SPX Establishes Lower Low As China Stocks Reverse Higher

Stock-Markets / Financial Markets 2010 May 30, 2010 - 12:04 PM GMT FDIC Friday anticipates a Summer break. - The FDIC Failed Bank List announced five new bank closures this week. And I thought the

examiners would have a long vacation over the Memorial Day weekend! Weiss Ratings just

published their list of weakest banks.

FDIC Friday anticipates a Summer break. - The FDIC Failed Bank List announced five new bank closures this week. And I thought the

examiners would have a long vacation over the Memorial Day weekend! Weiss Ratings just

published their list of weakest banks.

U.S. Stocks, Oil, Euro Tumble as Treasuries Rally on Spain - U.S. stocks slid, capping the worst May for the Dow Jones Industrial Average since 1940, while the euro slumped and Treasuries rose as a downgrade of Spain’s debt rating and escalating tensions on the Korean peninsula triggered a flight from riskier assets.

The Dow tumbled 122.36 points, or 1.2 percent, to 10,136.63 at 4 p.m. in New York and lost 7.9 percent this month. The Standard & Poor’s 500 Index sank 1.2 percent to 1,089.41, led by financial shares on the Spanish downgrade and energy companies after U.S. President Barack Obama extended a moratorium on new deep-water drilling. Oil erased gains after rallying as much as 1.6 percent to more than $75 a barrel. Ten-year Treasury yields decreased 7 basis points to 3.3 percent. The euro slipped 0.7 percent to $1.2273.

A Continent Of Lies And Broken Promises - Openeurope.org.uk has put together a paper of the most blatant half-truths, propaganda, and outright lies, abused by Europe not only over the past month, but also over the past 10 years, for the entire duration of the now rapidly collapsing eurozone experiment. As the paper notes: "More than ten years since the euro was launched, and with the single currency facing its greatest ever crisis, the parameters have radically changed. Amid all the uncertainty, one thing has become painfully clear: the EU elite simply got it wrong on the euro."

The VIX pulls back, ready for next attack out of the megaphone.

--The VIX pulled back within its

Broadening Formation this week.

It remained above its 10-week

moving average at 25.28. The

pullback took longer than expected,

due to the approach of the

Memorial Day weekend.

--The VIX pulled back within its

Broadening Formation this week.

It remained above its 10-week

moving average at 25.28. The

pullback took longer than expected,

due to the approach of the

Memorial Day weekend.

The setup appears as an inside week, a time of indecision, while the VIX gathers strength for the next onslaught.

The NYSE (weekly) Hi-Lo index rose to 11, but remained in bearish territory for the week. The percentage of stocks selling above their 50-day moving average rose from 8 to 17.20 this week, but also remains in bearish territory.

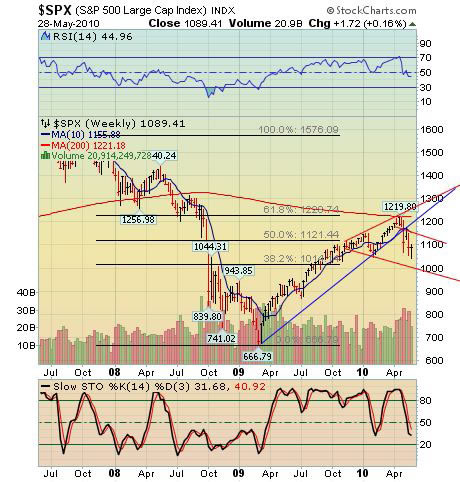

The SPX establishes a lower low.

--The SPX made yet a second low

below its “flash crash” low this

week. I had expected the SPX to

close at or near its retracement high,

but some big money pulled the

trigger and sold in the last 20 minutes

of the session. What a turnaround!

--The SPX made yet a second low

below its “flash crash” low this

week. I had expected the SPX to

close at or near its retracement high,

but some big money pulled the

trigger and sold in the last 20 minutes

of the session. What a turnaround!

You are looking at a very bearish pattern in the SPX. The new lows from May 6th have firmly established a new downtrend. It’s time to prepare for a multiple month decline lasting through August to November.

The setup is so bearish that I expect to see another “flash crash” of even greater magnitude on Tuesday or Wednesday.

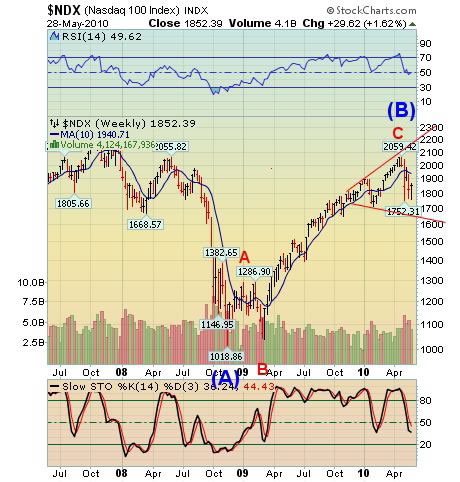

The NDX did not go lower.

--The NDX is still hesitant to take

out its “flash crash” low. The bounce

closed the week near the top of the

range that I had suggested last

weekend. The most powerful phase

of the decline, including the potential

for a market closure, lies directly

ahead of us. Unfortunately, the more

positive looking profile in the NDX

means that there will be more

investors caught in the downdraft

when the trap door swings open.

