Glenn Beck and Co. Cashing in through Scare Tactics

Politics / Mainstream Media May 29, 2010 - 04:59 AM GMTBy: Mike_Stathis

It seems as if the new trend in modern America is to use scare tactics as a way to sell the sheep.

It seems as if the new trend in modern America is to use scare tactics as a way to sell the sheep.

It worked for President Bush when he warned of Saddam’s WMDs.

It also worked for Paulson when he shoved the unconstitutional banking and auto bailouts (TARP and other taxpayer funds) down the throats of U.S. taxpayers. (1) (2) (3) (4)

Today, various individuals, from media clowns to investment pundits are using their own brand of scare tactics in order to get people to buy gold. As you shall see, this article addresses the controversy of these activities.

Let me first begin with a reminder about the dangers of America’s media monopoly.

Instead of presenting different perspectives in a manner which promotes an open forum of debate and inquiry, the media feeds its audience one-sided views of what they want you to believe, which most often does not represent the reality. This is an inconspicuous form of censorship most are unaware of.

Remember, airing one or two pieces that go against the consensus viewpoints promoted by the media does not represent equal representation. And without equal representation, you essentially have slanted views. The media uses many sneaky tactics to hide their manipulative messages. (5)

Instead of airing experts with no agendas and excellent track records, hacks like Beck and his circus monkey peers turn every problem into a political issue, so as to make you think the problems will be solved the next time around when you vote for the other party.

Beck is now making economic predictions, despite the fact that he is not qualified to do so.

In the process, the media industry cashes in on your fear by serving as paid shills for gold dealers. (6)

The various deceitful and sometimes illegal activities of the media have been successful because there are too many naive Americans ready to swallow everything they are told, rather than bother to question things. In the process of tuning into the media monopoly, Americans become brainwashed. Events are spun, dramatized and exaggerated. While this has been going on for decades, it has never been as bad as seen today.

Washington (or I should really say the elites who pull the strings of the Washington puppets) knows that if Americans realized they have no vote, and their so-called two-party political system is actually a one-party dictatorship, there would be mass anarchy. (7)

About 17 months ago, when the tea party movement began, there was a small chance of the people waking up and uniting to put an end to the Washington mafia. That is specifically why the neo-con strategists rapidly organized a campaign to take over the tea party movement.

Instead of a movement opposing the Washington mafia, it was transformed into a front for the Republican Party.

Instead of a force of the people for the people, the tea party movement became a form of controlled opposition. (8) (9)

The main reason why this transformation occurred was due to the fact that tea party organizers across the nation were absolutely clueless. They were pissed off after seeing what happened, but they were clueless as to why it happened and who was to blame. So they were looking for leadership and visibility. And the neo-con pundits provided it.

As a result, the tea party movement has become one of the biggest laughing stocks to come out of the United States in decades. But don’t tell that to tea party members, as they will cry and call you names as always happens when delusional people are confronted with the truth.

Neo-cons devised an elaborate scheme to hijack the only organized force that could inspire a positive impact. In the beginning, they moved in on the tea party with subtly. A few of the radio entertainers (all of which who have banned me) began to superimpose republican agendas onto those of tea party advocates.

Many of these lying scumbags gave speeches at tea party events, serving to gradually link the masses behind this movement to the Republican Party. But they didn’t force themselves on the tea party. Naïve members rallied to align themselves with these media liars. And neo-con plants sparked this call to action using various forms of psychological trickery.

Next, tea party plants from the Republican Party began calling into radio shows like Rush’s and trashed Obama, so as to further galvanize the mission of the tea party as a takeover by the Republican Party.

As this movement grew, neo-cons who had infiltrated the tea party began using social networking sites to influence the tea party sheep in mass, with the knowledge that sheep always love to follow.

Other neo-con plants invaded tea party web sites, making posts that further likened the agenda of the tea party to that of the Republican Party. And of course, tea party members fell for this rudimentary trick without bothering to take a step back and question the direction the movement had taken.

