What to Do Next : 5 FInancial Alternatives To Stocks For These Volatile Times

Stock-Markets / Financial Markets Aug 28, 2007 - 01:37 AM GMTBy: George_Kleinman

In the financial markets, all we know for sure is that nothing's for sure.

The way I see it, financially speaking the stock market doesn't appear to be the place to be right now. Stocks have retreated in recent weeks, but they certainly could go lower, possibly a lot lower. For the foreseeable future, I plan to steer clear of most stocks, investment real estate and any bond below investment grade.

The question of the hour is what to do next? There are viable alternatives for both safety and for high-potential speculation.

In this special two-part Commodities Trends (part 2 will be e-mailed on our next scheduled release date, August 20) I'll first explain why stocks look risky to me right now, and then outline five viable and tradable alternatives.

These are alternatives I personally have invested in, trade in, or am looking to diversify into. You won't be reading about certain of these alternatives in the mainstream financial press. The objective of this two-part series is to help you prosper in today's financial world, one fraught with risk and uncertainty.

You may have noticed the plethora of IPOs, mergers, acquisitions, junk bonds, financings, hedge funds and deals of all sorts in recent months. This type of mania often takes place just prior to stock market crashes.

It occurred just prior to the stock market crash of 1987 and again right before the dot-com mania in 1999-2000. It occurred before the Japan crash in the early 1990s, the Southeast Asia crash in the late '90s and, yes, even prior to the Great Depression of the early '30s. It's the smart money's way of cashing in and cashing out.

I've observed this phenomenon before, and believe I understand the reason so many smart people have been looking to cash in and cash out right now. The reason is the liquidity that fuels a bull market is quickly drying up, and this could create a big problem not just in stocks but also in a variety of financial markets.

The liquidity problem was created by the Fed's (Greenspan's) easy money policy, and has recently come to a head with the subprime loan problems. At first I didn't fully understand what a contagious problem this was. Originally I thought, like most investors, that the subprime problem only affected some naïve homebuyers enticed by teaser loans and a few hedge funds.

However, now I'm beginning to understand how this problem is a spreading monster with implications for the entire stock market.

Here's why: We already know foreclosures are skyrocketing. The worst is yet to come. Before the end of 2007 more than $200 billion in subprime, adjustable rate mortgages will adjust upward from low teaser rates. Many subprime borrowers will see their monthly payments increase by 30, 40, and even 50 percent. And it's a fact that many, many more of them will default.

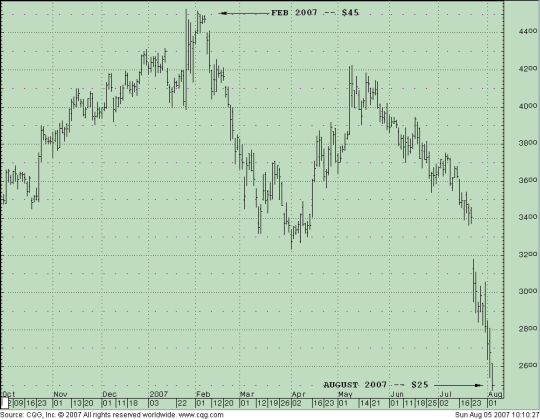

How do I know this? It's already happened on billions of subprime debt that has already adjusted in the first half of this year. This is why two Bear Stearns hedge funds are in collapse. This is why the chart for American Home Mortgage , the tenth-largest mortgage lender in 2006, looks like this:

American Home Mortgage

Source: Commodity.com

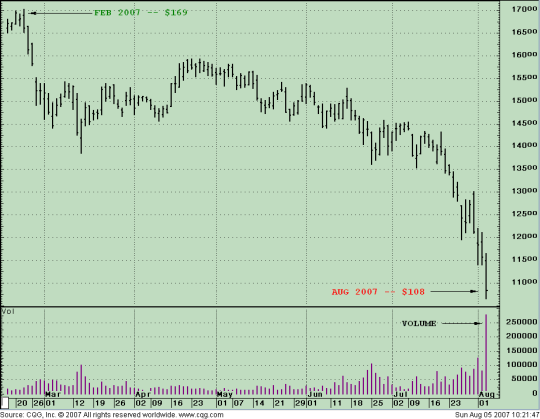

This is why the chart for the largest mortgage lender in the US, Countrywide Financial Corp , looks like this:

Countrywide Financial Corp

Source: Commodity.com

With housing prices falling, these borrowers who thought they could always sell their homes are finding out they have negative equity and can't refinance and can't sell.