--The NDX is still hesitant to take

out its “flash crash” low. The bounce

closed the week near the top of the

range that I had suggested last

weekend. The most powerful phase

of the decline, including the potential

for a market closure, lies directly

ahead of us. Unfortunately, the more

positive looking profile in the NDX

means that there will be more

investors caught in the downdraft

when the trap door swings open.

This setup reminds me of the close on Friday, October 3, 2008. The NDX closed at 1470. The following Monday it opened at 1426. This time the market has the advantage (for the bears) of a three-day weekend.

Gold has begun its final ascent.

-- Gold appears to have begun its

wave (v) of 5, its final surge before

its collapse. It has multiple targets

that it may achieve. On this chart,

for example, cycle wave (v) equals

cycle wave (i) at 1370. On the

Super cycle chart, Cycle wave (5)

equals Cycle wave (1) at 1350. The

H&S target is a more modest 1295.

On the bearish side, a drop below

1170 calls for a broken uptrend and

collapse.

-- Gold appears to have begun its

wave (v) of 5, its final surge before

its collapse. It has multiple targets

that it may achieve. On this chart,

for example, cycle wave (v) equals

cycle wave (i) at 1370. On the

Super cycle chart, Cycle wave (5)

equals Cycle wave (1) at 1350. The

H&S target is a more modest 1295.

On the bearish side, a drop below

1170 calls for a broken uptrend and

collapse.

The top view as long as the rally remains intact is that the rally may continue beyond 1300.

Oil makes a final retracement prior to its crash.

Last week I had mentioned that

$WTIC had met the bottom trendline

of its Broadening Formation (as has

USO), and predicted more downside

before this decline is finished.

Although the bottom trendline of the

Broadening Formation is not

generally viewed as strong support

for a bounce, the cycle timing was

such that it happened anyway.

Last week I had mentioned that

$WTIC had met the bottom trendline

of its Broadening Formation (as has

USO), and predicted more downside

before this decline is finished.

Although the bottom trendline of the

Broadening Formation is not

generally viewed as strong support

for a bounce, the cycle timing was

such that it happened anyway.

That has altered my view only to a small degree, since a very sharp and large decline is now upon us in oil as well. If we view this as a complex head and shoulders pattern, with this week’s action representing the right shoulder, the next target is 49. This agrees with the average decline from a broadening top falling in the area of 50-52.

The Bank Index decline gains momentum.

Despite the rally earlier this week,

the $BKX is beginning to gain

momentum to the downside with a

lower weekly close.

Despite the rally earlier this week,

the $BKX is beginning to gain

momentum to the downside with a

lower weekly close.

Remember that the $BKX is one of the leading sectors in this decline.

Because of that, I am more bearish on it than the $SPX, for example. The next target for $BKX is 32, provided it does not extend. That means that the BKX as well as the other indices (except gold) will have all fallen to the bottom trendline or below their Broadening Top formations.

The Shanghai Index appears to have reversed.

--The Shanghai Index appears to be

in the early stages of a major reversal

to one of the retracement targets

above 3500. You may recall that I

had been suggesting for the past two

weeks that a pivot window was open

for a major reversal in FXI and

$SSEC. The pivot actually occurred

on May 21st, two weeks beyond my

“perfect turn” date. An inversion of

the Shanghai market to the U.S.

equities poses an interesting

question. Could it be that some

event may trigger a flow of money

from the U.S. to China? I am still

waiting for the answer.

--The Shanghai Index appears to be

in the early stages of a major reversal

to one of the retracement targets

above 3500. You may recall that I

had been suggesting for the past two

weeks that a pivot window was open

for a major reversal in FXI and

$SSEC. The pivot actually occurred

on May 21st, two weeks beyond my

“perfect turn” date. An inversion of

the Shanghai market to the U.S.

equities poses an interesting

question. Could it be that some

event may trigger a flow of money

from the U.S. to China? I am still

waiting for the answer.

$USB may have one more surge to higher ground.

-- $USB may need one more push

higher to complete its pattern.

I put the Fibonacci lines on the chart to

show two things. First, this rally is a

retracement and not a surge to new

highs. Second, the 61.8% retracement

agrees with the upper resistance given

by my cycle model. While we

shouldn’t underestimate this rally, we

should also start to formulate an exit

strategy. The pivots allow another

week of rally, but soon we may see a

rotation back into stocks as bargain

hunters look at oversold markets.

China, perhaps?

-- $USB may need one more push

higher to complete its pattern.

I put the Fibonacci lines on the chart to

show two things. First, this rally is a

retracement and not a surge to new

highs. Second, the 61.8% retracement

agrees with the upper resistance given

by my cycle model. While we

shouldn’t underestimate this rally, we

should also start to formulate an exit

strategy. The pivots allow another

week of rally, but soon we may see a

rotation back into stocks as bargain

hunters look at oversold markets.

China, perhaps?

$USD is impulsing higher.

-- $USD appears to have begun a

probable wave iii of (iii) of 3, which

should stretch to its Head and

Shoulders target at 89.75. It appears

that the weekly push that I had

anticipated last week has occurred

and retraced, making it ready for a

much larger push higher next week.

-- $USD appears to have begun a

probable wave iii of (iii) of 3, which

should stretch to its Head and

Shoulders target at 89.75. It appears

that the weekly push that I had

anticipated last week has occurred

and retraced, making it ready for a

much larger push higher next week.

The next pivot in UUP is scheduled for Wednesday, which may be a lesser cycle peak for the $USD.

I hope you all have a wonderful

weekend!

Regards,

Tony

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.