Eventually, confused tea party members, desperate for visibility and leadership and enthralled by media celebrity began requesting idiots like Sarah Palin to speak at their events, of course for no less than $100,000.

The case of Sarah Palin illustrates a prime example of the power of the media.

Due to Americans’ infatuation with television, the media has turned this brainless idiot into a millionaire overnight, a best-selling author of a useless trash book which she didn’t even write, a faux news commentator, and most likely a presidential candidate down the road. This demonstrates the shear stupidity of the American population.

And of course we have the typical losers looking to profit from Palin’s “popularity” with the sheep by writing a book about her. How can people not see this as exploitative and deceitful? (10)

Moreover, her daughter…you know, the teen single mother…is now offering her services as a speaker for $30,000 per event.

That’s right. $30,000 for a kid to speak; a kid who has accomplished nothing. Just a normal kid who I would have to assume has a below normal IQ.

Notice Bristol Palin’s Hollywood-esque PR event in the picture above. I bet Paris Hilton was next in line for her photo-op.

Notice Bristol Palin’s Hollywood-esque PR event in the picture above. I bet Paris Hilton was next in line for her photo-op.

Can someone tell me how in Hell an immature 18 year old is qualified to speak to anyone other than a high school audience?

Like everything else, it’s all about supply and demand. And when you have a population filled primarily with sheep, you can imagine how easy it is to create celebrities and heroes from crooks, liars and losers. Welcome to the United States of America.

It should be crystal clear that ANYONE who gets media exposure, regardless whether bad or good, will become an instant celebrity in today’s American society, because American sheep allow it.

Brainless idiots, losers and liars will get lucrative books deals, reality TV shows and other offers from the media, which made them “celebrities” in the minds of America’s dumbest citizens. As you can imagine, that represents the majority of the U.S. population.

Do you remember how big Octomom became?

Let’s have a look how Miss Suleman has cashed in.

If you are a supporter of PETA (which is led by a bunch of wackos) you should write and tell them you refuse to support an organization that uses funds from members to promote and enrich the livelihood of a scumbag.

For what? Scrutiny over her attempts to bleed the welfare system dry?

What about Joe the Plumber, the plant used by McCain’s strategists?

What about Joe the Plumber, the plant used by McCain’s strategists?

If you are a supporter of PETA (which is led by a bunch of wackos) you should write and tell them you refuse to support an organization that uses funds from members to promote and enrich the livelihood of a scumbag.

What about Joe the Plumber, the plant used by McCain’s strategists?

This idiot got a big book deal. Remarkable.

It’s sometimes depressing to see things through my eyes. I see a nation filled largely with sheeple who have no idea what is going on; a nation filled with sheeple who are actually being programmed by the media and government, all while much of the world laughs in amazement.

These are the same sheeple who wonder why and how they get exploited year after year. And when the time comes to blame someone, they always seem to pin the tail on the wrong donkey.

Most often, they are brainwashed to believe one political party over the other is to blame, when the facts reveal a different story.

Other times, they allow the media to implant scapegoats in their mind rather than indentify the real criminals. We saw this strategy used after the dotcom collapse. As you will recall, not one of the dotcom criminals went to prison. Rather, the media focused the attention on Enron, WorldCom, Tyco and other companies that had absolutely nothing to do with the dotcom scams.

Today, we see a similar tactic utilized by America’s tightly controlled media monopoly. If something works, you don’t change it. Instead of calling for the indictment of the banking executives for committing securities fraud (as well as less obvious crimes such as insider trading, naked short sales, and other criminal activities) the media has focused the attention on Bernie Madoff. (11)

However, as criminal as Mr. Madoff’s Ponzi scheme was, we cannot forget that it was actually a victim of the real Ponzi scheme; the multi-trillion Ponzi scheme committed by Wall Street banks and mortgage lenders. They, rather than Madoff should be the focus of attention by the media. (12)

You need to ask yourself why your favorite media whore who makes daily appearances on CNBC, FBN or CNN never bothers to mention the real criminals. Could it be that they value the free media exposure and the millions of dollars that comes with it over telling the truth? And you actually celebrate these guys?

