than 10% (see chart above). Investors with an allocation to gold would have seen reduced volatility and again seen their returns enhanced in May - as they would have done in the last 10 years and throughout history.

Gold Sovereigns - 1 Year (Daily).

Physical demand remains robust and premiums on gold bullion coins continue to rise. The FT reported at the weekend how premiums on British gold sovereigns had increased from 3% to over 7% in just one month on British sovereigns as British investors buy the coins as they do not attract CGT (see chart above). Recent buying has seen supply issues develop in the gold sovereign market which could see a further rise in premiums in the coming weeks.

There are estimated to be some 1 billion gold sovereigns in the world as they have been minted since the first of them was created for Henry VII in 1489. However, the sovereign market place and the physical gold market is tiny compared to equity, commodity, bond, currency and derivative markets.

Silver

Silver is currently trading at $18.40/oz, €15.00/oz and £12.51/oz.

Platinum Group Metals

Platinum is trading at $1,546/oz and palladium is currently trading at $457/oz. Rhodium is at $2,625/oz.

News

The US Mint has sold 190,000 1-ounce gold coins, CNBC reported, citing Reuters. The US Mint sold 190,000 ounces of American Eagle gold bullion coins last month, the most since sales of 231,500 ounces in December as data on its website show. The data includes coins sold in one-ounce, half-ounce, quarter-ounce and one-tenth of an ounce sizes (Bloomberg).

The Perth Mint has launched the latest edition of its Australian Koala gold proof coins. Made from 99.99 per cent pure gold, the 2010 version of the coin comes in four different sizes, with the one-ounce piece featuring a high relief design struck on a particularly thick blank, Coin Update reports. A picture of a young koala in a tree can be found on the reverse of the coin, while the Ian Rank-Broadley effigy of Queen Elizabeth II is on the obverse. The coin also includes the historic 'P' mintmark. Just 250 of the two-ounce gold coins will be made, while the one-ounce coin is limited to 2,000 units. A total of 5,000 one-tenth ounce coins will be minted, along with 15,000 of the one-25th ounce pieces. Other collectors' gold coins recently released by the Perth Mint include the 2010 proof Australian sovereign and the 0.5 g Mini Roo coin (World Gold Council).

Average cash costs at gold mines rose to $544 an ounce in the first quarter, the most in at least two years, Fortis Bank Nederland/VM Group said in a report. Average cash costs for mining gold rose $91, or 20 percent, in the last 12 months, according to the report (Bloomberg).

The price of gold in India touched an all-time high yesterday on uncertainty in global markets and a weak rupee, DNA newspaper reported. Standard gold in Delhi reached the 19,000 rupees mark, while in Mumbai the metal closed at 18,750 rupees per 10 grams, up 345 rupees from the previous day. Gold futures in India, the largest consumer of the precious metal, advanced for a second day to a record, spurred by a weaker domestic currency and gains in global prices of bullion. August-delivery futures rose as much as 0.7 percent to an all-time high of 18,850 rupees ($400) per 10 grams on the Multi Commodity Exchange of India Ltd. The contract traded at 18,808 rupees at 12:02 p.m. in Mumbai (Bloomberg).

Silver held in ETF Securities Ltd.'s European and Australian exchange-traded products added 0.1 percent to a record 27.807 million ounces yesterday, according to the company's website. The company's European and Australian palladium holdings fell 1.8 percent to 504,888 ounces (Bloomberg).

The risks of "depression" and currency crises in Europe and the US are rising, said Ashmore Investment Management Ltd.'s Jerome Booth. "We should not talk about credit crunch in the past tense, we should not talk about rosy scenarios of recovery without realising that, at best, that may be a 65 percent probability event," Booth, who helps oversee about $33 billion in emerging markets as head of research at Ashmore, said at a LatinFinance conference in London. "We have risk of major currency crises in Europe and the United States. The risk of depression today is significantly higher than it was a year ago," Booth said (Bloomberg).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.