Interview with Nick Leeson on Gordon Brown Gold Sales and GATA

Commodities / Gold and Silver 2010 May 25, 2010 - 06:41 AM GMTBy: GoldCore

Nick Leeson is a former derivatives broker and investment officer of Barings Bank. His unsupervised, unauthorised trading caused the collapse of the 233 year old Barings Bank, the United Kingdom's oldest investment bank, in 1995.The losses of $1.3 billion were considered massive at the time.

Nick Leeson is a former derivatives broker and investment officer of Barings Bank. His unsupervised, unauthorised trading caused the collapse of the 233 year old Barings Bank, the United Kingdom's oldest investment bank, in 1995.The losses of $1.3 billion were considered massive at the time.

Nick Leeson has served his time and is contrite for his actions. GoldCore in no way condone his activities but believe that his losses serve as a reminder to the fragility of the still unreformed global financial system. Indeed, Leeson offers interesting insights into governments' response to the crisis and his opinions on the UK gold sales are noteworthy.

Nick Leeson has served his time and is contrite for his actions. GoldCore in no way condone his activities but believe that his losses serve as a reminder to the fragility of the still unreformed global financial system. Indeed, Leeson offers interesting insights into governments' response to the crisis and his opinions on the UK gold sales are noteworthy.

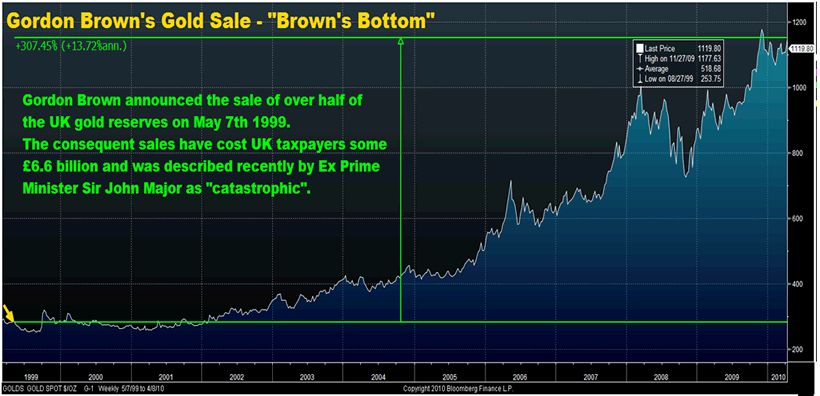

Leeson's $1.3 billion loss has recently been surpassed by the losses incurred by the UK Treasury after departing Prime Minister Gordon Brown's sale of more than half of the UK's gold reserves at historically low prices when he was Chancellor for the Exchequer. Former Prime Minister, Sir John Major, recently commented that the £6.6 billion losses incurred by UK taxpayers were 'catastrophic'.

The interview is topical given Brown's recent disastrous election defeat and the increasing scrutiny of the poor economic legacy he has left the UK.

Mark O’Byrne, GoldCore

In the movie, Rogue Trader, there is a scene where the actor Ewan MacGregor is standing in front of a mirror in a state of panic shouting the words ‘I Nicholas Leeson have lost fifty million dollars in one day!’ Did this actually happen Nick?

Nick Leeson

Well there is a degree of artistic license taken there... I did look in the mirror and say "sh*t ! ... I have lost $50 million dollars today". But I said it to myself rather than out loud.

Mark O’Byrne

During the recent election and his defeat, Gordon Brown has been receiving a lot of criticism recently for his stewardship of the UK economy. How do you think he did?

Nick Leeson

If they ever make a movie about the life of Gordon Brown, remind me to go and see it. Forget about the fact that as Chancellor he presided over the biggest stockpiling of debt that the UK has ever seen - compelling viewing that it may make.

I wouldn’t even be mildly interested in seeing how as Prime Minister he pretty much threw the kitchen sink at the developing financial crisis in the hope that it may go away and failed to alter its course. Indeed, it may make things much worse in the long term - particularly for the value of sterling.

