Brief Stock Market Notes

Stock-Markets / Stock Markets 2010 May 28, 2010 - 01:11 AM GMTBy: Mike_Stathis

I wanted to give you an overview of what I see today and explain how you should view things, emphasizing the need to understand your own investment strategy, because I know that those who read this site comprise ST traders, swing traders and long-term investors.

I wanted to give you an overview of what I see today and explain how you should view things, emphasizing the need to understand your own investment strategy, because I know that those who read this site comprise ST traders, swing traders and long-term investors.

For those who read my latest special report, today's market activity should come as no surprise. As you will recall, I mentioned the likelihood of a short-term bounce in the market.

However, that does not necessarily mean tomorrow will be an up day. The market is in the PROCESS of forming a short-term trend (at this point). That means that over the short-term, if a ST upward trend is confirmed, you should see higher lows and higher highs.

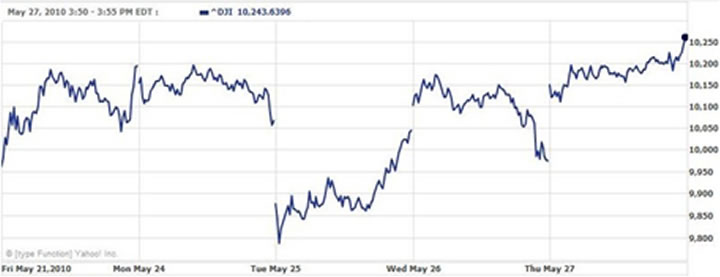

The following 5-day chart of the DJIA illustrates the breakout that occurred at the end of Thursday's tradng session. While the technical data is not quite convincing enough for me to conclude that a ST upward trend has formed, based on analysis of other (undisclosed data) I feel that this trend will become more definitive in the coming days.

But remember, this is a short-term uptrend that I am discussing; very short-term at this stage.

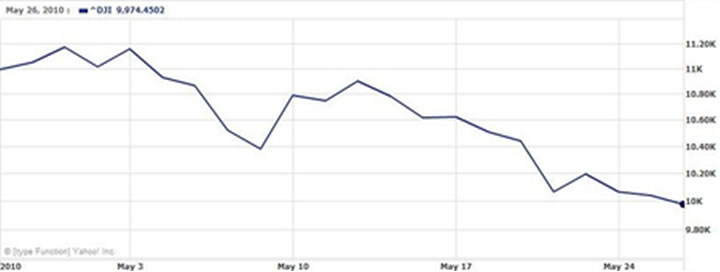

Keep in mind the 1-month chart of the DJIA. As you can see, it is down. When put into context of the 1-month chart, this ST trend (once again, not conclusively confirmed) has meaning only for day traders.

This means that I am defining short-term in days rather than weeks. So if you aren't a ST trader (very ST) be careful. Don't allow yourself to fall for false signals like most investors.

Meanwhile, for downside risk, it should be obvious what support level to watch out for. I discussed this in the recent report. Examine a chart of the DJIA and you should be able to spot it with ease.

Any violation of this level should be interpreted as evidence of significant downside.

For now, the market has bounced off this level and is likely to continue the upward ST trend (assuming no major events occur). But once again, I would not advise playing this unless you are making day or (maybe) swing trades.

Adding to more ST upside could be the (premature) announcement of success BP is reporting with its top kill plugging method.

Those who might have jumped into BP based on the price points I provided have seen nice gains. I expect BP to continue upward as long as the news remains positive. However, you might consider taking partial profits down the road depending on how much shares rise versus time (the higher the rise over the shorter period would be reason to trim down) since I feel this drama is far from over.

Remember, shares of BP can move fast. And they can turn just as fast on the downside, depending on how much the media dramatizes the oil spill.

In a report I released last week, I stated that I felt shares would fall below $40 before it was all said and done (although this was certainly no guarantee). Shares have fallen as low as $40.61, which is pretty close to my sub-40 level.

Any rapid spike (even over a period if a few days) should be evaluated for profit-taking. You should also factor in the effect of rising oil prices.

Others who are less active might want to hold on, and add to their position if it makes sense from a cost basis standpoint. Otherwise, you might want to save your cash for other opportunities.

Some might wish to sell covered calls to lock in some income in order to reduce downside. For instance, the 42 Jan 10 calls (strike price as $42) traded for close to $6.50. If your shares get called away in January, you would have locked in a nice 21% profit (15% for the calls plus 3 dividend payments).

I would be surprised if management lowered the dividend in 2010 (just a guess). If shares don't get called away, you've lowered your cost basis to around $34, which is an excellent price to cushion against a market collapse.

Remember, while the ST trend in the DJIA might look attractive for entry, you need to keep the longer-term picture in persepctive. If you elect to chase momentum, you need to understand the longer-term picture. No one knows what this may be. We can only go by probabilities which change daily based on new developments.

Keeping a grasp on the longer-term picture will help you manage risk and determine whether you should be staying out or making short-term trades.

The most important thing is not being in the market when it goes up, but being in or out of the market when you have a good level of certainty. You should gauge your investment strategy based on your level of certainty.

If you are unsure of things, you should stay out and wait for more certainty or clarity.

Perhaps I am missing something, but I do not see any clarity right now other than worsening economic conditions.

When you stay off of the momentum train, that often means you will miss some upside. If you are a ST trader, jumping in on the momentum might be a reasonable move.

If you not a ST trader, I would caution you to stay on the sidelines and focus on protecting your capital.

If you are out of the market when the upward momentum begins, you should never let that bother you. Always let your level of certainty dictate your investment decisions. Ask yourself if you see ST, IT or LT upward momentum. Then ask yourself whether you are equipped to exploit the trend.

Of course, we can never have an absolute level of certainty. Everything is relative.

So what am I doing?

I'm about 20% to 25% invested. I trimmed down to that level towards the end of 2009, as discussed in the newsletter. Since then, I have exchanged some positions, but have not added to my holdings by much.

I am not in a position right now to play day or swing trades. If I were, I would be looking for more upside. But I certainly would not risk much capital. The last thing you want to do is get locked into positions. Investors should always be cautious of trading liquidity during periods of global uncertainty, such as what we currently face.

And I am generally not a fan of stop-loss orders due to the type of trading strategy I employ.

Over the past couple of weeks, I have not added to any positions other than with oil-related securities.

If I had to bet on it, I'd say that the DJIA will reach new (ST) highs over the next few days, up to (most likely 10,500) and perhaps as high as 10,700 ( 100pts) at the best of scenarios prior to retracing back down towards key support levels. But of course this is only what I see today. There are many variables that can change things in just one day. Things can change on a dime.

Always remember this. Large short-term price movements (whether up or down) are usually inaccurate. In other words, such movements are very often counteracted by retracements.

This is why you need to keep the intermediate and longer-term picture in sight. When combined with patience, it becomes easier to ride the ups and downs of the market.

Understand your investment strategy and apply it to where you see things headed, after adjusting for risk, your own liquidity needs and so forth. If you are not able to construct an investment/trading strategy based on these core principals, you should not be in this market.

If you are an investor, whether you have a 401(k), IRA, or you invest in individual securities, you need to be armed with the best available insights. You can get them by subscribing to the AVA Investment Newsletter. Check here for partial samples.

By Mike Stathis

www.avaresearch.com

Copyright © 2009. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher. These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.