The Ongoing Impact of the US Housing Sector

Interest-Rates / Credit Crunch Aug 28, 2007 - 01:51 AM GMTBy: John_Mauldin

Who should we blame for the problems in the credit markets? This week in Outside the Box my good friend Barry Ritholtz takes on the task of pointing his prodigious finger at the guilty parties. As he notes, there is plenty of guilt to go around. This is a problem that is going to stay with us more than a few weeks. As I wrote last week, it is not a problem of liquidity. It is a problem of credibility. Until investors of all types feel safe getting back into the structured finance market water, US mortgages and all sorts of consumer finance are going to be severely hobbled. There is plenty of money on the sidelines, but it is going to take some work to make investors feel comfortable.

Who should we blame for the problems in the credit markets? This week in Outside the Box my good friend Barry Ritholtz takes on the task of pointing his prodigious finger at the guilty parties. As he notes, there is plenty of guilt to go around. This is a problem that is going to stay with us more than a few weeks. As I wrote last week, it is not a problem of liquidity. It is a problem of credibility. Until investors of all types feel safe getting back into the structured finance market water, US mortgages and all sorts of consumer finance are going to be severely hobbled. There is plenty of money on the sidelines, but it is going to take some work to make investors feel comfortable.

Part of that process is to figure out what went wrong and how do we avoid getting into this mess yet again? How do we restore credibility? I offer a few quick thoughts on this at the end of Barry's work. And if you have the time, you should click on some of the links Barry has to various research, especially the first link which shows that housing prices could easily drop 15% (or more in some of the bubble areas!).

Finally, I should note that I am going to be speaking yet again at the New Orleans Investment Conference (October 21-25, 2007). This is always one of the great investment conferences of the year. You can click here to learn more.

John Mauldin,

Editor, Outside the Box

First Consumers, now Structured Financing:

The Ongoing Impact of the Housing Sector (and who is to blame?)

By Barry Ritholtz

With John Mauldin enjoying the beginning of his summer sight-seeing in Europe, its up to us worker drones to address the various goings on the capital markets.

Today, we will take a quick review of the impact of the ongoing fallout from the Housing market on the consumer, and look at what is occurring in the broader financial system. Perhaps we may even discover who is responsible for the entire sordid mess.

How we got to where we are today

You may recall, late last year, I penned a commentary titled Real Estate and the Post-Crash Economy . That discussion reviewed the major events following the 2000-02 market crash and the 2001 economic recession, from the Fed's extraordinary rate cuts to the entire Real Estate driven economy. You may want to go back and reread that piece, as it provides a lot of context for today's discussion.

As we noted back then, with housing cooling, we were expecting the economy to decelerate. Mortgage equity withdrawals (MEW), the funding mechanism for so much consumer spending (cars, vacations, plasma screens and home improvement), was sliding lower. That process continues today, as housing has yet to find a bottom ( http://bigpicture.typepad.com/comments/2007/08/how-low-will-ho.html ).

The economic weakness has shown up first in retail spending figures. Especially hard hit have been the number one and two retailers in the U.S., Wal-Mart and Home Depot. But its not just those two retailers. As the chart below shows, the U.S. consumer appears to be getting tired. Housing is already in a recession, and Automobile Sales are on the verge of one, if not already there. Not just GM and Ford, but Toyota and Honda have seen year over year sales drops in the U.S.

Year to Date Return, S&P Retail Index

Slowing economic activity here has been offset by strength abroad. Robust growth in Asia, Europe and Latin America, along with a weak U.S. dollar, has been a huge boon to American exporters. U.S. corporate profits are actually quite strong, albeit at a cyclical high. The corporate sector has not been hit by Housing - yet.

More recently, banking and finance companies have felt the sting of the housing slowdown. Indeed, it is not just the retailers and auto dealers who have been affected by Real Estate - the entire financial system is being impacted. Let's look at how that came to be.

