Stock Market Volatile Corrective Range, Debt Deflation Escape Velocity Towards Inflation

News_Letter / Financial Markets 2010 May 31, 2010 - 12:56 PM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

May 23rd, 2010 Issue #32 Vol. 4

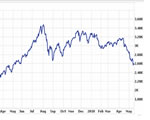

Stock Market Volatile Corrective Range, Debt Deflation Escape Velocity Towards InflationInflation Mega-Trend Ebook Direct Download Link (PDF 3.2m/b) Dear Reader The week started the way it ended - VOLATILE, the Dow came up for a breath of air on Monday by rallying some 100 points above the previous weeks close to 10718, only to be pulled back under water all the way to the bottom of its range, culminating in Fridays sinking towards the low end of its 10,900 to 9,800 range by putting in a low of 9,919. Thursdays stock market violence triggered the perma-bears to start growling again as a crescendo of short this that and the other bear market calls have returned, as illustrated by Nouriel Roubini's call that the stock market could fall by 20% over the next few months which implied a target of 8,150 on CNBC at Dow 10,185, but Houston we have a problem, read more here. Last weekends in depth analysis concluded with a volatile SIDEWAYS trading range into mid July 2010, between a range of 10,900 and 9,800 with the immediate trend expected to target the lower end of the range by early June as illustrated by the below conclusion and graph (16 May 2010 - Stocks Bull Market Hits Eurozone Debt Crisis Brick Wall, Forecast Into July 2010) Stock Market Conclusion Despite the flash in the pan crash and prevailing Eurozone sovereign debt default gloom and doom, the bottom line is that this is still a stocks bull market with the Dow ONLY down less than 6% from its bull market peak. Therefore the sum of the above analysis concludes towards the stocks bull market under going its most significant and a highly volatile correction since its birth in March 2009 (15 Mar 2009 - Stealth Bull Market Follows Stocks Bear Market Bottom at Dow 6,470 ). This correction could last for several months and may extend all the way into early October, which suggests that the next 2 months are going to see an ABC correction to be followed by a sideways price action between the extremes of 10,900 to 9,800 and so despite continuing wild gyrations I would not be surprised if the Dow is little changed from its last closing price of 10,620 in 2 months time (16th July 2010). Expectations remain for the bull market to resume its trend towards a target of between 12k to 12.5k by late 2010 after the tumultuous trading period over the next few weeks. I have tried to illustrate a more precise Dow forecast projection in the below graph, reality will probably end up being far more volatile.

The stock market correction's assault on the low resulted in the Dow being propelled back up towards the mid way balancing point of the range at 10,350 which implies continued overshoot to above 10,400 in the immediate future. My original expectations remain for a volatile stock market that targets a bottom in about 5 to 10 days in the target range of 9,800 to 9,850 within a trading range of 10,900 to 9,800, therefore the Dow is expected to trade back below 10k by early June. However the big picture is for this trading range is to eventually resolve to the upside, the forecast expectation is for the Dow to possibly remain stuck in the trading range until mid July, though it is a difficult call to make as to exactly when the Dow will make the breakout higher. Gold and the Inflation Mega Trend Gold Buying Opportunity! Notice no question mark, Gold's tumble to about $1,175 is healthy as my immediate take on the event concluded on Thursday (20 May 2010 - Gold Plunge to $1,175 a Buying Opportunity? ). Gold falling towards $1,150 is not even making me blink, its a non event, normal, expected even if I had not written about it before hand, its much better for Gold to be at $1,175 then to have risen to $1,300 BEFORE correcting, the bull is shaking the loose clingers on off of its back. I don't trade gold, but I am a long-term holder with a small investment position that I aim to increase. Don't forget the big picture of the INFLATION MEGA-TREND (Ebook Free Download), all that money printed by our respective central banks can only end in INFLATION - Not DEFLATION, Gold at $1,175 is a manifestation of INFLATION NOT DEFLATION, the same goes for other commodities and assets to varying degrees as fiat currencies fight to competitively devalue towards Very High Inflation, where its only going to be rare assets such as Gold left standing, especially as we have all recently watched the European Central Bank go from a non-money printer to burning the Euro without limit in its quest to prevent a sovereign debt triggered Eurozone collapse! Though I must admit I was surprised to see the U.S. Fed apparently sending billions of dollars to support the Euro. So the U.S. is now printing money for the Europeans too! The dollar is rising because every currency is falling at different deflationary debt deleveraging escape velocities Towards INFLATION. Your smoke monster analyst wondering if he will be in any shape to watch the LOST finale at 5am (UK)! Comments and Source: http://www.marketoracle.co.uk/Article19726.html By Nadeem Walayat Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