Understand this. Anyone who is not pounding the table calling for the criminal indictment of the banking executives is your enemy. They are all on the same side. They are against you, not with you. If you cannot see that, I suggest you get your mental vision checked. (13)

The media has a mission. It’s to keep you wrapped up into trivia and lies, distractions and deceit, all while censoring the few who know what they are talking about and who lack agendas; the few who cannot be bought off by the promise of big media exposure.

The media’s sole purpose is to protect its sponsors, even if that means shielding them from scrutiny for criminal activities. If you really think you are getting the truth from the media, you are a damn fool. (14) (15) (16)

If you want to know why you have suffered huge investment losses, I’ll tell you. It’s because you were duped by the media.

The crooks involved in this deceit are widespread and range into the tens of thousands, from the mainstream media and their hacks to the bloggers who pump gold and promote currency trading and investment scams.

Once again, I must say that the vast majority of Americans are complete idiots. While the upside to this is that it makes the rest of us look really smart, the problem is that a small handful of people cannot do much to affect a positive change. All we can do is effortlessly take your money as you align yourselves on the losing side of each trade.

But for those who understand the dangers faced by these activities, taking your money from stock trades is of no relevance. Much bigger things are at stake; namely the future of America.

Today, when you hear about a so-called tea party candidate, you should no longer be surprised why they are republicans, as the tea party and the Republican Party are one in the same.

As a matter of fact, unbeknownst to most Americans, the tea party movement is a mere arm’s length from the Democratic Party. It’s a Washington mafia. Those who fail to see this simply lack an understanding of things. These are the people who have become brainwashed by the media monopoly. (17)

It’s shocking to see the same people who blame CNBC and Jim Cramer for their investment losses continue to tune into these programs. Sorry, but if you watch this trash, not only do you deserve to lose every dime you have, I’m hoping you do.

And for those who think that FOX is somehow better than CNBC or any other network, I’m here to tell you that you have been fooled. They are all in the same club. This is why the producers, hosts and other staff shuttle from one network to the next, in the same manner professional athletes and Wall Street professionals join what were formerly their competitors. Changing the name of the company doesn’t mean a thing. They are all in the same ball game; they are playing against YOU. And they’ve been blowing you out for decades. It’s time to wake up.

By providing an audience for this criminal industry, you are empowering them. The size of their audience directly dictates how much they can charge for ads.

The same applies to the radio and print media. They are all members of the same crime syndicate. This syndicate also extends to Washington, Wall Street, the Federal Reserve and large corporations. If you aren’t convinced of this, I suggest you do some research.

While the principal organizers of the hijacked tea party movement remain largely in the shadows, the ones with visibility - Mark Levine, Sean Hannity, Rush Limbaugh, Glenn Beck continue to twist the original mission of the party, largely without notice.

As it stands today, the tea party movement will forever be viewed as a joke. And the members will be laughed at for being fooled into casting aside their original mission. Instead of adhering to their original mission to combat the Washington mafia (similar to the Boston Tea Party’s revolt against the British government), the tea party movement has willingly accepted the agendas of the Republican Party, as if there is any real difference from the Democratic Party.

Understand this. The neo-con media clowns lie 90% of the time when on air.

How do I know? I’ve heard their rants. I’ve heard their ridiculous speeches.

Furthermore, each one is extremely afraid to have me confront their lies.

How do I know? The call-screeners (known as the show producers) never let me on when I announce who I am and what I want to discuss.

In the past I have discussed how gold dealers have partnered with the neo-con consortium of the Washington mafia in order to exploit the success of their brainwashing activities.

