Gold New Record High; Silver Surges 4% and Breaks Above Long Term Resistance

Commodities / Gold and Silver 2010 May 12, 2010 - 07:23 AM GMTBy: GoldCore

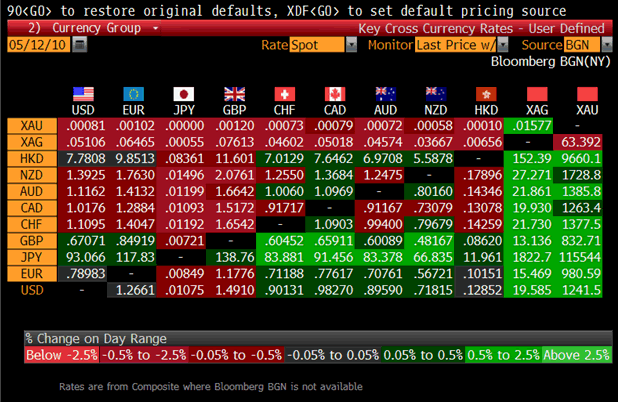

Gold has rallied to a new record high ($1,244.80/oz) on continuing concerns about sovereign debt contagion and the risk posed to the single currency. Gold rose to $1,224/oz early in New York yesterday, it then fell off slightly before closing with a new record closing high and a gain of 1.61%. It has range traded from $1,228/oz to $1,234/oz in Asian and early European trading this morning prior to rising to new record highs in dollars, Swiss francs, pounds and euros. Gold is currently trading at $1,231/oz and in euro and GBP terms, at €968/oz and £820/oz respectively.

Gold has rallied to a new record high ($1,244.80/oz) on continuing concerns about sovereign debt contagion and the risk posed to the single currency. Gold rose to $1,224/oz early in New York yesterday, it then fell off slightly before closing with a new record closing high and a gain of 1.61%. It has range traded from $1,228/oz to $1,234/oz in Asian and early European trading this morning prior to rising to new record highs in dollars, Swiss francs, pounds and euros. Gold is currently trading at $1,231/oz and in euro and GBP terms, at €968/oz and £820/oz respectively.

Silver has surged to $19.62 an ounce, the highest price since March 18, 2008 (see chart above). Silver thus breached resistance at $19.24/oz and looks set to challenge $20 per ounce in the coming days. Silver remains under the radar of investors despite its sterling performance in recent years and strong fundamentals. Silver remains undervalued versus gold and could rise to over $25 per ounce in the coming months. A close above resistance near the high of March 18th, 2008 at $21/oz could see silver go parabolic as it did in the 1970s when conditions were far more benign than they are today.

Gold for immediate delivery climbed to a record 1,375.2462 Swiss francs an ounce. The price of gold in euros, British pounds and Swiss francs jumped to a record as the currencies slumped, prompting investors to buy bullion as a store of value. Futures of the metal in Shanghai reached an all-time high.

Gold and Silver up Versus All Currencies Today

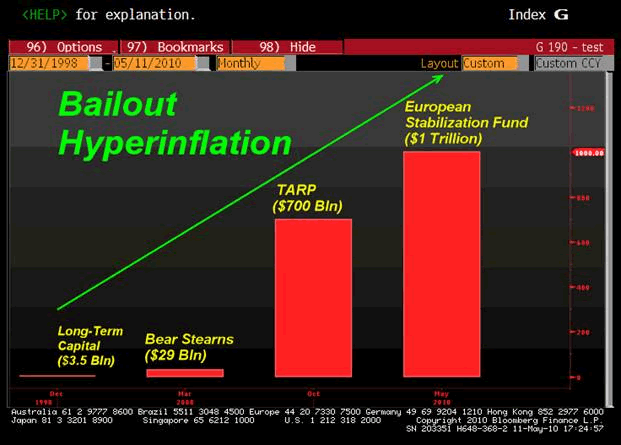

Inflation concerns due to the use of printing presses are rising as seen in the comments of Jean Claude Trichet who said "our goal is stability of prices on the medium and long term" and "we will not turn on the printing press." Gold is now in unchartered territory but technical traders will likely look to the psychological big round numbers of $1,250 and $1,300 as the next levels of resistance. Above that $1,400/oz is more than possible in the coming months and gold could even spike higher. Prices could potentially spike to over $1500 per ounce prior to correcting back to previous resistance at $1,200 per ounce which will then likely become support.

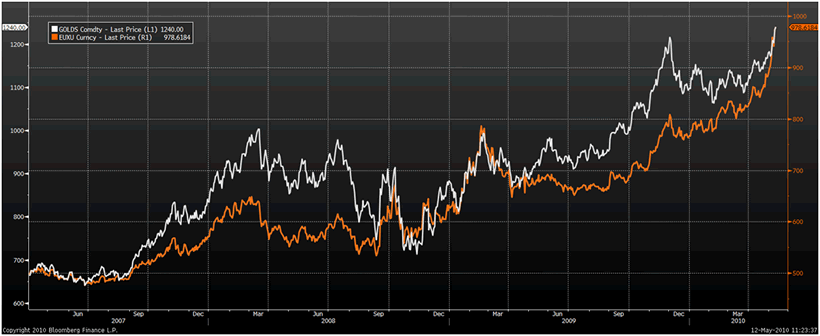

Gold in USD and EUR (March 2007 to Today) Showing Strong Correlation

Our trading desk has seen a marked increase in demand - especially for allocated gold and physical gold coins and bars. Demand for silver coins and bars has risen as well. While uncertainty in property and equity markets was driving prices in recent years, the significant uncertainty in currency markets and with regard to the very survival of the euro single currency is what is driving demand and leading to higher prices. In an environment where a possible return to Spanish pesetas, Greek drachmas and German deutschmarks is possible, gold is thriving and thus surging in all currencies.

Bloomberg Chart of the Day

Silver

Silver range traded from $19.08/oz to $19.39/oz this morning in Asia before surging to multi month highs in European trading. Silver is currently trading at $19.52/oz, €15.18/oz and £12.86/oz.

Platinum Group Metals

Platinum is trading at $1,697/oz and palladium is currently trading at $531/oz. Rhodium is at $2,825/oz.

News

Investor Jim Rogers said Europe's bailout of indebted nations to overcome the sovereign-debt crisis is just "another nail in the coffin" for the euro as higher spending increases the region's debt. "I was stunned," Rogers, chairman of Rogers Holdings, said in a Bloomberg Television interview in Singapore. "This means that they've given up on the euro, they don't particularly care if they have a sound currency, you have all these countries spending money they don't have and it's now going to continue."

UBS AG have raised their forecasts for gold in the next month but continue to be bearish on silver. Gold in one month will be at $1,300 an ounce, up from a previous forecast of $1,200 and silver will be at $18.50, up from $16, UBS analyst Edel Tully wrote in a report e-mailed today. The three-month gold forecast was raised to $1,200 from $1,150 and the three-month silver forecast was increased to $17.25 an ounce from $16.50, she wrote. Thus, UBS AG is forecasting gold will be lower in 3 months from today.

Nouriel Roubini said Greece and other "laggards" in the euro area may be forced to abandon the common currency in the next few years to spur their economies. A "real depreciation" in the euro is needed to restore competitiveness in nations including Spain, Portugal and Italy, he said in an interview on Bloomberg Television today. The euro will remain the currency for a smaller number of countries that have "stronger fiscal and economic fundamentals," Roubini said.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.