Weekly Financial Markets Analysis - Deja Vu

Stock-Markets / Financial Markets Sep 01, 2007 - 01:00 AM GMT“This is like déjà vu all over again.” Yogi Berra

When I read the following article, I get the feeling the feeling that, somehow, we've been here before. The Wall Street Journal Online printed an article called, “ 'Conduits' in need of a fix .” The article describes a practice at commercial banks of keeping certain assets “off the books” in order to avoid disclosure rules and collect additional fee income. Until now, this has been a very profitable practice for banks. However, subprime mortgages have found their way into these conduits and are causing havoc in the money markets due to the inability to gauge the risk of these vehicles.

This practice is similar to the practices of Enron just a few years ago. Enron was able to report massive profits from trading conduits that were nonexistent or so opaque that no one really knew what they were invested in. The difference here is that if a bank cannot sell assets in its conduit investments, then it has to draw down other reserves and, voila! The heretofor invisible asset is now a liability of the bank.

The inability to sell collateralized mortgage obligations and collateralized debt obligations due to the specter of subprime defaults seems to be the catalyst causing the necessity of four major commercial banks to go the Federal Reserve loan window last week. Oh, you say, “The Fed has just bailed out these banks. Therefore, the problem is solved.” Read on, dear friends.

Michael Nystrom has just entered the fray by reprinting with permission, an excerpt from Robert Prechter's Elliott Wave Theorist, which was published three weeks early. The Federal Reserve is “federal” in name only. In reality it is a private bank that will demand only the highest rated collateral for its loans. Therefore, it will not buy any subprime debt.

In his speech at Jackson Hole , Wyoming this morning, Fed Chairman Ben Bernanke attempted to reassure listeners that he is “on the ball.” However, there was a discordant note when he added that, while the Open Market Committee would stand by its pledge to limit the adverse effects on the broader economy that may arise from disruptions in the financial markets, it is not the responsibility of the Fed to protect lenders and investors from the consequences of their financial decisions. Investors, beware!

The Nikkei may be starting its next leg down.

This mornings news that Japan remained mired in deflation for the sixth straight month may not have been the catalyst for the 415 point surge in the Nikkei 225 last night. However, the drop in the unemployment index to 3.6% may have had something to do with it. The continued deflation is worrisome to the Bank of Japan, because not only are consumer prices declining, but asset prices are also falling.

This mornings news that Japan remained mired in deflation for the sixth straight month may not have been the catalyst for the 415 point surge in the Nikkei 225 last night. However, the drop in the unemployment index to 3.6% may have had something to do with it. The continued deflation is worrisome to the Bank of Japan, because not only are consumer prices declining, but asset prices are also falling.

The Chines stock market now bigger than Japan ?

The dramatic fall of the Nikkei index and the recent surge in the Shanghai Composite index may have resulted in the Chinese stock market overshadowing Japan's . This is a result of China 's emerging market being much more responsive to new debt, while much of Japan 's debt has been tied to real estate and stocks since the 1980s.

The dramatic fall of the Nikkei index and the recent surge in the Shanghai Composite index may have resulted in the Chinese stock market overshadowing Japan's . This is a result of China 's emerging market being much more responsive to new debt, while much of Japan 's debt has been tied to real estate and stocks since the 1980s.

Keeping the markets up for the holidays.

Today's action in the domestic markets was typical of month-end activities, especially since it is just before one of the biggest holidays of the Summer. What the rally fails to do is re-establish the upward trend by going above 1500. Traders are off to the Hamptons , celebrating their last Summer vacation.

Bonds showing high certainty over rate cuts?

Bernanke's speech left the topic of rate cuts unchanged, however. That means any potential rate cut is fully priced into the bond market. Meanwhile, investors' flight to safety in the bond market seems to have abated. The cost of borrowing short-term is higher than the long-term bond rates, which means that this rally may be over very soon. In addition, there is a clear five-wave form that suggests a completed pattern to the upside.

Bernanke's speech left the topic of rate cuts unchanged, however. That means any potential rate cut is fully priced into the bond market. Meanwhile, investors' flight to safety in the bond market seems to have abated. The cost of borrowing short-term is higher than the long-term bond rates, which means that this rally may be over very soon. In addition, there is a clear five-wave form that suggests a completed pattern to the upside.