We also now know about the Bear Stearns problems, explaining why it's chart looks like this:

The Bear Stearns Companies

Source: Commodity.com

Note that Bear Stearns also has a Countrywide connection. Also note the volume spike in the shares last Friday. Large volume is generally significant. Volume spikes can occur at bottoms (it's always darkest just before the dawn), and I believe it will be important to watch how Bear Stearns performs over the coming weeks. If it can stabilize here and head higher, perhaps the worst is over. However, if Bear Stearns (and also Countrywide) start to move lower still from this large-volume area, they (and the stock market in general) could move substantially lower.

Here's the question this all hinges on: How many more are out there?

I fear many more. Certain of these entities and hedge funds are getting singed, and the investing public may not even have a clue. Many of the banks could be getting burned as well. The yields on high-risk money are going up, and this is the heart of the problem.

The mergers, acquisitions, public offerings and deals of all varieties and sizes have one common denominator: They're fueled by cheap money. And because of the subprime problem, cheap money is fast becoming a relic of the past.

It's all related. As home equity evaporates, delinquencies go up, foreclosures go up, home equity loans go down, with consumer spending behind it. As the economy weakens we buy less from China. Liquidity from China starts to dry up, affecting the global economy and energy consumption fades. Oil money, which has also been fueling hedge funds and deal making, is less plentiful. There are other hedge funds on the wrong side of some of these positions, and other hedge fund collapses.

More risk, more leverage. Cheap money is what got deals done. Cheap money is fueled by liquidity. Less liquidity means money is dearer and becomes more expensive, and this is definitely not a recipe for stock market success. And the US government has few options. Overextended with a costly foreign war, and trillions in debt, one of the only ways out of this is money printing. This ultimately exacerbates inflation, causing rates to rise even further and compounding these problems.

Stock market crashes are generally preceded by periods of prosperity and are seldom predicted. They're created by periods of easy money that turn into periods of tight money, ultimately leading to money printing and inflation.

You get the picture, and I'm not exactly sure how it all shakes out. But I've lightened up substantially on stocks in my personal accounts (only holding those I consider very long term), investment real estate and junk bonds.

And this brings us to the meat of the matter.

Five Financial Alternatives (to Stocks) for These Volatile Times

We'll discuss Nos. 1 and 2 in this issue and tackle Nos. 3 through 5 on August 20.

Financial Alternative No. 1: Buy Six-Mmonth US Treasury Bills

Six-month Treasury bills are risk-free and as we go to press are yielding 4.88 percent. Not a bad place to park a good portion of your funds to safely wait out a market shakeout. (You can check out current Treasury and other key rates here .)

Financial Alternative No 2: Buy Japanese Yen

My reasoning here has to do with diversification out of the US dollar and the yen carry trade.

The yen carry trade works like this. Numerous market players (including Bear Stearns) have in recent years borrowed yen (a low-yielding currency) to invest in higher-yielding currencies such as the Australian dollar. When you borrow something, you eventually have to pay it back. For all the reasons stated above, the hedge funds will be liquidating large directional positions, and this includes their short yen positions (reputed to be massive).

Covering short yen should in effect place a bid under the market and raise the value of the currency. The rate on the yen, the yield, is virtually zero. Any gains in yen-denominated assets will come from appreciation of the currency itself in relation to the dollar.

