Gold Rises to New Record Highs to Over Euros 1,000

Commodities / Gold and Silver 2010 Jun 01, 2010 - 07:02 AM GMTBy: GoldCore

Gold is the strongest currency in the world today and has risen to $1,220/oz and over €1,000/oz with a variety of macroeconomic and geopolitical headwinds supporting the yellow metal. These include geopolitical risks in the Koreas and in the Middle East, the macroeconomic risks posed by the continuing sovereign debt crisis, concerns about the euro and growing concerns about a double dip recession.

Gold is the strongest currency in the world today and has risen to $1,220/oz and over €1,000/oz with a variety of macroeconomic and geopolitical headwinds supporting the yellow metal. These include geopolitical risks in the Koreas and in the Middle East, the macroeconomic risks posed by the continuing sovereign debt crisis, concerns about the euro and growing concerns about a double dip recession.

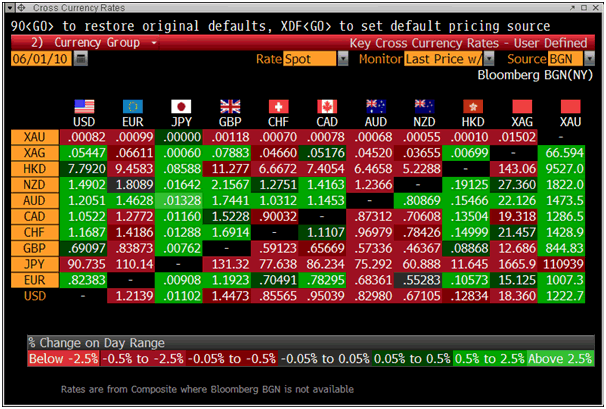

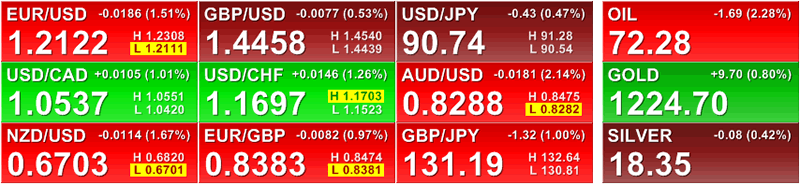

Risk aversion has increased with equity markets internationally under pressure due to the poor Chinese manufacturing data and continuing sovereign debt concerns in the eurozone. Gold is currently trading at $1,222/oz and in Euro, GBP, CHF, and JPY terms, at €1,007/oz, £845/oz, CHF 1,428.58/oz, JPY 110,933/oz respectively.

The growing environmental catastrophe in the Gulf of Mexico may also have ramifications for markets. The financial cost of tackling the oil spill in the Gulf of Mexico, the worst in US history, now stands at nearly $1 billion as BP prepares for its latest attempt to stem the flow of oil. Scientists are concerned that the massive oil spill could kill much of the invertebrate and fish in the sea and this could ripple across the food chain leading to even higher food prices and inflation. US wholesale food prices are up 6.8% in the past year. Food prices for the month rose by 2.4%, the sixth consecutive monthly increase and the largest jump in over 26 years. This jump in inflation has come at a time of dollar strength and should the dollar experience another period of weakness (which seems likely) then inflation could rise significantly.

Gold has risen again due to continuing economic uncertainty in the eurozone. This is not being helped by the increased degree of political uncertainty as seen in Germany where President Kohler has resigned due to remarks he made supporting the war in Afghanistan.

A close above $1,230/oz could see us quickly surge to surpass the recent record (nominal) high of $1,248/oz. Gold's support is at $1165/oz and $1185/oz.

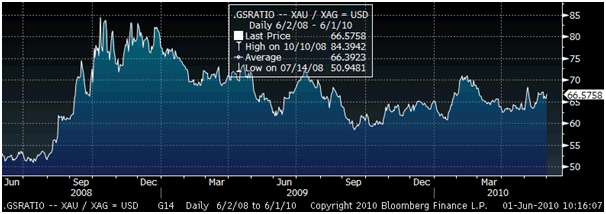

Silver

Silver is currently trading at $18.35/oz, €15.13/oz and £12.69/oz. Silver remains very undervalued versus gold and has massively underperformed gold remaining less than half of its nominal high of $50/oz in 1980. This should change in the coming months and should see silver outperform and play catch up with gold resulting in the gold/silver ratio falling over time.

Platinum Group Metals

Platinum is trading at $1,545/oz and palladium is currently trading at $456/oz. Rhodium is at $2,675/oz.

News

Gold may advance to $1,400 to $1,450 an ounce by the end of the fourth quarter following an "anticipated consolidation phase" earlier in the year, Commerzbank said in a technical analysis report (Bloomberg).

India gold futures recovered from their previous day's losses on Tuesday afternoon to hit a fresh all-time high following strong overseas (Economic Times).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.