No, what I really want to see is a movie about possibly the worst trade in history. Forget about the fifty million that I lost in one day and there is every chance that that figure is conservative. I don’t even register on the Richter scale when it comes to Gordon Brown’s biggest faux pas.

Mark O’Byrne

I presume you are referring to Gordon Brown’s gold sales and the "Brown bottom"? Interesting, that the election took place on May 6th and it was on May 7th, 1999, that Gordon Brown announced he was planning to sell 400 tonnes of the UK's natural stock of gold.

Nick Leeson

Yes, nearly 11 years ago, Gordon Brown decided to sell almost sixty percent of the UK's national patrimony - our gold reserves.

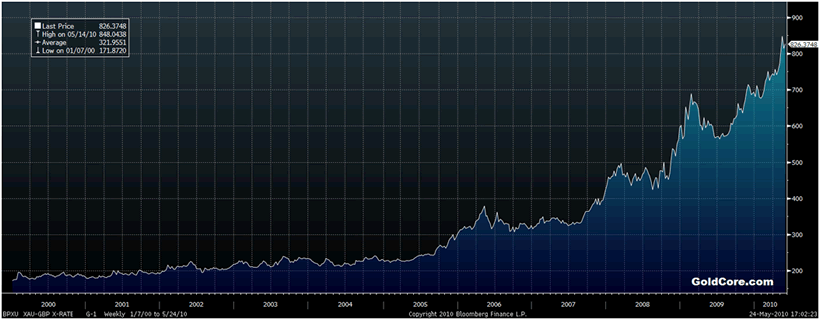

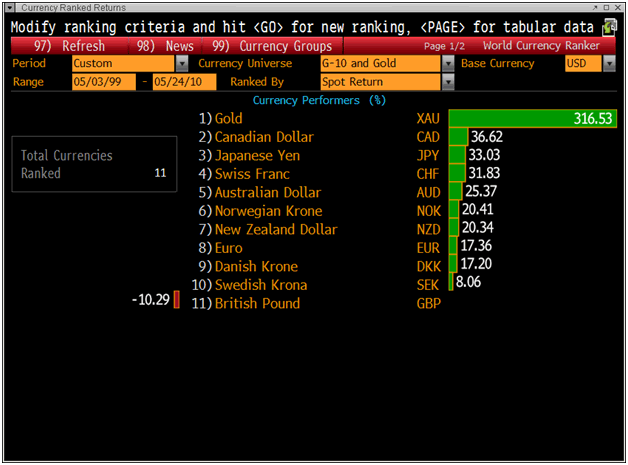

Between July 1999 and March 2002, Gordon Brown sold 415 tonnes of gold at an average price of $276 per ounce (less than £200/oz). Since Brown's sale, gold has rallied strongly for nine consecutive years, significantly outperforming the majority of other asset classes over the past decade. Today, gold is trading at over $1,200/oz and £840/oz (or €985/oz), considerably more than a three-fold increase in price in dollars, sterling and the beleaguered euro.

More significantly, the gold sold is worth some £6.6 billion more than the £2.2bn that the Treasury received over the period of the sale.

Mark O’Byrne

The way Brown went about the sale has caused controversy and raised questions?

Nick Leeson

Indeed it has. Gordon Brown telegraphed the sales to the market by announcing them in advance, leading to lower gold prices. Some such as MP Peter Tapsell repeatedly cautioned him in Parliament not to do it and campaigned against the sales. Thus, Brown sold near the very bottom of the market at prices that had not been seen since 1979. Indeed, many believe that the sales actually helped depress the gold market significantly.

Mark O’Byrne

Have you heard of the allegations by GATA and others that some Wall Street banks and governments might collude to suppress the gold and silver price and what do you make of it?

