Gold Falls on Profit Taking as Retail Investors Remain Hesitant

Commodities / Gold and Silver 2010 May 18, 2010 - 07:49 AM GMTBy: GoldCore

Gold fell for a fourth day in Europe due to profit-taking but is likely to remain supported due to continued concerns about sovereign debt contagion and currency risk. Gold rose to a record intraday nominal high of $1,249 a troy ounce last Friday but has since pared back its gains and is now trading at $1,209.95 an ounce, down 1.3% on the day amid a combination of profit taking and increased risk appetite.

Gold fell for a fourth day in Europe due to profit-taking but is likely to remain supported due to continued concerns about sovereign debt contagion and currency risk. Gold rose to a record intraday nominal high of $1,249 a troy ounce last Friday but has since pared back its gains and is now trading at $1,209.95 an ounce, down 1.3% on the day amid a combination of profit taking and increased risk appetite.

Gold has also fallen in sterling, euros and other currencies. Many retail investors remain wary of bubbles and we have seen some retail buyers taking profits in recent days. Sentiment remains mildly bullish but there is no sense of a frenzy, mania or panic buying. Gold is currently trading at $1,209/oz and in euro and GBP terms, at €974/oz and £836/oz respectively.

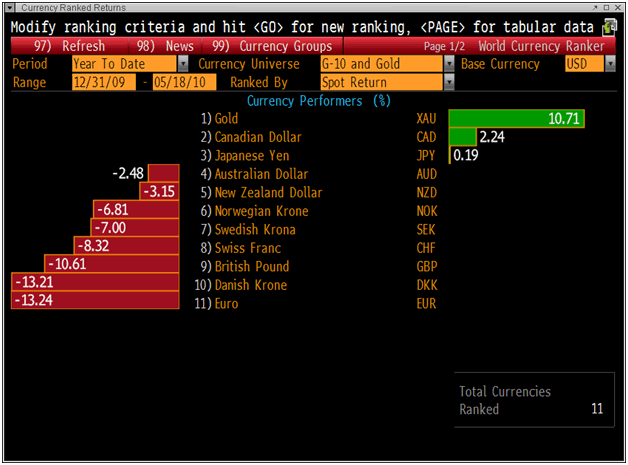

Currency Ranked Returns (YTD)

While the euro has fallen to 4 year lows against the dollar, it important to remember that the euro's average price against the dollar since its inception has been 1.18 and thus the euro at 1.23 is not particularly cheap. What is concerning analysts is the long term ramifications for the euro of the eurozone sovereign debt crisis and indeed the real existential threat to the euro. Also the speed of the recent falls and the hugely volatile nature of recent trade in the euro is leading to worries of further sharp falls. Should speculators such as George Soros, the man who 'broke the Bank of England' scent blood then the euro could experience further sharp selling. While the weaker euro is beneficial to European exporters, it would likely lead to higher inflation and ultimately to higher interest rates.

Other economies, such as the UK, face a similar double edged sword. Weaker currencies are needed to stimulate export driven job creation and economic growth but competitive currency devaluations could lead to inflation and higher interest rates.

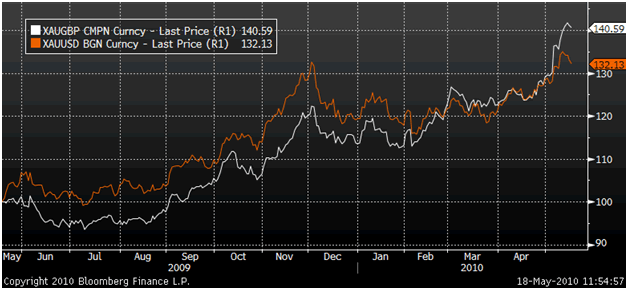

Gold in USD and Gold in GBP (1 Year)

Concerns about sterling will not be helped by the incoming Chancellor George Osborne's comments regarding finding "various skeletons in cupboards" and accusing the departing government of "fiddling the books". Nor will they be helped by the departing chief secretary to the Treasury leaving a letter for his successor stating that "I'm afraid to tell you that money has run out".

Bank of England Governor Mervyn King has downplayed the threat of inflation after consumer prices jumped at the fastest annual pace since 2008, saying the surge is "temporary". Inflation accelerated to 3.7 percent in April from 3.4 percent the previous month, the Office for National Statistics said today in London.

Silver

Silver has dropped from $18.98/oz to $18.64/oz this morning in Asia and Europe. Silver is currently trading at $18.70/oz, €15.05/oz and £12.93/oz.

Platinum Group Metals

Platinum is trading at $1,685/oz and palladium is currently trading at $508/oz. While rhodium is at $2,800/oz.

News

The Federal Reserve's practice of indiscriminately printing money is the chief culprit that has led to the surge in gold and demise of the euro, Rep. Ron Paul (R-Texas) told CNBC Monday. As gold hits a succession of all-time highs and the euro struggles for mere survival, Paul said debt overloads at the base of the recent currency trends can be traced directly to the US central bank. "The Federal Reserve behind the scenes has the power to create money out of thin air. It's very bizarre," Paul said. "They can bail out their friends and let the people they don't like fail, and create a trillion dollars or more out of thin air in order to prop up some companies at the expense of others ... It's absolutely bizarre and, yes, the American people right now I think are waking up to it." Paul linked the disruptions to the departure in 1971 from the old Bretton Woods global currency system. He said he has been anticipating the surge in gold as confidence in currency wanes, and after the Bretton Woods collapse. "This is the unwinding of a system," he said. "Until we replace it with something else you're going to continue to see this." But Paul predicted that the system will be changed as more and more people begin to see its fundamental flaws.

"The gold surge recently has people discovering they're really printing money," Paul said. "They're just kidding themselves and kidding the American people that the Fed can keep doing what they're doing, because the economic laws will bring this to an end and probably in the not-too-distant future."

Gold will rise to $1,500 an ounce by the end of 2011, Francisco Blanch, global head of commodities research at Bank of America Merrill Lynch, said today at a mining conference in London (Bloomberg).

Dennis Gartman, an economist and editor of the Suffolk, Virgina-based Gartman Letter, said "we wish to run to the exits -- entirely -- with our long positions in gold versus the foreign currencies." "With the public now heavily involved, we want out and are heading for the sidelines," he said today in his daily note (Bloomberg).

US Gold Corp CEO and founder Rob McEwen stated that in period between 2012 and 2014 gold price can soar up to $5,000 per ounce. "The cause of gold price rise can be weakening of US dollar against the background of rapid growth of United States' public debt," Mr. McEwen said.

He Ruiyan, the head of research at Hong Kong firm Xiamen International Trade Futures Co., forecasts that gold price can reach $2,000/oz before the end of 2010. "The US government, striving to help domestic economy, prints money. The US increases its debt in devastating scale and that will reduce value of dollar further," Mr. Ruiyan said.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.