Stock Markets Hit by Spanish Woes, Korea And Soaring USD LIBOR

Stock-Markets / Stock Markets 2010 May 25, 2010 - 02:27 PM GMTBy: PaddyPowerTrader

Back into crisis mode courtesy of Korean sabre rattling, Spanish banking woes & skyrocketing USD inter bank rates. This toxic mix dragged down US stocks Monday with the Dow Jones Industrial Average to its lowest level in three months. Bank of America and JPMorgan Chase declined 3.5% plus to lead losses on the Dow, while Wells Fargo shed 4.7% after being downgraded over at Goldman Sachs.

Back into crisis mode courtesy of Korean sabre rattling, Spanish banking woes & skyrocketing USD inter bank rates. This toxic mix dragged down US stocks Monday with the Dow Jones Industrial Average to its lowest level in three months. Bank of America and JPMorgan Chase declined 3.5% plus to lead losses on the Dow, while Wells Fargo shed 4.7% after being downgraded over at Goldman Sachs.

Apple as so often is the case bucked the losing trend rising 1.8% after Morgan Stanley raised its share-price estimate and added the stock to its list of “best ideas.” Big picture wise for me there’s more than a whiff of the dog days leading up to Bear Sterns & Lehman’s around at the moment as increasingly events are overtaking and swamping the actions of policy makers who are consistently behind the curve

Overnight he MSCI Asia has just lost 3.34% overnight, and is trading at a level not seen since September 2009. Korea and Spain have been two important drivers of risk aversion early this week. In Spain the focus has been on the Bank of Spain taking over CajaSur and the merger of four other Caja’s (savings banks Monday), but I note that the IMF also sent warnings to the government on the urgency of reforming both the labour laws and the pension system and consolidating the banking sector rather than over egging the austerity measures and killing the economy stone dead. The focus, for me though remains very much on the growing pressures in the funding markets (see below)

On the FTSE (which is at a 8 month low) today RBS (- 8%) and Barclays (-6.5%) are down sharply while on the continent Deutsche Bank, BNP, Calyon & Soc Gen are also struggling as investors worry about banks exposure to the PIIGS, rising funding costs, fears of a fresh liquidity crunch & the hit to the bottom line that pending government taxes levies and new regulations will entail

Today’s market Moving Stories

•European Union Financial Services Commissioner Michel Barnier will tomorrow disclose proposals requiring EU countries to impose an upfront levy on banks, the Financial Times reported, citing unidentified European Commission officials. The proceeds of the plan would be paid into national funds to be used to insure against future financial failures and insolvencies, the FT said. The proposals are at a preliminary stage with the aim of legislating by 2011, the newspaper reported. Legislation would need the approval of both the European Parliament and member countries of the EU, the FT said.

•Four Spanish savings banks Monday said they have signed a protocol of intentions to eventually merge their operations while maintaining separate brands and corporate image. Caja de Ahorros del Mediterraneo, Cajastur, Caja Extremadura and Caja Cantrabria in a release said they intend to form “a financial group with the ambition to become one of the main financial units of the Spanish financial system.” The new merged bank would have EUR135 billion in assets and 2,300 branches

•The WSJ notes that European banks are being forced to pay more for short-term dollar borrowings than banks in the U.S. and Asia . On Monday, the London interbank offered rate, or Libo, the rate at which banks lend money to each other, and thus a vital sign of their mutual trust rose to its highest level for the three month dollar rate since last July. While the current Libor, at just above 0.5%, is far below the sky-high levels of 4.81875% reached at the height of the financial crisis in 2008, it is still a significant jump from 0.25% as recently as March.

•China: The State Administration of Foreign Exchange comments that China has ‘made some progress in combating illegal flows of speculative capital and at present is not facing a large influx of hot money’. It added that there were ‘small-scale inflows’ of speculative funds into the property sector. The comments emerged after a three-month investigation into cross-border money flows.

•UK: MPC member Adam Posen comments that the UK, “worryingly”, shares several financial parallels with 1990s Japan. He said “The real costs of recession and even financial crisis tend to accumulate over time as job loss turns to long-term unemployment, and as financial disruption turns to under-investment and capital misallocation. It is impossible to completely offset such negative structural effects and, unfortunately, I believe that there is reason to think they will be larger and more immediate in the U.K. today than they were in Japan in the 1990s.”

