Rogue Chinese Whispers Denied As Stocks Rally

Stock-Markets / Stock Markets 2010 May 27, 2010 - 09:01 AM GMTBy: PaddyPowerTrader

Flip flop on another whiplash Wednesday as US stocks fell late in the day, with the Dow closing below 10,000 for the first time since February, as a (seemingly bogus) report that China may review investments in European government bonds spurred concern the credit crisis will worsen. Microsoft tumbled 4.1% after CEO Steve Ballmer said the effects of the debt crisis will not be isolated to Europe.

Flip flop on another whiplash Wednesday as US stocks fell late in the day, with the Dow closing below 10,000 for the first time since February, as a (seemingly bogus) report that China may review investments in European government bonds spurred concern the credit crisis will worsen. Microsoft tumbled 4.1% after CEO Steve Ballmer said the effects of the debt crisis will not be isolated to Europe.

Wells Fargo and Goldman Sachs slid more than 1.6% as financial shares in the S&P 500 dramatically reversed. We had a sharp rally in the Dow futures this morning, though of course on these schizophrenic days when we alternate between a frenetic reactive sense of bearishness and bullishness it’s only the final hour of trading that counts. The late-day movement is starting to be a pattern as indexes generally point in one direction for much of the day, and then reverse just before the close. This is not good for the heart.

On a turnaround Thursday the world seems a more contented place. The markets were cheered by the KOSPI and Won ripping higher on the back of press reports that North Korea is to apologize to the South for the ship sinking incident. The markets will also take comfort in the fact that LIBOR-OIS seems to be stabilizing around 31bps. And the Spanish parliament passed a tough new austerity package (even if only just).

As I write the Dow futures have managed to shrug off some disappointing GDP numbers (3% versus the expected 3.4%). Weaker personal consumption figures and a weekly jobless claims number that was 5k worse than consensus expectations.

Today’s Market Moving Stories

•Spain’s parliament has this morning approved a €15bn austerity package (by a single vote 169 to 168). And this austerity bug is contagious as Italy does its homework, too with an expenditure cuts-biased €24bn package for 2011-12.

•European banks are beginning to hoard cash and take fewer short-term loans, the Wall Street Journal reported. Banks are issuing less short-term IOUs in Spain, Portugal and Italy, and many European banks are preferring to move cash to the European Central Bank rather than lend to other banks.

•BBVA, Spain’s second-biggest listed bank, is being squeezed out of the US commercial paper market as a source of funding, in the latest sign of pressure facing eurozone banks. BBVA bank did not renew €1bn in short term funding in the US market, going elsewhere due to rising interest rates.

•US Treasury Secretary Timothy Geithner landed in Europe and reasserted a traditional American role of dispenser of financial advice to the world, telling European governments to get their fiscal houses in order. After two years in which an historic financial crisis seemed to deprive the US of its self-confident global economic leadership, Geithner signalled a newfound willingness to reassert American authority on the future of the world economy.

•The OECD are forecasting higher global growth. I hope they are right, but think their models are more backward looking than a leading indicator. The economy of the OECD’s 30 members will grow 2.7% this year, more than the 1.9% predicted in November.

•Japanese exports rose 2.3% m/m or 40.4% y/y in April – above the consensus forecast for a rise of 38.9%. This was the fifth consecutive increase. Exports to Asia, which account for more than half of Japan’s total exports, rose 45.3% y/y. Shipments to the EU increased 19.8% y/y, slowing from a 26.7% gain in March.

•Portugal’s BES Investment’s CEO warned that banks in Portugal and other European nations faced a liquidity shortage and that the ECB needed to address this issue directly. He called for the ECB to provide liquidity to the market in the same way the Fed did in 2009. He said while BES had its funding covered for this year, the liquidity issues meant that it wouldn’t be able to extend its credit offering any further.

•The peasants are revolting. British Airways cabin crew continue their strike; the CWU union is calling for a 5% pay rise for its BT workers, and is threatening a strike if it is rejected. In Germany, ground staff at Berlin’s two main airports are out today, looking for higher wages. In Finland, steel maker Rautaruukki sees its Raahe plant down, with 400 workers out in protest at staff cuts. And there’s a national day of strikes in France across multiple industries and unions. In Italy the GCIL union has called for a general strike before the end of June and in Romania, joint union decision to call a general strike before the end of June.

•Greek telecommunications engineers cut off the telephone line to the Prime Minister’s house while attempting to disconnect a customer who was behind in payments, the telephone company OTE said.

Chinese Rumours That Spooked The Markets

This is the story that spooked the market last night. According to the FT, China, which boasts the world’s largest forex reserves, is reviewing its holdings of eurozone debt after the crisis that swept the region’s bond markets. Officials with China’s State Administration of Foreign Exchange, or Safe, which manages the reserves, have met foreign bankers in Beijing in recent days to discuss the issue. Safe, which holds an estimated $630bn of eurozone bonds in its reserves, has voiced concern about its exposure to the five so-called peripheral eurozone markets of Greece, Ireland, Italy, Portugal and Spain.

