The Nuclear Power Investing Option

Commodities / Energy Resources May 18, 2010 - 02:54 PM GMTBy: Marin_Katusa

by Marin Katusa, Chief Investment Strategist, Casey’s Energy Opportunities - Earlier this year, the Obama administration announced large new federal loan guarantees for the nuclear energy industry - totaling about $54 billion, or more than triple the current level of funding. Philosophically, we abhor government subsidies to any industry, but we also recognize that they're a fact of life these days, with an inordinate influence on markets. So even though we'd prefer the government didn't pick industry winners and losers, we must be mindful of what Washington is doing if we expect to reap profits as investors.

by Marin Katusa, Chief Investment Strategist, Casey’s Energy Opportunities - Earlier this year, the Obama administration announced large new federal loan guarantees for the nuclear energy industry - totaling about $54 billion, or more than triple the current level of funding. Philosophically, we abhor government subsidies to any industry, but we also recognize that they're a fact of life these days, with an inordinate influence on markets. So even though we'd prefer the government didn't pick industry winners and losers, we must be mindful of what Washington is doing if we expect to reap profits as investors.

In this instance, the ramping up of government support means boom times are coming for the nuclear energy industry, which is about to awaken from a three-decade long sleep. And if you correctly position your energy investment portfolio, you can benefit from a comeback that's baked in the cake.

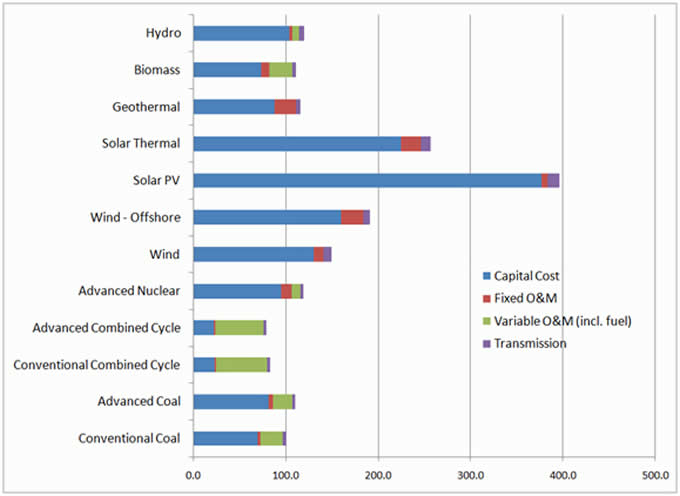

Power is all about the numbers. Consider the illustration below, which shows how current electricity generation technologies stack up when it comes to producing energy (cost is in dollars per megawatt hour). Solar and wind generators are not cheap and don't work when it's dark or calm. They're competitive only with heavy government subsidies and even then, will never contribute much juice to the grid.

Source: EIA. Adapted from http://www.investingdaily.com/tes/17201/sell-wind-and-solar-energy-stocks.html

Hydro, biomass, and geothermal fare much better, easily competing with more traditional technologies, and there are good investment opportunities among them that we're following. But again, in the larger picture they're minor players.

In terms of bang for the buck, it still comes down to coal, gas and nuclear, and Washington realizes we're going to need all three to meet our future energy needs, especially as electric vehicles begin to replace those that run on gasoline.

The Obama administration is all for going as "green" as possible, but realizes that wind and solar are not going to cut it. Thus, after thirty years in the doghouse, the nuclear option has regained the respectability in America that it enjoys among nations such as China, where ten new plants per year are proposed (our last new construction project broke ground in 1977).

Despite lingering doubts among those who remember Three Mile Island, uranium has been dusted off and presented to the public as a safe, environmentally friendly, cost-effective source of power. And the new generation of plants is all of those things, compared with the dinosaurs of the 1970s.

Even bureaucrats can understand that. Thus there's been a major policy shift in D.C., and a powerful new trend has been set in motion. That's clear. But how to profit from it?

First off, companies that build new nuclear power plants will see an uptick in demand for their services. The problem there is that companies operating in this sector are huge conglomerates with diverse business lines. So an increase in revenues from the unit that constructs nuclear power plants could easily be offset by a corporate decline elsewhere that has nothing to do with nuclear energy.

Investing in conglomerates generally means an expectation of modest gains. That may be sufficient for some investors, but not for us as speculators. We prefer to look for opportunities to double our investment, or better, letting us put less money at risk for potentially greater returns. So, we want exposure to companies that will benefit from this new policy in a bigger way, those that are more of a pure play.

For one, that means uranium producers. An increase in the number of nuclear power plants will drive higher demand for the mineral, bullish both for those who pull it from the ground and those who reprocess spent fuel.

The price of uranium is not going to skyrocket overnight. What with regulatory hurdles and long lead times, new construction in the U.S. will take a while. But permits will be issued, and in the interim, everyone else is forging ahead, with some 60 plants currently going up worldwide. Demand will steadily increase.

On the supply side, keep in mind that the U.S. and Russian governments have their own strategic nuclear fuel reserves, in the form of nuclear warheads. At present, half of all U.S. nuclear electricity comes from reprocessed fuel from Russian bombs, through the "Megatons to Megawatts" agreement. That has acted as a ceiling on the price of uranium in recent years. However, in 2013, Megatons to Megawatts will end, and American utilities will have to secure fuel through alternative means.

A few enterprising Western utilities see the writing on the wall and have been proactively securing their cheap supply of uranium through long-term contracts. But the rest will be forced to pay more on the open market, squeezing their already razor-thin margins. The utilities whose management had the foresight to lock in their supply at good prices will have an edge over their competitors that will be reflected in their stock price.

The miners are looking good, as well. If you add demand growth to the termination of the Russian pipeline, you get steadily rising prices for their product. And that will translate into fattening bottom lines.

As an investor, you'll want your money in the savviest utilities, along with select uranium mining companies that are poised to prosper. Then you'll be on your way to profiting handsomely.

Want to know which uranium mining and utility stocks are set to explode to the upside? Try Casey's Energy Opportunities risk-free for 3 months today and gain access to one of the best energy analysts of our day, Marin Katusa. Marin and his energy team know all the inside details and have prepared a shortlist of the best companies to own. For only $39 per year, they will keep you in the loop on oil, gas, nuclear, and renewable energies. Click here for more.

© 2010 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.