China Reassures Global Markets and Promotes Yuan Denominated Gold Investments

Commodities / Gold and Silver 2010 May 28, 2010 - 09:51 AM GMTBy: GoldCore

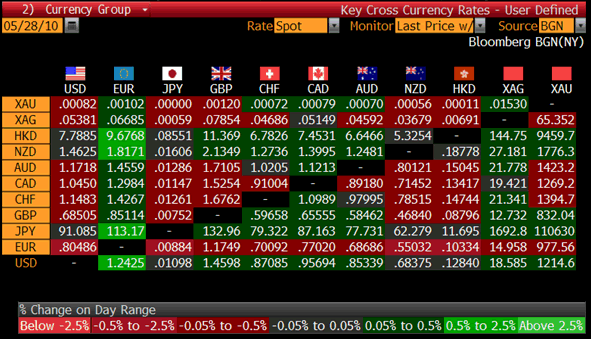

Gold edged higher again yesterday on a continuing safe haven bid due to various macroeconomic and geopolitical risks and has fallen marginally in trading today. Gold is currently trading at $1,206.48/oz and in euro and GBP terms, at €976.43/oz and £830.34/oz respectively.

Gold edged higher again yesterday on a continuing safe haven bid due to various macroeconomic and geopolitical risks and has fallen marginally in trading today. Gold is currently trading at $1,206.48/oz and in euro and GBP terms, at €976.43/oz and £830.34/oz respectively.

Asian stock markets rose, European markets are mixed, and US markets are down. This is despite a big rally on Wall Street yesterday which was attributed to China's reassuring expression of confidence in Europe's ability to restore financial stability. This has, for the moment anyway, alleviated concerns about the eurozone's debt crisis and the euro itself.

However, warning signals from the banking system continue and are reminiscent of the situation prior to the Lehman Brothers collapse when warning signals were initially ignored prior to the market panic. Interbank rates continue to rise as seen in the 3 month Libor rate which has reached new 10 month highs. This shows a continuing lack of trust in the interbank market and this will be supportive of gold due to its lack of counter party risk.

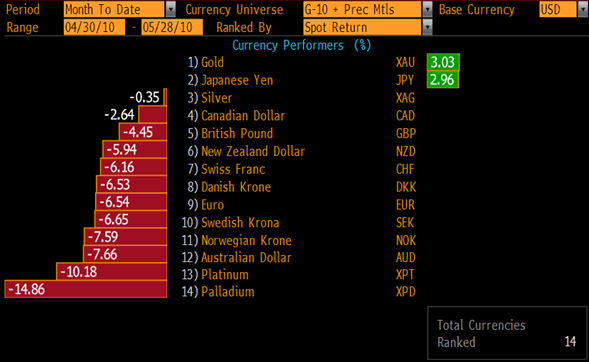

Gold and G10 Currencies - Month to Date.

China's rebuttal of claims it was reviewing its eurozone debt holdings has lifted hopes that Europe's debt crisis will not spread. As ever it would be wise to watch what the Chinese do rather than what they say. Their central bank has been quietly accumulating gold reserves in recent years without declaring it to the wider market and driving up prices. Similarly, should the Chinese be worried about euro, dollar and other fiat currency denominated assets they are unlikely to signal those concerns to markets thereby likely leading to falls in the value of those assets. Far better to slowly and gradually pursue a policy of reserve diversification thereby accumulating gold without spooking markets are causing the gold price to surge.

China's intentions with regard to positioning the yuan as a global reserve currency are being increasingly seen (see News below) and can be seen in the news that China wishes to internationalise the yuan by having important commodities such as gold traded in yuan. An official from the People's Bank of China said overnight that China should develop more yuan-denominated gold investment products. China should improve gold investment products and development more of them considering the more than 30 trillion yuan in savings the country has, said Wang Zhenying, deputy director-general of the Department of Financial Market Management at the People's Bank of China Shanghai office. The official said that China's trading in yuan-denominated gold investment products boosts the internationalisation of the currency and the country. "A currency's international status depends on its being accepted in trade and settlement and having certain international commodities denominated in that currency helps China's goal to internationalize the yuan," said Wang Zhenying, deputy director-general of the Department of Financial Market Management at the People's Bank of China Shanghai office. "Gold is a good choice to have yuan trading."