But Bloomberg later carried a story directly contradicting this saying that the head of the Chinese sovereign wealth fund said he plans to keep investments in Europe even after the euro’s decline. The China Investment Corp. had debated whether to lower the percentage of assets it allocates toward the continent, President Gao Xiqing said. The fund will monitor issues regarding the 16-nation currency and regulation to see if a return to previous growth rates is possible, Gao said. The article didn’t specify which issues the Chinese fund would be tracking. Hence the relief rally in equities today.

Hawkish Tones Coming From Fed Mouths

In a speech Wednesday Fed member Lacker said he was less comfortable with the Fed’s extended period language. He said while the inflationary implications of increased bank reserves have been minimal so far, they needed to be watched carefully. Inflation may remain extremely low for another couple of months, but then it’s likely to move back up to trend at around 1.5 to 2%.

This is becoming a more frequent message from the Fed. Hoening has officially dissented from the formal communication a number of times now, while today Fed member Bullard warned that maintaining rates near zero for an extended period carried the risk of creating new bubbles. He said the problem the Fed was running towards was that markets may confuse an extended period of low rates with a rate peg that doesn’t respond to shocks. In fact he said the markets may loose faith in the Fed’s commitment to remove quantitative easing.

Company News

•On the move today in Europe include Daily Mail +1.4% released a solid interim management statement and Maersk, +4%, trading higher after agreeing to sell its UK chain of Netto Stores to Asda for $1.1bn in a move that makes strategic sense given it didn’t have the scale in the UK it has in other countries.

•Insurance names are also bid today with Ageas up 9% after news that it had lightened up its PIIGS bond exposure to the tune of eur 4.8bn and invested the proceeds in “core” Eurozone markets. Aviva is up 6% today and Legal & General is also better by 6%.

•BHP Billiton and Rio Tinto Group rose in London trading after The Australian newspaper said Prime Minister Kevin Rudd’s government proposed changes to a mining profit tax.

•Rumour that the giant Prudential / AIA deal is off. No comment from The Pru and cable and the GBP in general is rallying on the “news”. Neptune Investment Management who owns 20% of the insurer has voted against the deal. The stock is up 5.5% today as it had traded off 15% since announcing the deal on March 1st.

•The big loser Thursday is Tate & Lyle (down nearly 9%) after numbers showed a 77% slump in profits as it was forced to take a £217mm charge after abandoning ambitious plans to open an ethanol plant in the US.

•Stateside US bank shares are trading up nicely pre-market with Citigroup and Bank of America both up 3%+. Pershing Capital’s Bill Ackman, said at a conference that he’d bought 150 million of the shares and a broker report tipped BoA Merrill Lynch shares to reach $27.

•A trader has paid $1.25 million to speculate in the options market that Citigroup will climb 30% by July, a bet with a potential return of more than 300%.

•Apple overtook Microsoft to become the most valuable technology company on optimism it can keep adding customers for its iPhone, Macintosh computer and iPad. Apple’s market value at close yesterday was at $222.1 billion, higher than Microsoft’s $219.2 billion. That made Apple the most valuable technology firm in the world. It’s also the second-largest US stock by market value, behind oil company Exxon Mobil, valued at $278.6 billion.

•ArcelorMittal, the world’s biggest steelmaker, will announce details Thursday of its plans for expansion of a major Brazilian steel plant. Expansion of the Joao Monlevade integrated long-steel products mill in Brazil’s Minas Gerais state will involve building new blast furnace facilities, among other upgrades.

•US stock markets are oversold and may rally strongly over the next few days, said investor Barton Biggs, who runs hedge fund Traxis Partners. “I think they’re going to stabilize in this general area, and then we’re going to have a significant move to the upside”. Biggs recommended buying US stocks last year when benchmark indexes sank to the lowest levels since the 1990s.

•Money manager Eric Sprott is buying gold and betting against stocks. Sprott is betting that governments around the world have run out of ammunition in their attempt to boost economic growth and counter banking losses through stimulus spending and lower interest rates.

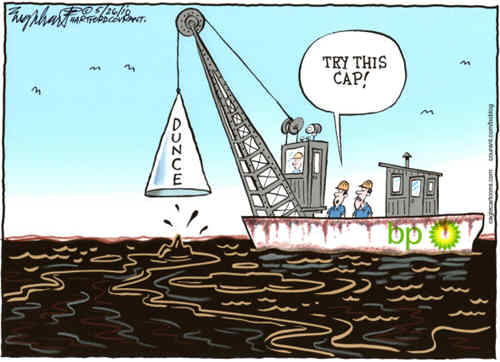

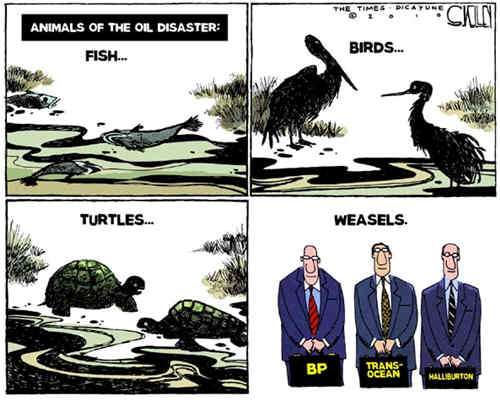

And Finally… BP Mocked With Hilariously Accurate Ad

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.