Guess Who’s Even MORE Broke Than Greece?

Interest-Rates / Global Debt Crisis May 18, 2010 - 12:05 PM GMTBy: Graham_Summers

Sentiment is a strange thing.

Sentiment is a strange thing.

Greece’s debt issues have been staring everyone in the face for years. And yet it wasn’t until January 2010 that they suddenly became “relevant” to the investment world.

Then, even after Greece became a “household” word for the investment community, for nearly five months the whole world (with the exception of the evil speculators who were betting against Greek debt… and turned out in fact to be Greek banks themselves) gave Greece a series of “mulligans” on its debt issues.

And then, in the space of about three weeks, Greece debt suddenly becomes about as popular as Ebola. What exactly changed in those three weeks? Greece didn’t suddenly become MORE bankrupt. All that changed was investors’ attitudes towards the country and its debt situation.

It’s truly staggering to think about. For five months, the market stayed afloat because various unnamed Greek “officials” claimed that a bailout was coming. The fact that “rumors” of a bailout even propped the market up indicates that market participants are borderline rat-stupid (how precisely does lending more money to a bankrupt country “solve” its debt problems?).

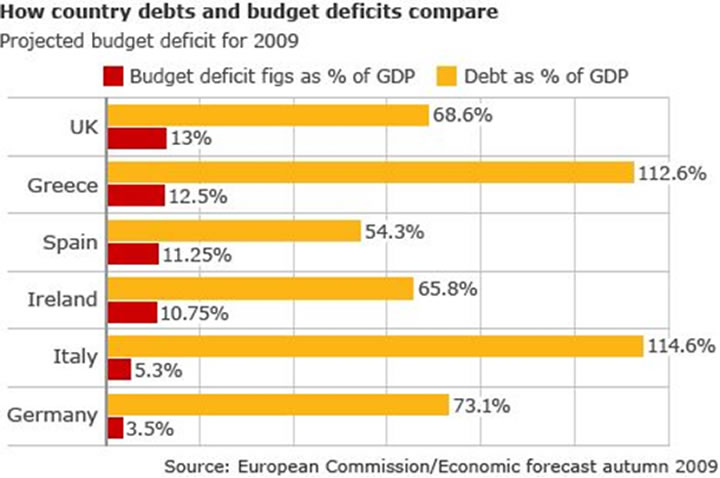

What’s even stranger is the fact that Greece’s fiscal situation isn’t all that worse than several other European countries. Ireland, Spain, and the UK all are running comparable deficits. Italy actually has a higher Debt-to-GDP ratio. And Germany and the UK are only a couple of years off from having Greek-type Debt-to-GDP ratios themselves. (see the chart below).

However, the oddest thing about this whole development is that the US’s fiscal condition is in fact AS BAD IF NOT WORSE than Greece’s.

The US is expected to run a $1.7 trillion deficit this year. Assuming that the GDP numbers are accurate (they’re not, but that’s an article for another time), the US economy is in the ballpark of $14 trillion. This means we’re running a deficit equal to 12.3% of GDP. That’s RIGHT next to Greece.

Then of course, you’ve got our Debt-to-GDP ratio. If you ignore unfunded liabilities like Social Security and Medicare, the US already has a Debt-to-GDP ratio of 98.1%. That’s only slightly off of Greece’s Debt-to-GDP of 112%.

Throw in Fannie and Freddie’s mortgage debts (Uncle Sam own $5 trillion of these now too), and we’re already well over a Debt to GDP of 112% (actually it’s 130% or so). And when you include Social Security and Medicare ($45 trillion) this puts total US Debt-to-GDP at 421% ($59 trillion of Debt on a GDP of $14 trillion).

Everyone knows this. Heck, even USA TODAY (not exactly the cutting edge in financial research) notes that in order to pay off our current liabilities, every US family would have to pay $31,000 a year… for 75 YEARS!!!

In plain terms, for the US to be criticizing Greece’s debt levels is beyond the “pot calling the kettle black.” It’s like a Black-hole calling a kettle black. At this point, we’re beyond broke. Even if the US taxed 100% of all personal income, we couldn’t pay our debt off for years (at least five)

So it’s small surprise that fewer and fewer investors are willing to lend to the US for any lengthy amount of time. We’re not even half way through the year and already we’ve had several long-term debt auctions that were fishy to say the least. I’ll detail precisely what I’m talking about in tomorrow’s essay. In the meantime, start preparing for the ‘Greece” situation to hit US shores. We’re no better off than Greece, we’re just larger, and have a “trigger-happy” money printer for a Fed Chairman.Good Investing!

Graham Summers

PS. I’ve put together a FREE Special Report detailing THREE investments that will explode when stocks start to collapse again. I call it Financial Crisis “Round Two” Survival Kit. These investments will not only help to protect your portfolio from the coming carnage, they’ll can also show you enormous profits.

Swing by www.gainspainscapital.com/roundtwo.html to pick up a FREE copy today!

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2010 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.