An American Concept: Crushing Sovereign Debt

Interest-Rates / Global Debt Crisis May 27, 2010 - 04:27 PM GMTBy: David_Galland

By David Galland, Managing Director, Casey Research writes:

Commenting on the European crisis – because this has gone well past being one that can be termed “Greek” – the New York Times cited a senior U.S. official on the significant role the U.S., including Obama himself, played in getting Europe’s leadership to agree to a bailout approaching one trillion. One particularly telling quote…

By David Galland, Managing Director, Casey Research writes:

Commenting on the European crisis – because this has gone well past being one that can be termed “Greek” – the New York Times cited a senior U.S. official on the significant role the U.S., including Obama himself, played in getting Europe’s leadership to agree to a bailout approaching one trillion. One particularly telling quote…

Now, the funny thing is that the way this latest bailout is structured calls for the European Central Bank to try and sell over $500 billion in new bonds offered by what is being termed a special purpose entity, whose bonds will be backed by the European member states – Greece, Portugal, Spain, and all the other PIIGS included. The rest of the money will be delivered by the IMF (17% of whose funding comes as a transfer out of U.S. taxpayers’ pockets).

Will the new special purpose bonds prove popular with investors? Or will they prove unpopular, requiring higher and higher interest rates? What happens then?

And who is going to buy all these bonds, given the energetic selling going on by the U.S. Treasury?

When you strip away all the psychology that senior officialdom seems to think is what really counts, you have a bunch of sovereign deadbeats attempting to impress by moving into a really nice new mansion – maybe even in Brooklyn Heights -- hoping to cover the mortgage with a “no (real) money down” liar loan.

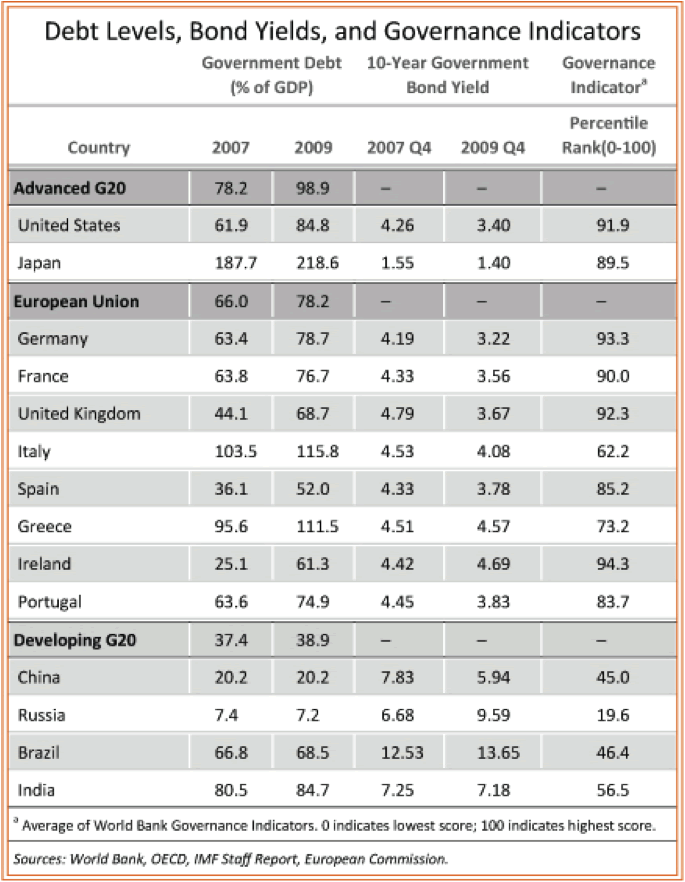

Do you want to own a piece of that loan? Because soon, thanks to the American concept and the new special purpose entity being cobbled together in Europe for the sole purpose of spitting out yet more debt, you’ll be able to buy up all of the stuff you want. Meanwhile, here’s what you’re actually buying…

Note, as bad as those numbers are, and they are bad, they don’t take into account unfunded liabilities – you know, little things like Social Security and Medicare. Throw those into the mix, and the picture gets a lot darker.

And what does Mr. Market really think about these numbers? As you can see from the table below, gold is starting to trade up against all the fiat currencies… just as we have been expecting it would.

.png)

Commenting on the situation, Casey Research CEO Olivier Garret had this to say…

I sometimes feel like a broken record (for our younger readers, that is a reference to solid vinyl discs with grooves in them that, when run over with a needle, would create sound… when scratched or “broken,” the record would repeat the same notes over and over) in my dire prognostications about just how wrong-headed it is what now passes for fiscal and monetary policy.

You can’t cure debt with more debt. And if you can produce the stuff in unlimited quantities, then it’s not money – that is, not if your definition of money is something you can use to efficiently hold and transfer wealth.

No wonder the big money traders are beginning to recall gold’s historical role as money. ---

Europeans are starting to get the picture – many precious metals sellers in Europe are now finding themselves out of stock – but most Americans are still woefully clueless when it comes to the safe-haven value of gold. And timing can be most important. Read our FREE report How Do I Know When to Buy? Click here to get it now.

© 2010 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.