The True State of Today’s U.S. Economy, Facts Vs Fiction

Economics / US Economy May 22, 2010 - 01:27 AM GMTBy: David_Galland

By David Galland, Managing Editor, The Casey Report : There is a lot of “noise” being tossed out by the politicos and their preferred pundits about how the U.S. economy is on the mend. Thus it is important to try and separate fact from fiction about where things really stand.

By David Galland, Managing Editor, The Casey Report : There is a lot of “noise” being tossed out by the politicos and their preferred pundits about how the U.S. economy is on the mend. Thus it is important to try and separate fact from fiction about where things really stand.

FICTION: Though sporadic, the U.S. economy will continue to improve.

FACT: The U.S. is headed for a currency crisis.

While having learned to cover their butts by adding some modest modifiers to their generally rosy forecasts, the administration’s shills (Geithner, Bernanke, Summers, et al.) are unified in telling us that the worst is over.

The fact is that the U.S., nay, the world, is headed for fiat currency crash. Let me push forward some evidence in support of that contention.

In this fiscal year, the U.S. government will run its second trillion-dollar-plus deficit. Concerned about the political heat going into the November elections, the Democrats have been making noise about cleaning up their sloppy spending.

A couple of months back, El Presidente of this banana republic intoned that his government… …[cannot] continue to spend as if deficits don’t have consequences… as if the hard-earned tax dollars of the American people can be treated like Monopoly money.

Which is to say, he acknowledged that the deficits have consequences. And what might those consequences be?

For starters, rising interest rates. Because in order to finance its hyperactive spending, the government will have to sell a lot of debt – and because all the developed nations find themselves in the same boat, they’ll have to manage those sales in an increasingly competitive environment.

Of course, higher interest rates put yet more pressure on the many businesses that rely on access to capital to sustain themselves. And higher rates crush borrowing for houses and other large-ticket items… which means, they crush the economy. Especially one perched on a foundation of debt.

Inflation is another consequence, because when the prospective debt buyers begin to stay home or, more likely, agree to show up but only for a more attractive yield, the Fed will increasingly be forced to monetize the debt. Leading to the demand for even higher yields. Once the monetization begins in earnest, and in plain sight, Obama’s high-speed spending train will find itself on very wiggly tracks, leading in relatively short order to a debt-fueled currency crash.

The point is that the only real hope for the country starts with deep cuts in government spending. Now, I am not talking about talking about cutting spending – you know, where you stand in front of a warmed-up audience and talk about spending cuts. But honest-to-goodness, real spending cuts.

Which brings me to Mars.

On April 15, the president gave a speech at Cape Canaveral where, ahead of time, it was advertised that he would announce serious cuts in the space program. That was the fiction spun out to the pundits.

Instead, when it came time to stand and deliver, Obama delivered a $6 billion boost in NASA’s budget, then offset the cancellation of a program that would once again send men to the moon by announcing a new program to land astronauts on Mars… and drop in on an asteroid as well.

Over the course of my days on this remarkable planet of ours, I have had the opportunity to get to know all manner of personality types. One of the most troubled have been the serial spenders… deluded individuals that simply can’t help but buy all that their hearts desire, no matter how much pain results from their debt-financed spending. That describes today’s political class.

Unless and until you start hearing the president making speeches about not going to Mars, followed by wishing legions of government employees the best of luck as they enter the private sector, the only conclusion to be drawn is that a space ship isn’t the only thing headed for outer space, but government debt as well.

The spending is unsustainable and so won’t be sustained.

FICTION: You can count on the mainstream financial media for unbiased information.

FACT: They’re lying to you.