For instance, clowns like Levine, Hannity and others have received huge payouts for sponsoring gold. But they don’t just say “buy gold.” They narrate long-winded propaganda pitches, placing exclusive blame for the problems faced by America on the Democrats, often centering out President Obama. Those who have followed me for some time realize that I disapprove of Obama’s actions and lack thereof since entering the White House. However, the results will be the same regardless who is in office because the fact is that the president is merely a puppet to the elites. (18) (19)

The neo-con talking heads exaggerate or completely lie about most of what they say. And they are able to get away with it due to the First Amendment. However, when one uses propaganda as a launching pad for pitching investments, this crosses the border of free speech rights.

They paraphrase the myths preached by many of the snake oil salesmen doomers littered throughout the media, discussing things like hyperinflation and civil unrest. Finally, once they have reached your emotions (panic and fear) they pitch gold to you.

They use the same tactics to justify America’s illegal and misguided occupation of Iraq. They have also tried the same tactics as a way to justify invading Iran.

Mark Levine has been particularly active using this manipulative approach. He rattles on for several minutes with his whining, highly annoying voice about how the economic collapse is the fault of liberals. Finally, he closes out his speech by telling his listeners to buy gold because the dollar is doomed.

Levine’s unethical manipulation of the facts has gotten so ridiculous that it often becomes difficult to decipher whether you are listening to some entertainment show or a gold infomercial. I’ve encountered anything quite like it. It’s beyond absurd.

According to Levine, liberals are responsible for the economic collapse, and Obama is turning American into a socialist nation.

Yet, Levine fails to remind his largely unintelligent audience that it was Bush who started the bailouts and that this collapse was the result of many years of negligence from both parties as well as the Wall Street criminals who Levine eagerly protects.

Then he closes up his whining sales pitch by talking about how you must own gold, as he does because inflation will soar.

Anyone who knows anything on Wall Street will tell you that gold is NOT, and I repeat, NOT a hedge against inflation. I have discussed this at length previously. (20)

Furthermore, the high volatility seen with gold is best dealt with by trading it, rather than a buy-and-hold approach. Anyone who is unable to realize by now that the buy-and-hold approach is disastrous has no business investing, unless their goal is to commit financial suicide. (21)

Let me be clear. Mark Levine, along with the others should be fined by the SEC for receiving compensation for giving investment advice without being a registered investment advisor.

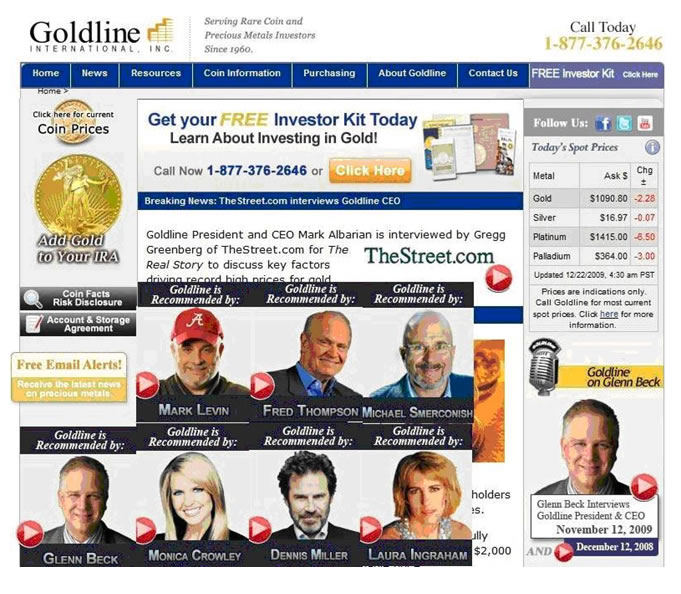

Perhaps even worse than Levine is Glenn Beck, the main hack for Goldline. This is a man that represents everything wrong today with the media. He is NOT and I repeat, NOT a news journalist, nor does he represent the truth. As a result, he refuses to air unbiased experts, for that would destroy his fantasyland stories. (22)