Structural Problems from the Wizards of Financial Engineering

My college roommate Mike - he's a techie who works for a prestigious university, so financial engineering is rather foreign to him - asked me the following question:

In what other arena can the value of an individual unit, used to collateralize a loan, be eroded by the quality of the loans written on other units to other debtors ? How are the value of all houses changing based not on any intrinsic change in any individual house or in all houses, but based on the ability of some people to meet their loan obligations ?Well, Mike raises a very interesting point. The short answer is that any asset which gets priced in a free market will be impacted by variations in other assets (including their financing issues), in that market.

Think of the way prices increased in the first place: Homes increased in value, in large part due to easy credit - to the ability for many marginal buyers to borrow, thereby adding to the pool of potential buyers, and therefore the total demand. The opposite happens when credit become tight - less cash to borrow decreases the total number of buyers, reducing overall demand. Prices then fall.

Remember back to the 2000-2002 market crash: When margin clerks were liquidating stocks for those buyers who couldn't meet margin calls, prices got walloped. It's the same principle: Borrowed money helped to drive asset prices higher, and when that money is not repaid, then the forced liquidation sales sends prices lower.

To give a more complete answer, we need to look behind-the-scenes at the financial machinations involved in financing homes. It turns out to be far more byzantine than most people realize. Let's delve deeper, looking at the complex interplay of psychology, liquidity, supply and demand.

Mortgage underwriters - the nice folks who lend you money so you can buy a home - need a steady supply of cash in order to keep lending. That requires two things: a good credit rating, and a liquid credit market to sell existing mortgages.

A large part of this process is serviced by Fannie Mae (FNM), ( http://www.fanniemae.com/faq/faq1.jhtml?p=FAQ ), the former government agency that is now a private company. They facilitate mortgage financing and securitization of mortgages.

About now, you should be asking yourself "What the heck is the securitization of mortgages?" That is the process by which 1,000s of mortgages are packaged together into bond-like financial products called Mortgage Backed Securities (MBS). Holders of these bond instruments are actually the folks who end up getting most of the interest and principal payment you make each month known as mortgage payments.

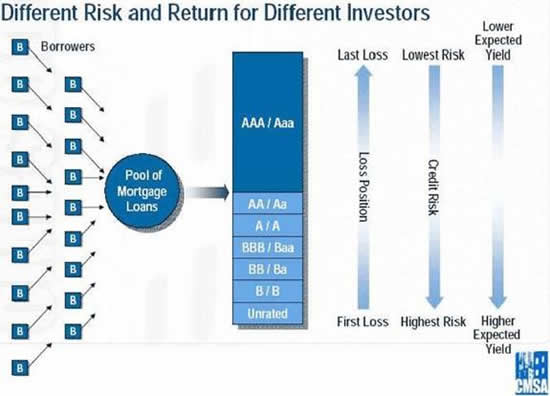

As the graphic nearby shows, MBS bond buyers can select a variety of ratings - each with a different potential risk and expected return. This is a huge liquid: Over the past 5 years, between $1 and $2 trillion dollars in new Mortgage Backed Securities were issued in the United States each year.

That's just the first step of what you will soon see as a rather complex process. There are all sorts of different mortgage paper - some are backed by residential mortgages (RMBS), some by Commercial property lending (CMBS). These various flavors are then sliced and diced into various categories, each rated, and each with a different potential risk and return to the buyer.

Source: Commercial Mortgage Securities Association

If that sounds complicated, well then I have some bad news for you: We are just getting started. From there, these MBS get sliced and diced into an alphabet soup of instruments and their derivatives: CMOs (Collateralized mortgage obligation), CDS (Credit default swaps) CDOs (collateralized debt obligations) and CLOs (Collateralized loan obligations). (See this for a picture of how complex this can get http://bigpicture.typepad.com/comments/files/RMBS.gif )

My personal favorite is CDO n - a generic term for CDO 3 (CDO cubed) and higher. These are CDOs backed by other CDOs, ranging from CDO 2 to CDO 3 to CDO 4 and so on.

Each of these is a more complicated instrument, predicated on the previous product. Each new item is engineered with an increasing degree of complexity, and a less transparent degree of risk and reward. They get packaged and repacked and repackaged further still. By the time the whole unholy mess is done, the final instrument is many times removed from the original paper - a simple mortgage.