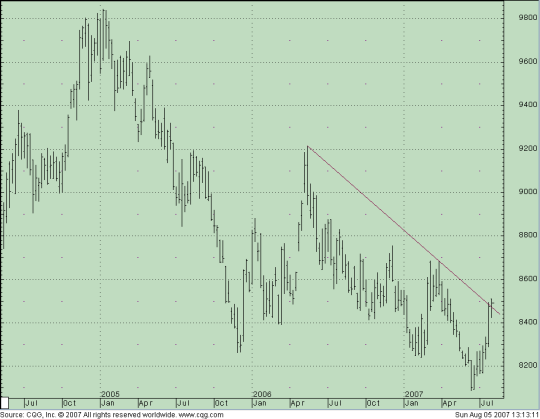

And the Japanese yen has exhibited a bottoming pattern in recent weeks; last week it broke above the weekly trendline, as shown below:

September Yen

Source: Commodity.com

How can a US investor buy yen? Some banks offer CDs denominated in foreign currencies, and you can buy Japanese bonds through many brokers.

I trade the Japanese yen futures on the Chicago Mercantile Exchange (CME). One Japanese yen contract is for 12,500,000 JPY, a value of about $107,000 at current exchange rates. The CME only requires an initial margin deposit of $2,700 per yen contract, or less than 3 percent of the contract's value. At 3 percent margin, if the Yen price moves only 3 percent you would double your margin money or get wiped out.

It makes more sense, in my opinion, to put up additional margin (say 25 percent). If a trader posts 25 percent margin, the yen would have to move 25 percent against you before a margin call would be generated. If the dollar value of the yen appreciated from the current 85 level to the 98 level (it traded there as recently as early 2005, a 15 percent move), your dollar return would be approximately $16,000 per contract traded.

If you posted the 25 percent margin with your broker per each contract you bought (about $25,000), a move of this magnitude would return more than 60 percent. In terms of the risk, I would use a stop loss point at 82, this being an approximate risk of 350 basis points from the 8,550 level. In dollar terms this amounts to approximately $4,500 per contract traded, or almost a 4-to-1 reward-to-risk ratio.

In our next issue I'll present Financial Alternatives Nos. 3 through 5.

Good luck and good trading during these volatile times.

By George Kleinman

President

Commodity Resource Corp.

Lake Tahoe,

Nevada 89452-8700

http://www.commodity.com

George Kleinman is the President of the successful futures advisory and trading firm Commodity Resource Corp. (CRC). George founded CRC in 1983 while on the "floor" of the Minneapolis Grain Exchange to offer a more personalized level of service to traders. George has been an Exchange member for over 25 years. George entered the business with Merrill Lynch Commodities (1978 - 1983). At Merrill he attained the honor of 'Golden Circle' one of Merrill's top ten commodity brokers internationally. He is a graduate of The Ohio State University with an MBA from Hofstra University. George has developed his own proprietary trading techniques and is the author of three books on commodity futures trading published by the Financial Times.

He is Executive Editor of Futures Market Forecaster, a KCI Financial publication. In 1995, George relocated CRC to Nevada and today trades from an office overlooking beautiful Lake Tahoe. The firm assists individuals and corporate clients. CRC¹s exclusive clearing firm is R.J. O'Brien with all client funds held at RJO (assets in excess of $1.9 billion). Founded in 1914, R.J. O'Brien is a privately owned Futures Commission Merchant, and one of the most respected independent futures brokerage firms in the industry. RJO is a founding member of the Chicago Mercantile Exchange, a full clearing member of the Chicago Board of Trade, New York Mercantile Exchange, Commodity Exchange of New York and the New York Board of Trade. RJO offers the latest in order entry technology coupled with 24-hour execution and clearing on every major futures exchange worldwide. There is risk of loss when trading commodity futures and this asset class is not appropriate for all investors.

Risk Disclaimer

Futures and futures options can entail a high degree of risk and are not appropriate for all investors. Commodities Trends is strictly the opinion of its writer. Use it as a valuable tool, not the "Holy Grail." Any actions taken by readers are for their own account and risk. Information is obtained from sources believed reliable, but is in no way guaranteed. The author may have positions in the markets mentioned including at times positions contrary to the advice quoted herein. Opinions, market data and recommendations are subject to change at any time. Past Results Are Not Necessarily Indicative of Future Results.

Hypothetical Performance

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

George Kleinman Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.