Gold, Precious Metals, Commodity Currencies and Stocks Fall

Commodities / Gold and Silver 2010 May 19, 2010 - 12:09 PM GMTBy: GoldCore

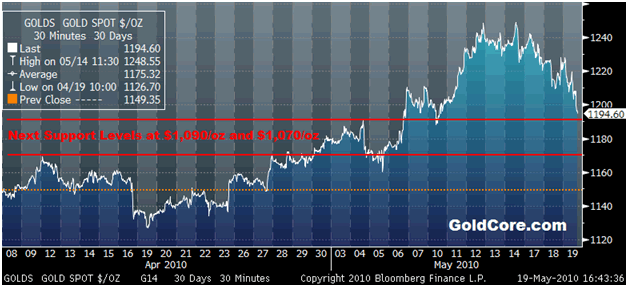

Gold closed with a loss of 1.09% yesterday. It rose from $1,206/oz to $1,220/oz in Asian and early European trading this morning. Gold subsequently came under pressure due to profit taking and institutional selling driving prices through key technical levels. Gold is currently trading at $1,190/oz and in euro and GBP terms, at €965/oz and £827/oz respectively.

Gold closed with a loss of 1.09% yesterday. It rose from $1,206/oz to $1,220/oz in Asian and early European trading this morning. Gold subsequently came under pressure due to profit taking and institutional selling driving prices through key technical levels. Gold is currently trading at $1,190/oz and in euro and GBP terms, at €965/oz and £827/oz respectively.

The bounce in the euro has led to further profit taking in gold. Gold has now fallen for 5 days in a row and significant technical damage has been done. However the big picture fundamentals remain positive for gold and this sell off is likely to again be the pause that refreshes . Gold had risen very sharply - in less than 2 months it rose by 15% (from $1,086 March 23 to a record high of $1,249 per ounce on May 14) and thus was ripe for a correction and consolidation. Support should be seen at these levels and at $1,070/oz. Below that the 50 day moving average is at $1,153/oz and support may be found at these levels.

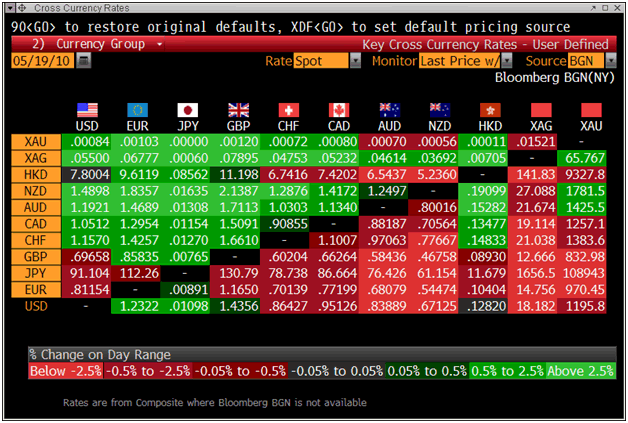

World stock markets have tumbled as investors digest Germany's unilateral ban on short-selling but the euro has rallied from fresh four-year lows on talk of central bank intervention. Commodities are mixed with precious and base metals down, oil slightly higher and many of the food commodities higher today despite risk aversion. Along with gold and silver, the commodity currencies have come under pressure and the euro, yen, dollar and pound are stronger today despite the stock market sell off (see Cross Currency Table below).

The Markit iTraxx Crossover index of credit-default swaps on 50 European companies, which typically rises as investor confidence deteriorates, jumped again today showing that concerns about the health of the financial sector are again rising and this should lead to further safe haven hedging with gold.

Silver

Silver has range traded from $18.58/oz to $18.76/oz this morning in Asia and Europe prior to sharp falls of 3.5%. Silver is currently trading at $18.10/oz, €14.67/oz and £12.57/oz. Smart money will use this latest sell off to again buy on the dip especially given that the gold to silver ration continues to be favourable to silver.

Platinum Group Metals

Platinum is trading at $1,600/oz and palladium is currently trading at $459/oz. Rhodium is at $2,775/oz. The PGMs have come under a lot of pressure in recent days on concerns that a renewed global slowdown could crimp demand. Platinum and palladium dropped to seven-week lows on concern that Europe's debt crisis will continue, potentially curbing demand for metals.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.