Furthermore, Beck is a poor excuse for an entertainer. The same can be said about the others. Along with Levine and virtually every other media personality you can think of, Beck also refused to interview me. Now I know why. He was too busy setting up financial arrangements with Goldline. In other words, Beck interviewed Schiff and the other gold bugs only to open the door for huge endorsements from Goldline. Clearly this hat-trick has created a one-sided agenda for Beck; a very lucrative one at that.

If he was to interview me, it would have caused Goldline to be upset because I speak the facts about gold. And I have no bias, as I am not a dealer in gold, nor do I promote gold ads. The next time you decide to believe anyone’s pitch about gold, you need to see whether they deal in gold or whether they advertise for gold companies. Thereafter, you need to examine their track record. I will guarantee you won’t find a single credible expert with a solid track record who is pumping gold, without having some financial interest in rising prices.

You must understand that the media’s job is NOT to provide you with valuable accurate insight. The media’s mission is to serve the agendas of its sponsors. And they cannot be sued for lying or for even banning the leading expert.

How do I know? I have consulted with law firms for damages resulting from the loss of revenues as the result of being banned. Being exposed to lies and censorship from the media monopoly is the price you pay for freedom of speech. Like everything else, it can be a double-edged sword if not properly used.

Unlike the clowns Beck interviews, I do not sell gold. Yet, I made a forecast for gold to soar in America’s Financial Apocalypse. The fact that I have turned soar on it now shows that I only care to tell the truth. I want to warn investors that they are not getting the truth.

If I were bashing gold for years, one could argue that I have a bias. This is clearly not the case. Now, I see a gold bubble that is forming due to the various media hacks who are being paid to promote it. If gold was such a great investment, why in the Hell is everyone so desperate to sell it to you?!

Those who waste their time on Beck and his peers (found throughout televised networks and syndicated radio stations) allow themselves to be brainwashed by his lies and twisted agendas. Meanwhile, they are all cashing in while you rush to buy gold after hearing their scare tactics.

Since receiving scrutiny regarding conflict of interest for promoting Goldline, FOX has made Beck end his endorsement with this shady company. However, during commercial breaks you will see ads by other firms that try to entice fear into the minds of viewers with lines like “your currency may be worthless.”

Recently, Congressman Weiner issued a report discussing how Glenn Beck and others have teamed up with Goldline using scare tactics so that their audience buys gold; gold which is sold for ridiculously high rates.

This shouldn’t come as a surprise to anyone with common sense. After all, gold is a commodity. That is, gold from one dealer is the same as gold from another. Therefore, the value is the same. Hence, the price you pay (or receive) from dealer to dealer should be very close to the same; that is unless you are getting a night with a high-priced hooker as a kicker.

So when you are charged higher prices than the spot (less a small premium) you are getting ripped off. How else do you think Goldline can afford to pay these hacks millions of dollars for endorsements?

They simply charge higher prices to offset expenses.

Well, it turns out that Goldline’s “high-priced hookers” are the media hacks that pitch gold.

According to Rep. Weiner’s report, the average Goldline mark-up was 90% above the melt value of the coin. The largest markup seen on a coin was 208% above the melt value.

In addition, according to Weiner, Goldline’s sales staff imply they are “Investment Advisors” or “Financial Advisers” by offering investment advice.

Next, Weiner discusses the role of these pundits.

“On numerous occasions, Glenn Beck has dedicated entire segments of his program to explaining why the U.S. money supply is destined for hyperinflation with Barack Obama as president. He will often promote the purchase of gold as the only safe investment alternative for consumers who want to safeguard their livelihoods. When the show then cuts to commercial break, viewers are treated to an advertisement from Goldline.