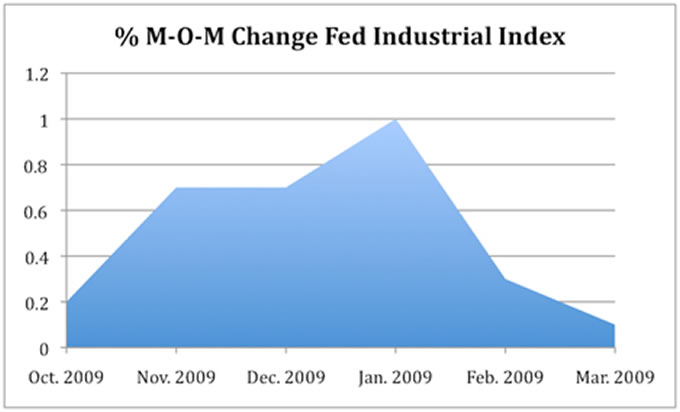

It’s important to do your own due diligence and trust only your own calculations when confronted with cheery financial headlines. A couple weeks ago, for instance, the Fed’s national industrial index was positively reported on as having continued to improve. By 0.1%. That’s an improvement of .001, or roughly the width of a whisker on a gnat. And even that vaporous improvement came on numbers that are still deep in the post-crash dumps.

But even if we use the Fed’s own numbers, we see that the month-over-month rate of improvements is losing steam, not gaining traction. This is an economy we can believe in?

That’s not to say that there aren’t some improvements in the economy. There clearly are. But I contend these improvements are largely selective.

For instance, the mining sector is doing quite well – and is now running at a capacity utilization rate of 90%, versus the broader manufacturing sector, which is bumping along at just 70%. Crude oil production is also running hot, at a capacity utilization of 87.4% in March, versus finished goods at an anemic 71.8%.

In other words, the stuff that the world actually needs to chug along is still in strong demand – but the rest of the economy is just limping along.

Anecdotally, I have had conversations with managers/owners in three different industries over the past month.

A developer of low-income housing said that while things were slightly better compared to this time last year, they were still a disaster and there was no real recovery in sight. The manager of a high-end boat/RV retailer, whose lot is chock-a-block full of expensive motor homes and boats, was trying to be optimistic going into his traditional big sales season, and he had clearly boosted inventory. But as the sales season is still not quite underway, his guarded optimism is based on nothing more than hope at this point. When I asked him about the availability of credit, he said that people with very good credit can get financing, but everyone else can forget about it. Oops, there goes the majority of his potential buyers.

Then, the other day, I had a beer with fellow Casey Researchers Olivier Garret and Alex Daley down at a local pub/restaurant/hotel. The owner popped around to say hi, and I asked him if he was seeing an improvement in the economy. His reply, “Oh, there is an economy? Could of fooled me!” While he made the comment as something of a joke, the establishment remained largely empty well into the traditional cocktail hour when we left.

As an aside on the topic of restaurants, I have noted that the better-run restaurants – the ones that provide value for money – are doing reasonably well in the New England resort town that hosts the headquarters of Casey Research.

Rather than confirming a broadly improving economy, however, I suspect this is not unlike the phenomenon where, for a brief period, chickens are able to run around without the benefit of their heads. Which is to say, dining out seems to be a reflexive action taken by people who still have jobs and who may have seen some improvement in their stock portfolios.

We humans really don’t like change and typically resist embracing it. Thus, those not forced by personal circumstances to hunker down – i.e., those still receiving paychecks – are following the boom-year custom of regularly dining out, and to a lesser degree, using their still active credit cards to buy stuff they really could do without.

My grandfather, a young man during the Great Depression, was a lifelong skinflint as a result of his experience. One of his favorite sayings when resisting one of the grandkids trying to put the touch on him for one toy or another was, “Money doesn’t grow on trees.” By the time this is over, people will be saying, “Money doesn’t sprout from credit cards.” Back on the topic of the financial media… I don’t watch the financial cable shows. For one thing, I don’t have cable. But even if I did, I wouldn’t, because almost to a person these people missed the crash. So, why should I listen to them today? Most of the pundits are talking their own book. And all of the financial news programs know that the stock houses and funds that buy the ads will bolt if their programs take a steadily dim view on the outlook for the economy and stock market.

FICTION: The housing market is improving.

FACT: Would you like to buy a bridge in Brooklyn?

In mid-April, Bloomberg reported that “Builders broke ground on more U.S. homes in March than anticipated and took out permits at the fastest pace in more than a year, a sign of growing confidence that sales will stabilize. “Housing starts climbed to an annual rate of 626,000 last month, up 1.6 percent from February’s revised 616,000 pace that was higher than initially estimated, Commerce Department figures showed today in Washington.”

