Euro Gold Near €1,000 On Euro Currency Survival Concerns

Commodities / Gold and Silver 2010 May 17, 2010 - 07:33 AM GMTBy: GoldCore

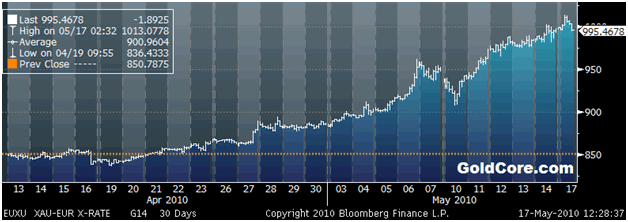

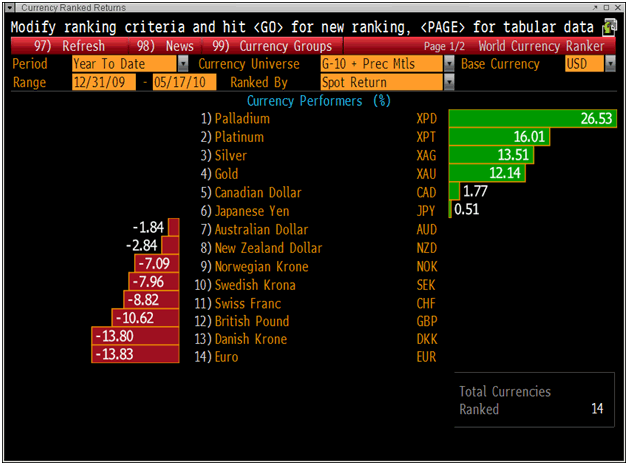

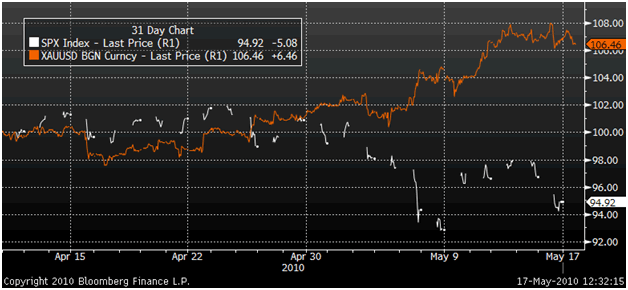

Gold has dropped from $1,242/oz to $1,230/oz in Asian and early European trading this morning. Gold closed with a slight loss of 0.11% in dollars on Friday while it was stronger in most other currencies. For the week, gold rose by 1% in dollars and by much more in other currencies and especially in the beleaguered euro.

Gold has dropped from $1,242/oz to $1,230/oz in Asian and early European trading this morning. Gold closed with a slight loss of 0.11% in dollars on Friday while it was stronger in most other currencies. For the week, gold rose by 1% in dollars and by much more in other currencies and especially in the beleaguered euro.

Silver surged by 4% in dollars and by more in other currencies and both gold and especially silver continue to have positive technical and fundamental pictures. Gold is currently trading at $1,230/oz and in euro and GBP terms, at €997/oz and £855/oz respectively.

Euro Gold Climbs to New Record Highs in Euros at €1,013 per ounce

The euro has fallen to new 4 year lows this morning on continuing eurozone debt and contagion concerns. Indeed, the survival of the euro itself is being questioned which is leading to continuing safe haven demand for gold. German and Austrian buyers have been buying in large quantities in recent days on concerns of the euro depreciating sharply. German concerns of currency collapse and hyperinflation are real due to their historical experience (Weimar hyperinflation) and this is leading some worried Germans to diversify into gold. Demand has increased quite significantly, however the demand increase is from a low base and talk of a 'gold rush frenzy' is exaggerated at this stage. Gold remains a fringe investment and has not been embraced by the majority of investors and savers yet - a minority of whom have any allocation to gold whatsoever.

A gold frenzy or gold rush may happen in the coming months if contagion spreads into Spain, Portugal and other industrialised nations. Especially as there is a growing lack of faith in western governments ability to stem the crisis and thus increasing concerns about whether inflation can be contained and whether fiat currencies will retain their value in the coming months and years. More aware investors and savers are worried that governments are merely rearranging the deck chairs on the titanic and storing up bigger problems for economies and currencies in the coming months.

The gold market remains tiny vis-á-vis savings, currency, bond, equity and derivative markets and only a small fraction of capital diversified from these markets into gold would see gold prices move up considerably. A real 'gold rush' or buying frenzy would likely see premiums on gold and silver coins soar to double digits very quickly as physical ownership will command a premium. Premiums have begun to creep up marginally in recent days but this could change quickly and if shortages develop again, premiums on 1 ounce coins and bars will surge.

Silver

Silver has dropped from $19.40/oz to $19.15/oz this morning in Asia and Europe. Silver is currently trading at $19.16/oz, €15.55/oz and £13.28/oz.

A new factor in the silver market to be considered is the Indian sub continents increasing appetite for silver. The price sensitive Indians are buying poor man's gold as they realise it is cheaper than gold. This could potentially lead to a new source of very significant supply which contribute to higher prices and may even result in a floor being put under silver prices above $18 per ounce.

Platinum Group Metals

Platinum is trading at $1,706/oz and palladium is currently trading at $520/oz. Rhodium is at $2,800/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.