By: Nadeem_Walayat Are the markets manipulated ? Are they ? You have been repeatedly told by those that clearly don't immerse themselves in trading on a regular basis that they are not manipulated instead the movements are a function of some ordered theory that implies certainty of outcome when all one can do in reality is to conclude towards a probability of outcome that are usually little better than 60/40, well on the 6th everyone got the answer that they should imprint into their memories that the markets REALLY ARE manipulated. If your going to learn one lesson from 2010 then let that be the lesson learned. Contemplate on it, let it sink in, let it skew how you interpret price action and maybe you too can join in on future market manipulations!

By: Gary_North The euro is falling. It is at the lowest exchange rate to the dollar in four years. Confidence in the euro is falling because it is becoming clear that the region's commercial bankers have made the same sorts of bad decisions that American commercial bankers made after 2000. They loaned money to debtors in Eastern Europe who will not be able to repay. These loans were collateralized by real estate, which rose. Real estate prices in Eastern Europe are now falling. The bubble has popped.

By: Shaily While none of us predicted the massive crash of May 6 2010, premium readers at Investing Contrarian were fully aware of a S&P fall to 1120 from 1190 which was the day when we initiated short position.

By: STRATFOR Rumors of the imminent collapse of the eurozone continue to swirl despite the Europeans’ best efforts to hold the currency union together. Some accounts in the financial world have even suggested that Germany’s frustration with the crisis could cause Berlin to quit the eurozone — as soon as this past weekend, according to some — while at the most recent gathering of European leaders French President Nicolas Sarkozy apparently threatened to bolt the bloc if Berlin did not help Greece. Meanwhile, many in Germany — including Chancellor Angela Merkel herself at one point — have called for the creation of a mechanism by which Greece — or the eurozone’s other over-indebted, uncompetitive economies — could be kicked out of the eurozone in the future should they not mend their “irresponsible” spending habits.

By: Martin_D_Weiss Martin Weiss: Just days ago, the cradle of Western democracy — Greece — was in flames! Rioters attacked banks, businesses and government buildings. The entire country plunged into chaos. Spain, Portugal, Italy and even the United Kingdom were reeling. The euro was crushed. Then, as we have warned you consistently and persistently, the raging storm in Europe struck our shores … ripped through our corporate bond market … created chaos in our stock market … and threatened to derail our already-fragile economic recovery.

By: Steve_Betts “I wouldn't call it fascism exactly, but a political system nominally controlled by an irresponsible, dumbed down electorate who are manipulated by dishonest, cynical, controlled mass media that dispense the propaganda of a corrupt political establishment can hardly be described as democracy either.” --- Edward Zehr

By: Pravda Most of us are aware of the very old fairly tale by Hans Christian Andersen in which two weavers promise an emperor the finest suit of clothes imaginable, but from a fabric invisible to anyone who is unfit for his position or "just hopelessly stupid". Well, in the fairy tale it turns out that nobody wants to admit that they are "unfit" or "stupid", so when the emperor parades before his subjects in his imaginary new suit of clothes, it takes a child to cry out: "But he isn't wearing anything at all!"

By: Jon D. Markman Jon D. Markman writes: Stocks scattered across the capital markets last week like the unwanted children of a terrible divorce, as a blunted rally following a global margin call put a hex on every sector and most commodities - but a U.S. recovery marched on. So far in the ten sessions of May, the Dow Jones Industrial Average is down 3.6%, the Nasdaq 100 is -4.7%, the S&P SmallCap 600 is -3.1% and overseas large-caps are down 8.6%.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.