Gold Tests Record Highs as Euphoria on Short Covering Rally Fades

Commodities / Gold and Silver 2010 May 11, 2010 - 05:59 AM GMTBy: GoldCore

Gold has recovered from the slight sell off seen yesterday and stayed above $1,200/oz in Asian trading before rallying in early European trading. The initial euphoria that saw stocks and the euro surge yesterday has quickly dissipated with the euro giving up most of yesterday's gains and stocks coming under pressure this morning.

Gold has recovered from the slight sell off seen yesterday and stayed above $1,200/oz in Asian trading before rallying in early European trading. The initial euphoria that saw stocks and the euro surge yesterday has quickly dissipated with the euro giving up most of yesterday's gains and stocks coming under pressure this morning.

Yesterday's relief rally may have been more about a massive short covering rally than anything else and there is a growing realisation that the unprecedented measures may not be enough to contain the eurozone debt crisis.

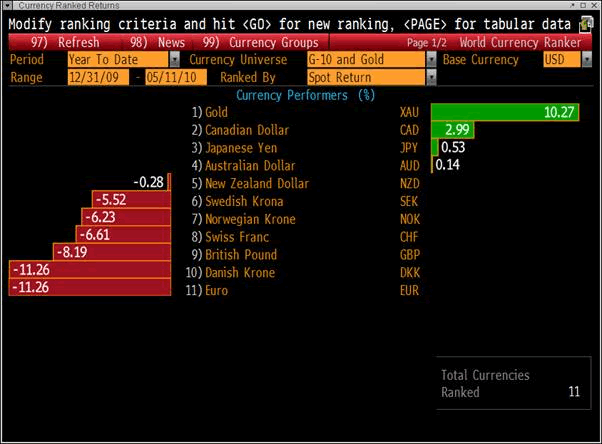

Gold is looking healthy and strong at these levels and seems very likely to surpass its December 2009 record highs (over $1,220/oz) sooner rather than later. A close above $1,224/oz could lead to the next leg up in gold's bull market with a rally to $1,400/oz quite possible given the degree of macroeconomic and monetary risk in the world. Risk which will remain with us for the foreseeable future.

There are real risks that the crisis could spread to effect other heavily indebted nations such as Japan, the UK and the US. While the yen is up again today after yesterdays falls, news that the outstanding balance of Japan's central government debt hit a record high of 882.92 trillion yen at the end of fiscal 2009 (through March 31) will not soothe market jitters. Nor will the horse trading taking place to create a new UK government amid concerns about the very poor UK public finances.

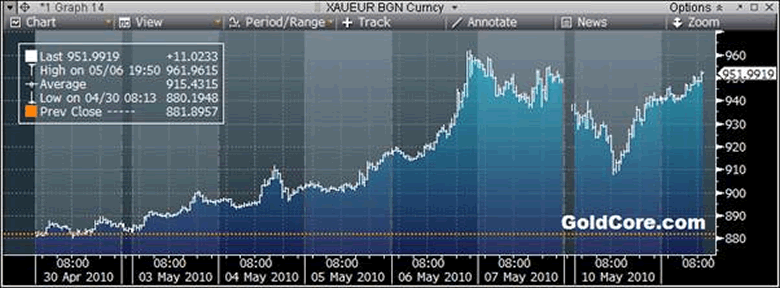

With the euro currency now being debased and the ECB electing to try and print their way out of this crisis by bailing out European banks exposed to the debt of the so called 'PIGS', the survival of the euro remains at question and hence gold remain close to Friday's record highs of €961.96 per ounce. The psychological level of €1,000 per ounce gold may become resistance.

The short term panacea of printing money has failed miserably in recent months to resolve our financial and economic woes, as it has done historically, and the real risk is that it leads to a currency crisis. With fiat currencies internationally being debased and devalued there is a real risk of serious inflation taking off followed by much higher interest rates. Chinese inflation numbers overnight were higher than expected and as the world's largest exporter, will likely lead to higher inflation internationally. False hope and pollyanna thinking got us into this mess and will not get us out.

Silver

Silver has range traded from $18.38/oz to $18.52/oz this morning in Asia and Europe. Silver is currently trading at $18.41/oz, €14.46/oz and £12.39/oz.

Platinum Group Metals

Platinum is trading at $1,684/oz and palladium is currently trading at $525/oz. Rhodium is at $2,825/oz.

News

Jim Rogers, the respected hedge fund manager who predicted the bursting of the global property bubble and much of the currency economic crisis has gain warned of an international currency crisis. Rogers said that "the currency crisis has been going on for a while. It did not start this week. It has been happening for a while. It started with, maybe depending on how you want to look at it, with Iceland or Latvia or many other countries who have been having problems, and the currency crisis is continuing and is going to get worse. This is not the end. Over the next year or more, we are going to see more. So prepare yourself."

Former General Consel to LTCM, Jim Rickards, who recently has gotten massive media exposure on everything from the JPM Silver manipulation scandal, to the Greek default, gave some interesting insights we have yet heard from anyone, which demonstrates beyond a doubt why any attempt by Europe to print its way out of its current default is doomed: "Look at what Soros did to the Bank of England in 1992 - he went after them, they had a finite amount of dollars, he was selling sterling and taking the dollars, and they were buying the sterling and selling the dollars to defend the peg. All he had to do was sell more than they had and he wins. But he needed real money to do that. Today you can break a country, you don't need money you just need synthetic euroshorts or CDS. A trillion dollar bailout: Goldman can create 10 trillion of euroshorts. So it just dominates whatever governments can do. So basically Goldman can create shorts faster than Europe can create money." Just wait until Europe finally realizes that the CDS "speculators" had all the cards in the poker game all along. And we hope Europe listens to the man: being LTCM's General Counsel he knows all about failed bail outs (Zero Hedge).

Investors should expect higher commodity prices in the "near term" and favor industrial and precious metals, JPMorgan Chase & Co. said in a report. Investors should be neutral on agriculture and increase bets on higher oil prices, the bank said, forecasting a West Texas Intermediate price of $93 a barrel in the fourth quarter (Bloomberg).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.