Nick Leeson

I have heard the allegations by GATA but it is not something I am particularly aware of. I would not be surprised if there were interventions and manipulation, but I honestly don't know. Governments are already intervening in the bond markets and all these markets are interlinked. Indeed, if one is attempting to protect the value of the dollar or the euro it might make sense to try and contain silver, and particularly gold prices. Gold is the canary in the coalmine and a surging gold price will not help efforts to maintain investors' and savers' confidence.

Mark O’Byrne

Brown's gold sale must be one of the worst trades ever. Ex Prime Minister Sir John Major recently called the decision "catastrophic".

Nick Leeson

It most certainly beats me and a host of others that I can think of. This 'Master of the Universe' went from running the Treasury to running the country. No wonder the country is in trouble.

Mark O’Byrne

How have the sales affected the UK and the man in the street?

Nick Leeson

If Brown had not sold much of Britain's gold, British taxpayers would be nearly £6 billion better off. Not to mention having an important monetary asset that might help protect the British pound as its sovereign debt faces a possible credit rating downgrade and fiscal deficits and red ink as far as the eye can see.

Having that £6 billion worth of gold reserves would mean that the pain that we all feel as taxpayers in footing the bill for the follies of the government and the banking system would be significantly less. And it would protect sterling from falling in value in international markets leading to inflation.

Mark O’Byrne

What were they thinking?

Nick Leeson

At the time the Treasury stated that it 'wanted to achieve a better balance in the portfolio' by increasing the proportion of reserves held in foreign currency. It wanted to reduce its risk to one asset class. But much of the proceeds were used to buy euros which given the problems in Greece, Spain and Portugal was not particularly 'prudent'.

The statement makes a lot of sense ostensibly and Brown should have remembered it. As if you are looking to reduce risk, everyone knows you must diversify your portfolio. Gold is and will always remain a store of value, a global currency and the place that markets look when there is a flight to safety. Importantly, it has an inverse correlation to equity and property markets and today’s global reserve currency, the dollar.

In recent times, the world of trusted money, limited debt and good fiscal housekeeping has been swept away by an unprecedented financial storm. Banks and governments have weighed themselves down with staggering debts. Britain is heading for a national debt of £1.4 trillion by 2014, twice the burden that Labour inherited in 1997.

G10 Currencies Performance (May 1999 to Today) - Gold Best and British Pound Worst Performing Currency.

Mark O’Byrne

In fairness to Brown, the US has been equally fiscally imprudent and the US government’s debts are now on their way to well over $20 trillion, ten times of that in 1980.

Nick Leeson

Indeed they are - imprudence has been seen internationally and it truly is a global debt crisis with its epicentre in the Club Med eurozone countries. And the nuclear monetary option of quantitative easing or printing money to buy bonds has been attempted to get the economy moving again. But it has had only limited success.

This comes with its own set of problems and if the monetary accelerator is held down for too long, it can easily give rise to inflation, stagflation and in a worst case scenario, hyperinflation.

Mark O’Byrne

Do you really think that the German 'wheelbarrow of paper money' style hyperinflation is possible?

Nick Leeson

It is possible but I think it is unlikely that the western world will see hyperinflation as seen in Germany's Weimar Republic or in Zimbabwe last year. However, very high inflation is possible.

With increasing monetary uncertainty, gold's dependability is again being recognised. People are losing faith in the major currencies and gold is reasserting itself as a monetary alternative to fiat currencies internationally.

Mark O’Byrne

Do you think gold is a bubble or will it go higher?

Nick Leeson

Gold's great liquidity is another important quality in these times and under some conditions it is likely that gold could become more liquid than even high quality bonds. With continued uncertainty in the world's financial markets, economies and monetary system, a new traded high cannot be ruled out and some believe that the inflation adjusted high of over $2,200/oz may be reached in the coming years.

Mark O'Byrne

Thanks for your thoughts, Nick.

Nick Leeson

My Pleasure - good talking to you, Mark.

Nick Leeson Interviewed by Mark O’Byrne, Executive Director of GoldCore

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

oliver

27 May 10, 12:35 |

Nick's Advice

Usually one would do the exact opposite of Nick, however im with him on this one. |