Its no surprise that many institutional investors and fund managers had nary a clue as to the quality of the instruments they were holding. And that violates one of the most important of Ritholtz' laws of investing: Never buy anything you do not understand . ( http://bigpicture.typepad.com/comments/2007/08/advice-for-rich.html )

The ugly side of low rates: The Reach for Yield

In our earlier commentary, Real Estate and the Post-Crash Economy , we discussed what happened when the Fed cut rates to 46 year lows and kept them there for too long. Everything priced in dollars had a huge boom: commodities, real estate, gold, oil, equities, etc. all rallied strongly.

But one asset class did not get to enjoy much of a boom at all: fixed income products . Ultra-low rates have a positively dreadful effect on those institutions that rely upon fixed income products to meet their funding and inflation-hedging needs. These include insurance companies, banks, private and public pension plans, trusts and endowments.

With rates so low, they began to feel the temptation to "reach" for yield. Some just a little bit, others with reckless abandon. Thus, another investing rule was ignored: Few things in life are as expensive as the reach for yield.

There are not all that many ways to get significantly more yield without taking on considerably more risk. Over the past few years, a variety of techniques were employed: Some managers crept further and further down the quality scale, in exchange for higher yields. Some took on just a little more risk, hoping no one would really notice. Others borrowed money in low rate nations (like Japan) and invested it in higher rate countries (aka the carry trade). Some used leverage, although that has a variety of inherent problems. Some clever folks tried complexity, which hides the additional risk you are taking on from the view of most observers.

One particular group of folks checked the box marked ALL of the above: certain types (but not all) hedge funds . Aggressive fund managers borrowed lots and lots of money from their prime brokers, and suitably leveraged up, went out and bought into the alphabet soup we discussed, or used the leverage to do a lot of supposedly low volatility trading.

Under normal circumstances, that might not matter much. However, these were not normal circumstances. Over the past 5 years, we have had an enormous credit bubble. The normally staid banking industry was seduced by the monstrous demand for high yielding mortgages to get collateralized into all of these instruments. Farmers know the expression "Make hay when the sun is shining." Bankers saw the nearly unquenchable demand for mortgages, and they knew it was time to make hay. They replaced the old method of approving mortgages (i.e., a human looking over a loan document) with an automated software program ( See this NY Times article ). This was a key technological development that allowed them to crank up the machinery to underwrite lots and lots of loans - some good, some bad, some really ugly.

In this headlong rush, lots of foolish shortcuts were taken. Loans were written to people with low FICO scores, on properties with very high loan to value (LTV); Documentation was often poorly filled out. An entire new category was created: "No doc" (no documentation needed) loans. Today, we know these products as "liar loans," thanks to the commission-driven mortgage brokers who encouraged borrowers to "get creative" when filling out the no doc applications.

Then there are the 2/28 loans. These were primarily offered to sub-prime borrowers - those with weak FICO scores, or modest incomes. These loans typically start at a fixed "teaser" rate for two years, before resetting 300 or so basis points to a variable rate. Disproportionately, these reset mortgages are the ones that have been going into default and foreclosure at alarming rates. And that has caused a cascade reaction all the way through the entire financial system.

Low rates drove the initial demand for mortgages; technology allowed for rapid processing in numbers never before possible; Securitization drove the demand for bundled mortgage purchases; Home Price Appreciation (HPA) kept even poor credit risks from defaulting for a few years. These factors are what led to a huge spike in real estate sales from 2002-2006.

When the history of this era gets written, what we know as the housing boom will likely be reconsidered as a giant credit bubble.

Who was Responsible?

Now, we come to the fun part of today's commentary: assessing blame for the whole shebang.

I have some bad news for you fans of schadenfreude: The responsibility is widespread, with plenty of blame to spare. I assess the responsibility for the mess to the following:

- Federal Reserve (FOMC)

- Borrowers

- Mortgage brokers

- Appraisers

- Federal Government

- Fannie Mae

- Lending banks

- Wall Street firms

- CDO Managers

- Credit agencies

- Hedge funds

- Institutional Investors (pensions, insurance firms, banks, etc.)

- And back to regulatory role of the Federal Reserve

Let's look at each of these in turn.

