Gold, Silver and SP500 Stock Index Trading Charts

Stock-Markets / Financial Markets 2010 May 16, 2010 - 11:59 AM GMTBy: Chris_Vermeulen

Last week was amazing for both gold and index traders as gold surged higher and the SP500 tested a key resistance then fell 4% in our favor. The past couple weeks with the mini market crash and Euro issues making the market extra volatile both gold and the broad market (SP500) index has been wild.

Last week was amazing for both gold and index traders as gold surged higher and the SP500 tested a key resistance then fell 4% in our favor. The past couple weeks with the mini market crash and Euro issues making the market extra volatile both gold and the broad market (SP500) index has been wild.

The added volatility makes trading more difficult because price patterns become less predictable and price movements are much larger increasing risk for traders.

Below are the charts & videos of what to look for in the coming days…

GLD – Gold ETF Trading

Gold continues to trend higher at an accelerated rate. Friday we saw gold pullback and test a key support level then bounced to close in the middle of the days trading range. As you can see the trend line support has become very steep and once the trend line support is broken I figure there will be a sharp drop to digest the recent rally.

SLV – Silver ETF Trading

Silver popped and tested a key resistance level from a previous high as expected. It also tested the top of its trend channel providing even more resistance. This week will be interesting as we wait to see if precious metals have a small pullback or continue to rally.

SPY – SP500 Index ETF Trading Chart

This chart clearly shows what I think is about to unfold by looking at the past market drop. Because of the mini market crash triggering everyone’s stops already I figure we have made the low and the dip we are seeing now will drift down a few more percentage points then bottom out

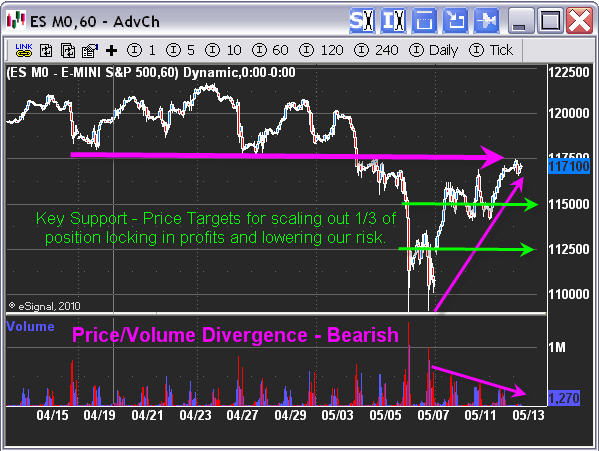

ES M0 – SP500 Mini Futures Trading Setup – Pre-Drop

Below is a chart of the SP500 which we shorted or bought the SDS bear etf trading fund last week looking to profit from a falling stock market. As you can see from the chart we saw the es mini contract drift into a key pivot point on light volume. What this means is that a large group of sellers will be waiting at that price, and because volume is light we know there are not many buyers at this price level. Simple supply/demand comes into play with more sellers causing the price to stop rising and eventually force the price lower which is what we were anticipating.

The green arrows show key support levels on the 60 minute chart where 1/3 of a position should be taken of the table to lock in gains which also reduces overall risk on the trade. Once we cash in the first 1/3 of the position we move our protective stop the breakeven which is the entry point for the remaining portion of our position. This turns the trading into a winner no matter what happens allowing us to enjoy the ride…

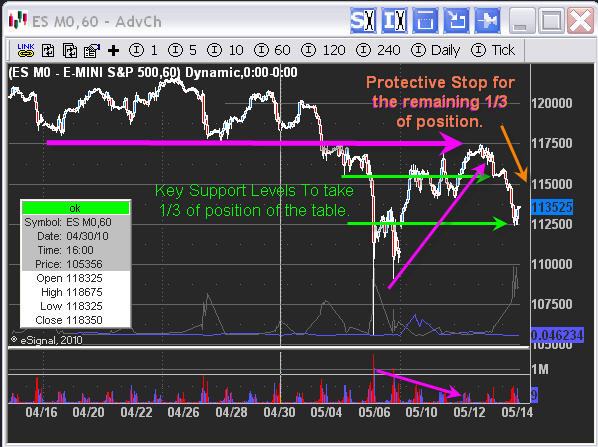

ES M0 – SP500 Mini Futures Trading Setup – Current Price

Here is the same chart 24 hours later showing both of our profit targets triggered pocketing 2/3rds of our position for a very nice gain. Depending on the type of trading vehicle you traded there was potential to make up to 150% return in less than 24 hours.

We currently hold 1/3 of the position left with a loose stop allowing the trade to mature incase the down trend continues for several days or weeks. If not and the price rallies then our stop will get triggered for small profit on the balance of the position. Either way we win.

Pre & Post Market Correction Video: http://www.thegoldandoilguy.com/..

Stock Market ETF and Futures Trading Conclusion:

In short, the market is trading on increased volatility making it difficult to find low risk setups. At the moment we are long gold and short the SP500 with both position deep in the money. All we can do now is manage our positions to make sure we maximize our profits.

If you would like to Get My Trading Signals be sure to check out my services at: www.TheTechnicalTraders.com

Hello, I'm Chris Vermeulen founder of TheGoldAndOilGuy and NOW is YOUR Opportunity to start trading GOLD, SILVER & OIL for BIG PROFITS. Let me help you get started.

To Your Financial Success,

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.