In the past there is always the “product” that is either the next big thing (the dot com boom) or the investment that will never go down in price (the housing market), and in the past much of the media has failed in its duty to conduct due diligence, but never before have they worked so hand in hand to cheat consumers.

Commentators like Glenn Beck who are shilling for Goldline are either the worst financial advisors around or knowingly lying to their loyal viewers.

Fred Thompson, Dennis Miller, Mark Levin, Laura Ingraham, Lars Larson, Michael Smerconish, Monica Crowley and Mike Huckabee are all paid spokespeople for Goldline.

Glenn Beck was also at one point a paid spokesperson but is no longer because it violated Fox news rules. Goldline does however sponsor his program and he commonly encourages his viewers to purchase gold, without mentioning that Goldline is a sponsor of his show.”

Weiner’s report cites some quotes from these shills…

Glenn Beck:

“Tonight, are we facing the end of the almighty dollar?... So I’m sure we can all assume that the dollar is here to stay, and everything is just peachy. But in the off chance that, maybe, somebody in the Middle East wouldn’t tell us exactly the truth, you know, that they’re not exactly 100 percent reliable, maybe we should discover what it means for our dollar and our country if it’s no longer pegged to oil. What does that mean for you? … Any way to protect yourself? Gold”. (Source: The Glenn Beck Show 10/7/2009)

Apparently, Beck read America’s Financial Apocalypse, (perhaps the copy I sent him in 2007) or some of my articles discussing the dollar-oil link, because I don’t anyone else who has discussed this.

But of course, I have also warned about buying physical gold, as well as debunked the inflation-hedge myth of gold. So maybe that’s why he has banned me (and yes, he has; I have proof). (21)

Yea, Beck make sure and thrown in a line on the Middle East so as to reinforce the lies America’s Zionist-controlled media monopoly has created. But don’t you dare mention anything about our friends in Israel having been caught spying on Washington despite the fact that they control virtually every aspect of our government, the media, the Federal Reserve and the rest of the financial industry.

“We could be facing recession, depression or collapse. Nothing Left! … I like to call it the three G system here for this, its God, Gold and Guns.” (Source: The Glenn Beck Show 11/23/2009)

If the scenario Beck and the other gold bugs preach (all of which who stand to make money off of you by pumping up gold with lies and scare tactics) plays out, you had better bet that no one will give a damn how much gold you have.

The only things you will be able to barter with are guns and bullets.

“There are those in power that […] want to destroy the dollar or … the dollar is on life support and they’d like it to stay there. It’s true. Not much that you and I can do about it. Well, there are a few things. You can prepare yourself, that’s what’s next year is a really all about on our program. Preparing yourself and part of that is – or could be – protecting yourself with gold. If you have the money to buy it, protect yourself from an out of control government with gold.” (Source: The Glenn Beck Program 12/3/09)

The dollar is on life support? Tell that to holders of the euro. It appears as if Beck has borrowed some lines from Peter Schiff and the rest of the gold dealers.

"I think you're nuts. When the system eventually collapses, and the government comes with guns and confiscates, you know, everything in your home and all your possessions, and then you fight off the raving mad cannibalistic crowds that Ted Turner talked about, don't come crying to me. I told you: get gold." (Source: Politico)

Okay, so gold is going to save us from this?

“Just the other night I was rereading Atlas Shrugged, and in it one of the characters is talking about the value of money and how paper dollars really hold no value whatsoever. They represent your work. The only thing of real value is gold. What you’ve backed that dollar up with. Well, we no longer back our dollars up with gold. If things get dicey, we’re on a banking crisis now, the declining value of the dollar, what will hold its value? Gold. I want you to call 866-GOLDLINE and find out about buying gold. You can buy it as an investment. I buy it really as insurance because it’s the one thing that will have value forever.” (Source: Goldline radio ad)

Actually, the dollar has an intrinsic value because it is backed by the empire of the world, the United States of America, as well as being linked to oil, as Beck himself admitted. In contrast, gold has absolutely no intrinsic value whatsoever. It’s like artwork; the value is only based on what people will pay for it. This of course is in contrast to silver, which one can argue does have an intrinsic value, since it is required for industry. (23)

Apparently, Beck is not satisfied with the $50 million handed to him by FOX, compliments of the idiots who watch him (remember, the audience determines salaries for these useless lairs because the size of the audience determines advertising rates).