•The second estimate of UK Q1 GDP gives a pretty uninspiring picture of the strength of the economic recovery in the early months of this year. Admittedly, the headline q/q growth figure was revised up, as expected, from +0.2% to +0.3%, in response to stronger industrial production than previously assumed. What’s more, this figure could rise further in subsequent releases if services growth which was left unchanged at +0.2% is also nudged higher, as has been the case in recent quarters. But the breakdown by spending components brought little sign of the re-balancing of the economy towards the external sector which will be required to maintain a solid recovery when the fiscal squeeze kicks in. Indeed, net trade deducted 0.3% from growth. With household spending flat, growth was therefore driven by government spending, inventories and investment. The first two won’t last much longer. And while the 1.5% q/q rise in investment is welcome, it reversed only part of the drop in the previous quarter and is still down almost 6% on the year. Overall, a pretty weak picture. I continue to expect growth of just 1% or so in 2010 overall, picking up only slightly to 1.5% in 2011

North Korea Ready For Action

North Korean leader Kim Jong Il ordered the country’s military to get ready for combat in a message broadcast nationwide last week following South Korea’s announcement that North Korea torpedoed the South’s warship. The message was broadcast on May 20 by O Kuk Ryol, vice chairman of the National Defense Commission, according to the website of colourfully named North Korea Intellectuals Solidarity, a Seoul-based group run by defectors from the communist country. Yonhap News agency reported on the group’s posting earlier today. The U.S. yesterday announced plans to conduct joint anti-submarine exercises with South Korea after the sinking of one of the South’s warships cost 46 lives. The South Korean won declined as much as 4.3% to 1,272.45 against the dollar after the Yonhap report. South Korean defense-related stocks rallied. Speco., a military installation parts developer, rose 12 % and. Victek , which makes electronic warfare equipment, surged 7.8%

Company / Equity News

•IBM., the world’s biggest computer-services provider, has agreed to buy Sterling Commerce for $1.4 billion in cash, gaining software that helps businesses conduct transactions. IBM willbuy Dublin, Ohio-based Sterling from AT&T Inc., the biggest U.S. phone carrier, according to a statement from the companies today. Its software helps businesses share information and transfer files to other companies.

•Nokia and Yahoo! have agreed to collaborate on mapping, e-mail and instant-messaging services to spur revenue from mobile advertising. The companies said they will present products displaying both brands in the second half of 2010. Nokia will offer Yahoo’s e-mail services and provide the Sunnyvale, California-based company with maps and navigation. Financial terms weren’t disclosed.

•Apple CEO Steve Jobs will address the company’s Worldwide Developers Conference in June, a sign Apple may be planning to unveil the next version of its iPhone, analysts said. “Given Apple’s track record, the most likely scenario is that they’ll introduce new hardware, in this case the latest iPhone,” William Kreher, a St. Louis-based analyst at Edward Jones & Co., said in an interview.

•The U.K.’s Pace Plc has become the world’s biggest maker of television set-top boxes, having overtaken Motorola Inc. of the U.S. and Technicolor of France, the Financial Times reported, citing figures from IMS Research. Pace increased supplies of the devices by 31 percent, to 17 million, last year

•A report in the Daily Mail (not a great source admittedly) speculates that Imperial has found a purchaser willing to pay GBP900m for the third party logistics arm of its Logista subsidiary

•M&S FY results were at the upper end of expectations, with PBT rising 4.6% to GBP632.5m on revenue up 3.2% (on a 52 week basis – reported results were 53 weeks). Whilst M&S does not break down profits by sector, General Merchandise like for like sales were +1.6% and gross margin was up 70bps, whilst Food sales were flattish (+0.3%), with gross margin down 95bps.

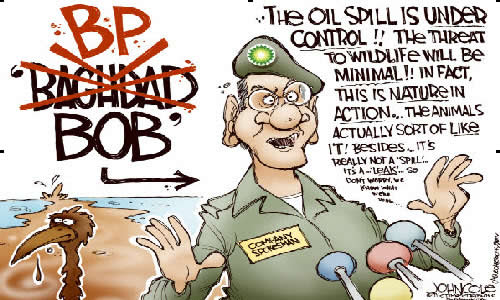

•The Times reports that he soaring cost of the oil spill in the Gulf of Mexico could forceBP to freeze its payout to shareholders for up to three years, City experts said. Britain’s second biggest company said that the bill to control the leak had increased by more than 20 per cent in the past week to $760 million, up from $625 million on May 18. However, that figure excluded the potential legal claims from the accident. If oil stays at $70 thenBP should be able to meet its spending plans and also maintain the dividend. But [the spill] will probably push back the time that they could raise it.”

•Australia’s biggest mining companies Monday sharply raised the stakes in the battle with the government over a planned new tax, warning that the proposal had already damaged the nation’s reputation and accusing the government of misrepresentations. Rio Tinto’s Chief Executive Tom Albanese said the government’s planned Resources Super Profits Tax is the biggest sovereign risk issue the miner faces.

•Oil companies are also weak as the price of crude slumped below $68 barrel hitting 67.31 at one point.

•British Airways scrapped flights for about 25,000 people for a second day, with no sign of a return to talks between the airline and the union representing cabin-crew workers over the wage bill and staffing levels.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.