All interest related issues begin and end with the Fed. As we have noted before, the FOMC cut rates extraordinarily low, and then kept them there for far too long. ( see Fed Fund Rates, 2000-06 )

Regardless of how low rates are, the simple fact remains that many borrowers recklessly took out mortgages regardless of their ability to pay the monthly carrying charges. This was simply reckless behavior, and should be appropriately recognized as such. I was surprised to learn that PIMCO's fund manager Bill Gross was calling for a bailout. ( http://www.cnbc.com/id/20411995 ) This makes me feel foolish for taking out a mortgage I could actually afford. Had I suspected a bailout of reckless behavior was forthcoming, I would have taken out a $10 million mortgage and gotten a much nicer house . . .

Next up in our cavalcade of criticism: The mortgage brokers . This is a lightly regulated industry, ripe for lots of abuse. Indeed, from videos posted on YouTube to the eventual mainstream coverage, some exotic mortgage brokers had become the new boiler rooms. ( http://bigpicture.typepad.com/comments/2006/09/exotic_mortgage.html )

Then there were the Appraisers . In the past, appraisals were assigned on a rotating basis. There was no incentive to inflate appraisals. However, that was when banks were the primary contact with the homebuyers. With the rise of the mortgage brokers, steering appraisal business to those appraisers known to give generous estimates rose rapidly. From there, it was a short step to outright fraud.

Its not like the Federal Government was unaware of the problem. In 2005, more than 8,000 appraisers - roughly 10 percent of the industry -signed a petition asking the federal government to take action. No regulation to prevent this rampant fraud was ever created. http://money.cnn.com/2005/05/23/real_estate/financing/appraisalfraud/index.htm

Then there was Fannie Mae . One might have thought the firm that had been in the business of securitizing mortgages since 1938 would have some insight into what was actually going on in the mortgage markets. No such luck. Perhaps Fannie Mae was otherwise occupied untangling its own massive scandal: An "extensive financial fraud" had occurred with earnings doctored so executives could collect hundreds of millions of dollars in bonuses. ( http://www.washingtonpost.com/wp-dyn/content/article/2006/05/23/AR2006052300184.html )

The Banks that underwrote these loans also get some blame. The automation they installed permitted rapid processing of bad credit risks, but it was the outstanding sloppiness and violation of the banks own internal procedures that allowed even more bad loans to get written. Hard as this may be to imagine, some loan documentation was so incomplete that the federally mandated "Truth-in-Lending Disclosures" were omitted. Without the proper disclosures, a mortgage could become "un-secured" - meaning it no longer has a first priority lien on the mortgaged property. ( http://bigpicture.typepad.com/comments/2007/08/coming-soon-tru.html ).

How did Wall Street manage to overlook all of these issues? Did they actually do their due diligence? Or, was it simply a case of keeping the securitization process rolling? I've had conversations with CDO managers and insiders , who stated "We knew we were buying time bombs." So I doubt it was sheer ignorance. Rather, it appears that as long as deal fees could be generated, Wall Street kept the CDO factories running. http://bigpicture.typepad.com/comments/2007/08/cdo-insiders-we.html

Then there were the Credit Agencies . Far from being objective arbiters of the credit worthiness of these debt instruments, the 3 major agencies - Standard & Poors, Moody's, and Fitch Ratings - conducted a form of "pay for play." Working closely with underwriters, they frequently rated paper AA and AAA that would (and will) eventually be revealed as junk. They were tremendous, well compensated enablers of the entire sub-prime fiasco. http://www.portfolio.com/news-markets/national-news/portfolio/2007/08/13/Moody-Ratings-Fiasco

Of course, none of this would really have mattered if a few hedge funds and a much larger number of institutional investors (including foreign central banks - China evidently bought $10 billion in subprime mortgages) didn't suck up so much of this suspect paper. Through the indiscriminate use of leverage, and by failing to know what they owned, the hedgies also must shoulder some of the blame.

And to be fair, the institutional investors who bought the paper were sold it by Wall Street firms who touted the AAA ratings of the paper. Their lawyers will certainly portray them as the victims when they get to court.

