Global Stock Markets Co-ordinated 2.5% Tuesday Drop

Stock-Markets / Stock Markets 2010 May 25, 2010 - 12:25 PM GMTBy: PhilStockWorld

We failed to retake 10,200 yesterday.

We failed to retake 10,200 yesterday.

We failed to retake 1,100 on the S&P and we failed our 2,225 line on the Nasdaq and that means we’ll be testing that 630 line on the Russell and, if they don’t hold, I’ll be sending a box of chocolates to CNBC to apologize for calling them a bunch of dangerous morons when they were telling their viewers to panic and liquidate their portfolios on Friday afternoon. Today, on their web-site, CNBC has quite the collection of headline articles including:

Global Markets Now Infected with Europe Fear

Global Markets Now Infected with Europe Fear- Markets Headed For a Double-Dip Recession: Pro

- Double-Dip Recession Now Assured?

- Year-Long Rally Is Over: Charts

- Roubini: Stocks to Fall 20% Further—Cash Is Best

- Correction Is ‘Not Over’—Market ‘Worse Than January’

- Fortress Chief: We Are De-Risking

- Greece ‘Tip of the Iceberg’: Deputy Doom

- Germany Prepares for $13 Billion ‘Debt Guillotine’

- Is the Shanghai Composite in Bubble Mode?

- In Europe, Britain May Face Largest Debt Hurdle

- Europe in Crisis, Lawmakers Get New iPads

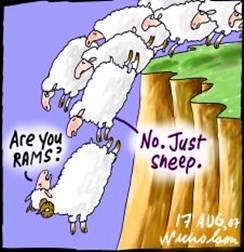

Gee, kind of a chicken and egg thing trying to figure out of they cause the panic or are they are just egging it on? After looking at the front page of their web site, even I’m ready to stop at the nearest gold vending machine on my way to the gun store. Cramer set the downside target at 9,500 last night and said the negativity may be overdone (I guess he’s reading CNBC’s web site).

Despite the dips, we don’t panic and liquidate our portfolios on one-day drops. As I mentioned in the Weekend Wrap-Up, we have plays like our SDS spread that pays 7:1 if the market stays below 1,085 and, in yesterday morning’s Alert to Members, we added 4 May and June hedges (DIA, QID, TZA, SDS)which triggered as we lost the Nasdaq in the afternoon. Mega kudos to the great Andrew Wilkinson, who gave us a heads up on today’s action by catching this move in his column:

EEM – iShares MSCI Emerging Markets Index ETF – An enormous bearish put butterfly spread comprised of 240,000 put options cast a gloomy shadow over the emerging markets fund late in afternoon trading. Shares of the EEM, an exchange-traded fund designed to provide investment results that correspond to the price and yield performance of the MSCI Emerging Markets Index – an index created to measure equity market performance in the global emerging markets, are down 0.35% at $37.21 as of 3:30 pm (ET). The massive bearish transaction on the fund suggests one big player is bracing for a potential 19% pullback in the price of the underlying shares by June expiration.

The butterfly spread spans the June $25/$30/$35 strikes, with 60,000 puts picked up at the June $25 strike for a premium of $0.11 each [wing 1] and another 60,000 puts purchased at the higher June $35 strike for a premium of $0.88 apiece [wing 2]. The body of the butterfly involved the sale of 120,000 puts at the central June $30 strike for a premium of $0.27 a-pop. The net cost of the spread amounts to $0.45 per contract. The EEM’s shares must slip beneath the upper break-even price of $34.55 before the investor starts to make money ahead of June expiration. Maximum available profits of $4.55 per contract pad the investor’s wallet if shares of the underlying fund fall 19.35% from the current price to settle at $30.00 at expiration. Shares of the EEM last traded below $34.55 back on August 19, 2009, and touched a 52-week low of $30.12 back on June 23, 2009. The investor responsible for the giant transaction only ever risks losing $0.45 per contract, but stands ready to amass more than 10 times that amount – $4.55 per contract – if shares nose-dive down to $30.00 ahead of expiration day next month