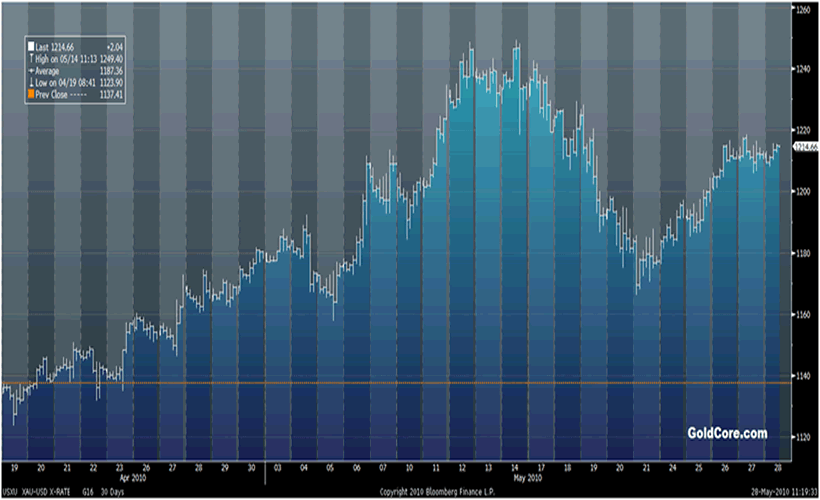

Gold Rises 3% in May So Far and Appears to be Consolidating Above $1,100/oz. Click on image to view full size.

China has been less vocal regarding the trading of oil in yuan or renminbi but this is a likely policy goal and could potentially threaten the petrodollar and thus the dollar's reserve currency status. Interestingly, Kuwait also denied reports they will reduce euro zone investments due to the region's ongoing debt crisis. Speculation that the euro could supplant the petrodollar and the dollar as global reserve currency are now well and truly dead. China's growing political and economic clout and the fact that it is the world's largest creditor nation mean that its currency does pose a long term threat to the dollar as global reserve currency.

Such threats to the dollar and growing concerns about fiat currencies internationally mean that gold is likely to continue rising for the foreseeable future and the inflation adjusted high of $2,400 per ounce seems inevitable.

Gold looks set to finish the week some 3% higher and the month some 3% higher as well. It has risen by more in other currencies which have fallen against the dollar. This is in marked contrast to equities which have fallen sharply in May and the MSCI is now down by 14% since its April peak. As ever, real diversification remains absolutely essential for all investors.

Cross Currency Rates at 1145 - EUR, CAD, AUD, CHF and XAG Stronger and USD Weaker. Click on image to view full size.

Silver

Silver is trading at $18.28/oz, €14.79/oz and £12.57/oz.

Platinum Group Metals

Platinum is trading at $1555/oz, palladium at $465/oz and rhodium at $2550/oz.

News

The FT's Javier Blas reports that silver prices are likely to hit $20 a troy ounce this year supported by "double-digit" growth in industrial consumption and strong investment demand, according to GFMS, the London-based metals consultancy.

The forecast comes ahead of the annual industry gathering in New York and amid strong demand for silver in the form of coins and physically backed exchange-traded funds because of the financial crisis. The consultancy said net investment surged last year to 136.9m ounces, up 184 per cent from 2008. Coin demand surged 20.7 per cent to 78.7m ounces.