Finally, we come back to the Federal Reserve - only this time, it is not the rate setting FOMC that gets the blame. Rather, it's the Central Bank's regulatory authority that gets the blame for sleeping throughout this entire episode. But not to worry: On August 14, 2007, the Central Bank proposed that "consumers have clear, balanced, and timely information about the relative benefits and risks of certain ARM products." Talk about locking the barn door after the horses have gotten out. ( http://www.federalreserve.gov/boarddocs/press/bcreg/2007/20070814/default.htm )

Where do we go from here?

The highly leveraged speculation in mortgage based securities cascaded across the globe. The aggregate foreclosures of bad mortgages led to a near seizure of credit markets. These markets are so essential to the smooth operation of the global economy that Central Bankers around the world had to react by injecting massive amounts of liquidity into financial networks. They have managed to stabilize skittish markets and restore investor confidence, for now.

However, we have no idea exactly how long this might last. And there is reason to suspect that the present equilibrium is quite delicate.

The Federal Deposit Insurance Corp (FDIC) noted that delinquent loans have increased $6.4 billion in Q2. The number of overdue mortgage payments increased 10%. That turns out to be the largest quarterly increase since Q4 1990. RealtyTrac notes that foreclosures are now running 93% higher than one year ago.

Now consider that the underlying cause of the recent turmoil has not been addressed. Estimates put the peak of the sub-prime resets that started this all somewhere between Q4 2007 to Q1 2008.

As we have learned, sub-prime resets result in a large number of delinquencies within about 60 days. Foreclosure proceedings often begin some 90 to 180 days after that. Eventually, these properties come back to market in foreclosure auctions. As Gary Shilling said recently, the mortgage pig is hardly through the python yet.

We should expect Housing market based economic and financial system dislocations to continue for the foreseeable future: At least through 2008, and likely through most of 2009.

Markets seem to have stabilized this week. That may not be a condition that lasts a very long time . . .

- Barry L. Ritholtz

Let me (John) add a few thoughts I had on this topic while preparing a speech in Copenhagen for Jsyke Bank. As I said above, the main problem is not one of liquidity but of credibility. And to address this certain reforms of the system must be made, and I would suggest as soon as possible.

One significant cause of the problem is the lending standards and practices of the mortgage banks. In order to re-start the securitization of mortgages, institutions must have transparency on the underlying mortgage lending practice. Standards need to be developed (and rather quickly) for creating mortgages. You can have multiple standards. One standard (class "A") might be loans with 80% loan to value, mortgage payments of no more than 25% of verified income, high FICO scores and so on. Another standard (class "B") would be lower FICO scores, payments of no more than 33% of verified income, etc. There could be any number of classes, depending upon the lending standards.

These standards would be the same for all mortgage creating entities. A mortgage bank could choose to make loans using any standard it chose, but the ultimate investor would have the confidence of knowing what the standard was

Then when a Wall Street firm puts together a mortgage backed security comprised of 1,000 different loans, it would be possible to create a class "A" standard security with clear payment and default risks. Rating agencies could then give ratings based upon a known standard rather than lumping all different types of prime or subprime loans with varying lending standards into one pool. (Today, as I understand it, the groupings would come under prime or Alt-A or subprime, but mortgage-underwriting standards within those broad classes could vary widely, depending upon which mortgage bank wrote the original mortgage.)

If there is an investor market for subprime loans with lower standards, it will develop at some point. But right now there needs to be some real industry standards set so that investors will come back to the market, and especially the subprime market. Without subprime loans, we will shut 10-15% of potential homebuyers out of the market, and as Barry noted above, that is going to have a major potential impact on home prices for a long time.

A subprime loan (say a young family starting out) with 80% loan to value, paying no more than 25% of their income to service the loan, and a few extra points of interest, will have value in the market (or at least it should). But absent some transparency, and wider risk premiums, it is going to be hard to get investors who may lose as much as $100 billion to get back into that market.

I finish this at the Polonia Palace Hotel in Warsaw. I am going to hit the send button and go visit the Old City and not worry about subprime loans for awhile.

Your still having sticker shock over how cheap the dollar is analyst,

By John Mauldin

http://www.investorsinsight.com

To subscribe to John Mauldin's E-Letter please click here: http://www.frontlinethoughts.com/subscribe.asp

Copyright 2007 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.