Gold Surges towards Euro 1,000 on Global Flight to Safety

Commodities / Gold and Silver 2010 May 26, 2010 - 11:15 AM GMTBy: GoldCore

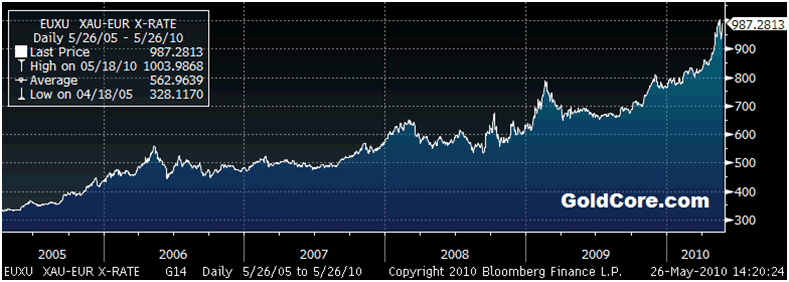

The flight to safety yesterday saw gold and US and German government bonds rise while equities fell internationally. Gold's rise was marginal but was significant all the same given the very sharp falls seen in equity and commodity markets. Gold rose sharply in euros and in the commodity currencies as these currencies came under pressure.

The flight to safety yesterday saw gold and US and German government bonds rise while equities fell internationally. Gold's rise was marginal but was significant all the same given the very sharp falls seen in equity and commodity markets. Gold rose sharply in euros and in the commodity currencies as these currencies came under pressure.

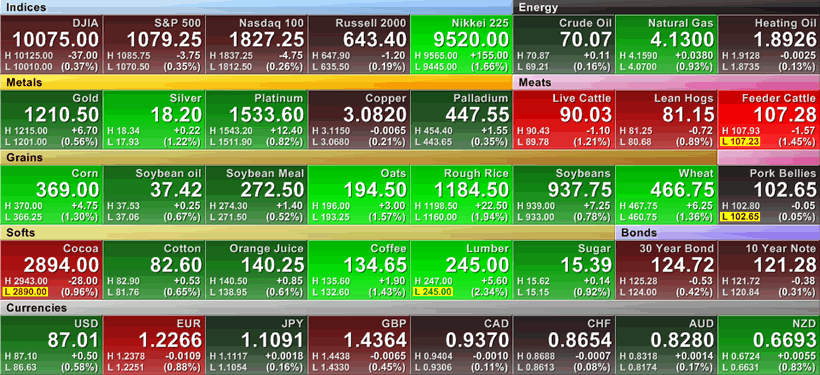

German consumer confidence index for June fell more than expected and the Italian government has imposed austerity measures involving 24 billion euros ($30 billion) in budget cuts. Gold is currently trading at $1,212/oz and in euro and GBP terms, at €985/oz and £842/oz respectively.

Gold in Euros - 5 Years (Daily)

While risk appetite has increased overnight in Asia and in Europe this morning (as seen in buoyant equity markets) it would be wrong to interpret this as a sign that the worst is over. Market sentiment remains fragile with continuing jitters over sovereign debt and currency markets, and over Europe's banking system. Pan-European sovereign credit default swaps are back to prices not seen since the €750 billion eurozone bailout package. While dollar Libor rose for the 11th day yesterday and euro basis swap figures showed that the cost to swap euros for dollars has now gone to the highest level since December 2008, showing the renewed fragility in the financial system.

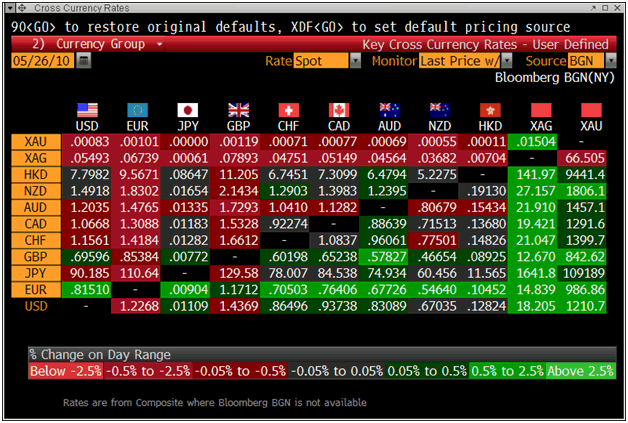

Cross Currency Rates as at 1423 GMT Showing Gold's and Silver's Strength This Morning

Gold's rise this morning is likely due to further safe haven buying on concerns that these risks could lead to contagion. The short term geopolitical risks of the inter-Korea tension were clearly overplayed, however as ever it is important to remain vigilant of the medium and long term risks of a military confrontation in the region.

The economic crisis in the EU is leading to severe political tensions as seen in the head of the European commission, José Manuel Barroso, launching a strong attack on the German chancellor Angela Merkel's handling of the euro's crisis of confidence calling her "naïve". Mrs Merkel recently warned that "the euro is in danger...if the euro fails, then Europe fails". Such severe political friction will do little to restore faith in the single currency.

Asian markets were up overnight and this has been attributed to Chinese commodity demand which was forecast by Rio Tinto to grow significantly in the coming 15 years.

Futures Markets Prices at 1423 GMT

Silver

Silver rose in Asian and European trading and is trading at $18.23/oz, €14.42/oz and £12.33/oz.

Platinum Group Metals

Platinum is trading at $1,529/oz and palladium is currently trading at $445/oz. Rhodium is at $2,675/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.