The butterfly spread spans the June $25/$30/$35 strikes, with 60,000 puts picked up at the June $25 strike for a premium of $0.11 each [wing 1] and another 60,000 puts purchased at the higher June $35 strike for a premium of $0.88 apiece [wing 2]. The body of the butterfly involved the sale of 120,000 puts at the central June $30 strike for a premium of $0.27 a-pop. The net cost of the spread amounts to $0.45 per contract. The EEM’s shares must slip beneath the upper break-even price of $34.55 before the investor starts to make money ahead of June expiration. Maximum available profits of $4.55 per contract pad the investor’s wallet if shares of the underlying fund fall 19.35% from the current price to settle at $30.00 at expiration. Shares of the EEM last traded below $34.55 back on August 19, 2009, and touched a 52-week low of $30.12 back on June 23, 2009. The investor responsible for the giant transaction only ever risks losing $0.45 per contract, but stands ready to amass more than 10 times that amount – $4.55 per contract – if shares nose-dive down to $30.00 ahead of expiration day next month

My comment to members regarding Andrew’s catch was: “Something is up, Andrew noted a big buy in Emerging Market shorts into the close. That’s more than $1M bet on something that one would hope is a black swan event but you don’t set up a trade like this if you don’t know something!“ Now, who knew something and what did they know? That would be very interesting to find out but, sure enough, the Emerging Markets are in full-blown melt-down this morning and now we have to decide if we jump out the window with the CNBC crowd or do we BUYBUYBUY on this dip…

We had noted the Spanish bank thing in the afternoon Member chat with the following news item (my comment in bold):

The next big crisis? The Spanish banking system is so dishonest that it is really “a kind of anti-market,” Jonathan Tepper says. Spanish banks could be sitting on €300B in mortgage-related losses, he asserts, but it is impossible to tell how bad things really are – or to fully assess the impact of the weekend’s – since they have refused to properly price houses sitting on their books.

This is sort-of a proximate trigger for the sell-off this morning. The WSJ is leading with “Europe’s Banks Hit by Loan Costs,” saying: “European banks are being forced to pay more for short-term dollar borrowings than banks in the U.S. and Asia—suggesting that lenders world-wide are increasingly nervous about the risks ahead for European banks” and we had already noted that higher in yesterday morning’s post so it’s hard to call this NEWs. Kim Jong Il is doing crazy stuff but that’s hardly news either but look at this (over?)reaction from the futures as we shatter our 1,070 and 1,55 levels – all the way down to test our 1,040 support… or at least it better be support!

Germany is looking to support things by banning naked short selling on ALL stocks (before it was just some of the Financials) but again, naked short selling was already banned in the US last year and we survived it and the ban sure hasn’t stopped any selling on the DAX so far! Kim Jong Il actually ordered his military to prepare for combat LAST WEEK so also not new news and I’m not even sure if the rumors coming out of Korea are true. Still, we aren’t going to go trying to catch falling knives and it’s going to be critical to hold our 20% lines this week (and a 4% bounce from there is still weak) which are, internationally:

Looks like there’s no stopping the 20% train. Keep in mind these are yesterday’s close and Europe is down about 3% as of 9am with the FTSE at 4,900, CAC at 3,300 and DAX at 5,640. We’ll need to see the CAC pull themselves together or we may be needing a new round of long-term Disaster Hedges to protect us below 800 on the S&P! US stock indexes are a little better but nothing to hang our hats on:

So much for finding safe havens for assets. Gee, I guess the only “safe” place to put your money is into Sovereign Debt Notes – ROFL!!! All I know is that it’s going to be a great morning to buy some TBT, I think selling the Jan $40 puts for $7 is the way to go. If you want to play for the boomerang effect on runaway interest when the G20 drops another $3Tn in stimulus on the market, then you can go for the 2012 $40/60 bull call spread for $3 – these are hedges against high interest rates and inflation to guard your cash!

Be very careful out there – hopefully we’ll be able to pick a few upside plays but we’ll be watching the EU closely to see if they can hold that 2.5% line for the day but things can certainly get worse if we can’t hold our lines…

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.