Are jumbo loans out the door?

The credit crunch has turned $417,000 into the magic number for home buyers shopping for mortgages.

The credit crunch has turned $417,000 into the magic number for home buyers shopping for mortgages.

This is causing prospective home owners to change tactics in buying the more expensive homes that don't qualify for conventional mortgage financing.

The fact is, a large percentage of homes are now priced above the authorized limit for Fannie Mae and Freddie Mac. This is eating into profits for home builders who specialize in these homes, as well.

The U.S. Dollar now looking up…

…as it weathered its first correction. Many investors have become conditioned in recent years to flock to plain-vanilla U.S. Treasury bonds and other U.S. dollar assets during turmoil, and so the dollar and Treasurys have rallied even as other U.S. investments suffer. We may yet see the dollar strengthen as the turmoil continues.

The press is suggesting that demand for gold will be up this year.

They are anticipating the normal seasonal up-tick in demand as the holiday season approaches. But the real demand for gold may have emanated from the excess liquidity which allowed traders and speculators to bid up the price in anticipation of higher inflation. This chart is telling us that, in fact, deflation may be around the corner.

They are anticipating the normal seasonal up-tick in demand as the holiday season approaches. But the real demand for gold may have emanated from the excess liquidity which allowed traders and speculators to bid up the price in anticipation of higher inflation. This chart is telling us that, in fact, deflation may be around the corner.

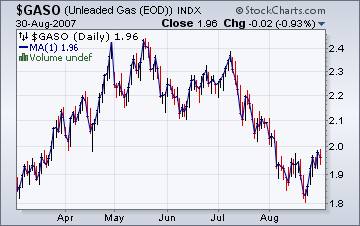

No hurricanes on deck. Enjoy the weekend.

The EIA's report on Wednesday tells us that there is good news and bad news. The good news is that gasoline prices are near their lowest since the Memorial Day weekend. The bad news is that inventories of gasoline are shrinking, which means that prices will stabilize near current levels for a while, even though demand will slacken in the fall.

The EIA's report on Wednesday tells us that there is good news and bad news. The good news is that gasoline prices are near their lowest since the Memorial Day weekend. The bad news is that inventories of gasoline are shrinking, which means that prices will stabilize near current levels for a while, even though demand will slacken in the fall.

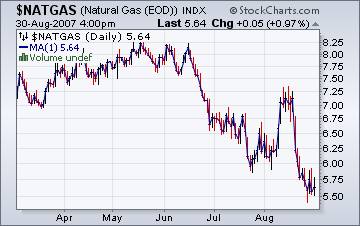

Supply: Large, Demand: Small.

Moderating demand and cooler weather kept the cost of natural gas in check, says the Energy Information Agency . The Labor Day weekend kept manufacturing demand down as well. The charts suggest that we could be in for a brief upturn very soon, but it may not last. Storage facilities are near capacity, and lower prices should follow.

Moderating demand and cooler weather kept the cost of natural gas in check, says the Energy Information Agency . The Labor Day weekend kept manufacturing demand down as well. The charts suggest that we could be in for a brief upturn very soon, but it may not last. Storage facilities are near capacity, and lower prices should follow.

The Discount Window is wide open.

WASHINGTON (Thomson Financial) - Banks borrowed an average of 1.315 bln usd daily from the Federal Reserve's discount window in the week ending yesterday, the Fed said this afternoon.

We now know who the clients are that the banks are borrowing at the Fed's Discount Window…themselves. And the Fed has relaxed the banking rules to allow this to happen. Mike Shedlock has a running commentary on this latest, very startling development. Two weeks ago, it was an undisclosed loan to Deutsche Bank. (What is the U.S. Federal Reserve Bank doing lending to a German bank?) Last week it was $2 billion to four of the largest banks in the U.S. This week it is over $6.5 billion more. When will it end?

“ Houston , we have a problem.”

Back on the air again.

Tim Wood of www.cyclesman.com , John Grant and I have had a running commentary on the markets again this week. You may listen to our comments by clicking here .Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: It is not possible to invest directly into any index. The use of web-linked articles is meant to be informational in nature. It is not intended as an endorsement of their content and does not necessarily reflect the opinion of Anthony M. Cherniawski or The Practical Investor, LLC.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.