"Silver's status as a precious metal was unequivocally reaffirmed last year by investors who purchased it not only as a speculative commodity-play on economic recovery but also as a safe haven asset, particularly at a time when the global financial crisis was raging," GFMS said in its annual silver report. But industrial consumption fell to 352.2m ounces, down 20.5 per cent from 2008. The metal is used in the electrical and electronics sector, in the automotive industry and to make photo-voltaic solar panels.

The sharp drop in industrial consumption in late- 2008/early-2009 hit prices, eroding a decade of sustained gains. In December 2008, silver prices fell to $8.42 a troy ounce. For 2010, GFMS said there would be a "solid gain in silver use". Mr. Klapwijk said most industrial consumers were still "hand-to-mouth", with little restocking taking place despite a recovery in the global economy.

The consultancy added that investment demand was expected to be "highly positive given the scope for the sovereign debt crisis to widen and the probability that real interest rates will remain low or negative in all the major currencies for some time". GFMS said supply last year was almost flat, increasing from 888.3m ounces to 889m due to lower scrap flows and government sales. Mining output rose 3.6 per cent to 709.6m ounces, however. It forecast "another year of flat supply" in 2010. It said that, although mine production was expected to increase modestly, the market was expecting further reductions in scrap flows and government sales (Financial Times).

China should improve gold investment products and development more of them considering the more than 30 trillion yuan in savings the country has, said Wang Zhenying, deputy director-general of the Department of Financial Market Management at the People's Bank of China Shanghai office. Gold consumption in China may double within the next 10 years, boosting prices as supplies fail to keep pace with booming demand from investors and the jewelry industry, the World Gold Council said in March. The yuan's limited use outside China may hamper the currency's ability to replace the US dollar in trade deals, some exporters have said. "Although the gold market only accounts for about 1/400- 1/500 of China's financial markets, the meaning of it is going to be significant," Wang said. He said his views were his own and did not represent central bank policy.

China's gold output reached 314 metric tons in 2009, ranking as the No. 1 in the world for the third year. The internationalization of the yuan remains a long-term goal as China's economy is not yet strong enough to support a world currency, former People's Bank of China Deputy Governor Wu Xiaoling said in March.

"We have more than 30 trillion yuan worth of savings in deposits and the lack of investment products have contributed to Chinese investors going into mungbeans and garlic lately," the central bank's Wang said. "We can develop more gold products to attract investor demand. "Full internationalization of the yuan will take 15-20 years, Dai Xianglong, chairman of China's National Council for Social Security Fund, said last month. This doesn't mean the currency will displace the dollar, which will remain dominant in the global currency system, he said. Gold is traded in yuan on the Shanghai Futures Exchange and the Shanghai Gold Exchange (Bloomberg).

Gold has reached record highs in recent weeks, but it will continue to rise, Ben Davies, CEO of Hinde Capital told CNBC Wednesday (see video on our Commentary page). Gold should be viewed not as a commodity, but as a cash supplement, Davies said. "There's been such proliferation of currency," he said. "As a consequence, gold is very undervalued." "I could be really obtuse and say $36, 000," he said. "But actually it's not as ridiculous as it might sound." If all the reported Fort Knox gold was re-valued at $36,000 per ounce, it would pay off all the debt in the US, he said (CNBC).

Gold may climb to $1,500 an ounce this year should investors continue to be concerned that Greece's debt crisis may spread through Europe, Citigroup Inc. commodity analyst Alan Heap said. "Certainly $1,500 an ounce is possible," Heap said. "Gold's rallying despite dollar strength and it's rallying because investors are once again concerned about sovereign risk." "Gold is at the moment fulfilling its traditional role as a safe haven," he told Bloomberg television (Bloomberg).

Gold may advance as Europe's sovereign-debt crisis boosts the precious metal's appeal as a haven asset, a survey showed. Twenty-two of 26 traders, investors and analysts surveyed (including GoldCore) by Bloomberg, or 85 percent, said bullion would rise next week. Two forecast lower prices and two were neutral (Bloomberg).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.