On the other side of the ledger, the Financial Times stated, “Whitehall Street International, Goldman Sachs’ international real estate investment fund, has lost almost all of its $1.8bn of equity following soured property investments in the US, Germany and Japan, according to the Fund’s estimates. “By the end of 2009, the fund was down to its last $30m, a paper loss of about 98 cents on the dollar, an annual report sent to investors last month said.”

If the world’s most successful investment house can lose essentially all its equity in a real estate fund, you know we’re not in Kansas anymore.

Fox Business presented another dose of realism, saying that “Commercial real estate is showing few signs of leveling out nationwide and several regions continue to get hammered by declining values.” I can tell you that around here, the commercial space that was empty a year ago is still empty today. And I’m talking even about the prime locations. So, how to explain the upbeat housing articles in Bloomberg, when the facts on the ground seem to indicate the exact opposite? Other than the steady evidence that Bloomberg has taken on a cheerleader role for the Democratic machine its boss is a solid cog in, builders may be looking to build simply because that is what they do.

What they’ll actually be doing is assuring their future bankruptcies. The following is an excerpt from an email from Jim B., a Casey subscriber and regular correspondent, shedding light on the matter (emphasis mine).

Down here in Austin, there's a housing construction recovery in bloom. I spoke to one of the contractors today. He was very happy to have his ten workers back to work after over a year of no work at all. One minor problem: the home construction company wasn't paying him. I'm guessing the companies are using their subcontractors as lenders and will repay the "loans" if/when the houses are sold. Their credit must still be in the toilet, so it can't get any worse. This looks ominous.

I buy distressed property, mostly foreclosures. The usual number of houses in foreclosure in Travis County in the mid-‘90s was around 325 per month. Of those, about 30 had enough equity to make a deal work. The number of foreclosures about six months ago was about 825, and the number of good deals was still about 30. So, about 500 houses per month above the normal rate are being dumped into the Austin real estate market. Just how new construction will overcome this competition is a drama I'm waiting to see.

At some point, real estate will again be a great investment – but for now, holding fire on new purchases seems the right thing to do. As for buying housing industry stocks or bonds – not hardly.

FICTION: The U.S. government has everything under control.

FACT: The U.S. government is on tilt.

At this point the list of hastily conceived, politically motivated spit-and-plaster fixes that have been cobbled together by the government in an attempt to fix the economy – versus just getting the hell out of the way and letting the economy fix itself – could fill a book. The only thing that matters to the administration and its allies is to corral a sufficient number of votes to get through the November elections on their collectivist feet.

And now Goldman Sachs has been charged with one of its many frauds. I should have seen this coming, as they had become – in the minds of Obama’s core constituents – the poster child of Wall Street’s greed. In addition, the firm has very, very deep pockets – just as Drexel Burnham Lambert did when the government laid them low with a $700 million fine… virtually none of which was then passed on to the purported victims of their indiscretions.

In the case of Goldman Sachs, I suspect that they may have become too clever by half – and that they’ve crossed some lines that will now be used by their erstwhile friends in Washington to string them up. And, in so doing, provide Team Obama with a win-win of appearing as a staunch opponent of Wall Street fat cats, while simultaneously confiscating another several billion to be cycled into the furnace of federal spending.

At this point, the only sane way to view the government is as an out-of-control gorilla that is wildly grabbing in all directions. As Goldman Sachs may be about to learn, once the gorilla has caught a hold of you, you’ve got real problems.

Unfortunately, the gorilla has grown so large that at this point it has its arms around the most of the economy. Counterproductive tax hikes are already baked in the cake and, if the administration has its way, it will soon try to layer on the mother of all tax increases in the form of a VAT. (I think at that point we might actually see riots in the streets.) Therefore our constant admonitions to be careful and to be largely in cash just now, combined with very carefully selected stocks that will weather even a Category 4 economic hurricane. Words to the wise.

- - - - - -

The Casey Report editors – Doug Casey and David Galland among them – have predicted all the recent economic trends months or even years before they happened: the bursting of the housing bubble… major bank failures… the credit crisis… the demise of the dollar… and many more. Learn how they do it and how you can profit from budding trends, even in times of crisis. Click here for more.

© 2010 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.