He wants more, as do most individuals with too much money. And he has shown that he will stop at nothing to get it, even if it means create panic and state lies about gold. After all, Beck is a professional liar. But he’s certainly not alone.

Mike Huckabee:

“I’ll bet you’re concerned about the economy and the depreciation of the dollar just like me. That’s why people are diversifying their portfolio with gold, as a way to protect against a falling dollar and future inflation. Goldline has been helping people acquiring gold for 50 years. The people at Goldline will explain just how easy it is for you to buy gold that’s delivered directly to you.” (Source: Goldline radio ad)

Dennis Miller:

“Hey folks in a perfect world we could print all our own money, buy ridiculous amounts of stuff and live happily ever after. Well life ain’t a fairy tale my friends. Look at the economy, they’re spending more than Paris Hilton on a bad day and it doesn’t get us a tiny dog and a pink purse either. It leads to a lower dollar. What can we do to diversify our portfolio and protect against that falling dollar? Buy gold. Gold prices have tripled in value and they are up more than 40% in the past 2 years. I trust Goldline.” (Source: Goldline radio ad)

Laura Ingraham:

“With the stock market where it is, volatile, moving up one day, down the next, the trillion dollar budget deficit. And look what’s happening in the banking industry, the government continuing to print money it looks like. It’s important to remember there’s only a finite amount of gold. It makes sense in these types of economic times to seek a safe harbour. And that is gold. I can’t tell you whether gold is going to get up or down. I can tell you however that gold makes sense as part of any portfolio. It serves as a great ballast against inflation.” (Source: Goldline radio ad)

Fred Thompson:

“Our country is experiencing the worst economic crisis since the Great Depression. Stocks and real estate have lost much of their value and government is spending trillions of dollars in a desperate attempt to bail us out. In these tough times I believe you should own gold. Gold offers diversification so all your eggs aren’t all in one basket. And gold is one of the few investments that is going up every year since 2001. My choice for gold is Goldline.” (Source: Goldline radio ad)

After reading these pitches, you would think they were financial experts.

When you see these idiots discuss “diversification,” you should be selling your gold rather than buying it because the involvement of these clowns signals that gold is in a bubble. It’s apparent they were reading from a script provided by Goldline. Isn’t that lying? What about the Truth in Advertising Act?

http://www.ftc.gov/opa/2009/10/endortest.shtm

As far as I’m concerned, these hacks should be fined by the SEC for giving investment advice for a fee, much in the same way that the clowns on CNBC and FBN should be fined.

They are being paid (whether directly or indirectly in the form of ads) by companies they are pitching. That means they should be registered as investment advisers. And I know of at least one SEC attorney that agrees with me.

But you shouldn’t think for a minute that Congressman Weiner represents some kind of hero.

He is no different than the rest of the criminal bastards in Washington (with the exception of Dennis Kucinich). They all grandstand while the cameras are rolling. But after a long day filled with bipartisan shouting matches, each member of both parties leave Capitol Hill together for dinner and drinks, laughing how they outdid their opponent, just as the mafia crime families behave.

Weiner’s report is merely a political weapon being used to thwart the growing (although futile) support of the republicans as elections near. But these efforts don’t matter to Americans because when it comes to the issues that really matter, both parties are the same.

Citations to this article (1-23) represent previous publications that are related to the material where cited and can be found on www.avaresearch.com

By Mike Stathis

www.avaresearch.com

Copyright © 2009. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher. These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.