Commodities Pause in Upward Climb

Commodities / CRB Index Sep 01, 2007 - 02:34 PM GMTBy: Donald_W_Dony

KEY POINTS:

KEY POINTS:

• CRB pauses again in upward path. 320 offers stiff resistance

• Oil reaches seasonal high in August. Slow

drift to 4th qt. low in motion

• Natural gas should begin short period of

stronger demand in September

• Copper weakens with drop below support

level, drifts to $3.00

• Gold to test $650 support level in September

of deterioration.

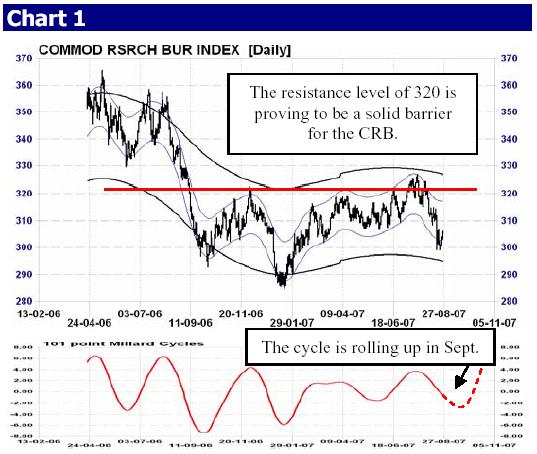

The phoenix rise for commodity prices in 2007 has been a slow and somewhat restrained climb. Many times the energy-dominated Commodities Research Bureau Index (CRB) has attempted to cross the key 320 line only to slip back to lower numbers. Longer-term (3-5 years), growth in commodity prices has clearly been up. Global demand for natural resources remains strong and steady with no signs of deterioration.

But what has capped prices in 2007?

Concerns, both real and perceived, about the continuous growth from the world’s largest consumer (U.S.A.) have keep traders on the defensive side. Even though GDP is estimated at 2% in 2007, which is a respectable number,caution still remains the watchword.

Pause in September

The chart of the CRB (Chart 1) illustrates what I am talking about. Though the growth of commodity prices since the low in January 2007 is positive (CRB remains in the upward sloping channel lines) it has been a struggle to advance.

In the lower portion of the chart, we see the main trading cycle for the CRB. There is a low developing in the second half of September. This would suggest that crossing the key 320 line, which indicates the end of the consolidation in 2007 and the start of stronger prices, will have to wait another month. September is showing all the signs of short-term weakness.

Though the big picture looks good for the continued climb the big picture looks good for the continued climb in commodity prices, there is another wild card. The much discussed U.S. subprime mortgage and credit squeeze is pushing industrial metal prices down (Chart 2). Fear of a broader-based retraction in the U.S. economy and thus lower demand; have left traders scrambling to the sell side.

This is the first page of the August issue. Go to www.technicalspeculator.com and click on member login to download the full 14 page newsletter.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2007 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.