Stock Market Manic Monday - Just Another Another Trillion Dollars for the Bankster's!

Stock-Markets / Stock Markets 2010 May 10, 2010 - 09:14 AM GMTBy: PhilStockWorld

I mean really - how much money did you lend Greece? Perhaps you wrote Spain a check? France??? Well, you did now! $220Bn of that money came from the IMF and 20% of the IMF’s money comes from the USA as we once again paper over the global financial crisis for another month or two - whatever respite $1,000,000,000,000 buys us these days…

I mean really - how much money did you lend Greece? Perhaps you wrote Spain a check? France??? Well, you did now! $220Bn of that money came from the IMF and 20% of the IMF’s money comes from the USA as we once again paper over the global financial crisis for another month or two - whatever respite $1,000,000,000,000 buys us these days…

So YAY, I guess. We couldn’t be more thrilled for ourselves as we cashed out at the top and went short, then we cashed out at the bottom and went long. We’ve caught moves in the market from top to bottom that used to be considered two or three good years of trading in the past two weeks - that’s nuts! We went up so fast that there was no point in putting plays on our new Watch List (can’t be a Buy List yet because we don’t like chasing) as we’ll be up 5% at the open today.

In addition to the DIA $107 calls (my comment into Friday’s close as to whether I would keep them into the close was: "Not if I can get out even but they are gambling money so I won’t take a small loss (not when I can have a much bigger one!)" - we also picked up very nice entries on BAC, BRK/B, C, CAT, ERX, GOOG, LVS, MEE, MON, RIG, T, TBT and TZA (shorting it). How long we stay in those after the instant gratification of a 5% bump in 8 trading hours remains to be seen, as I said in our Watch List post:

There are two major forces at work there - the NEED to OVERCOME GREED and the TOOLS to OVERCOME FEAR. At PSW, we have a 2-step program for overcoming greed. Step number one is "Taking the money" and step number two is "running." The people who master these two complex steps find they have lots of cash at the bottoms and the tops of the cycles - they find that you can buy low and sell high once you realize that you don’t have to wait until the top to sell nor do you have to wait until the bottom to buy - especially when we can go from top to bottom at the lightning pace of today’s crazy markets. That’s where our TOOLS come in.

Having the right hedging tools lets you take advantage of these crazy market moves. Options provide us with fantastic cushions to make speculative entries, even when the rest of the market is in panic - ESPECIALLY when the rest of the market is in panic. Today we’ll be taking advantage of the panicking shorts the same way we took advantage of the panicking longs on Thursday and Friday (thank you Cramer!). Ordinarily, I’d feel kind of bad about it but "I told you so" doesn’t even begin to cover it - we’ve simply done exactly what we said we were going to do, which was pretty much the exact opposite of what the crowd was doing for the past few weeks, the past few days was just the whole thing in a microcosm but more of the same to us.

So, getting back to fundamentals for a moment - THIS SOLVES NOTHING! I pointed out last week that giving Greece $140Bn was not going to cut it and, fortunately, I have a lot of influence over in Europe and they listened to me. The chart I featured in Thursday’s post showed the terrifying web of entangled loans that made the Greek bailout a very small drop in the bucket. Now, not only has the EU, ECB, and the IMF (20% of that is our money) all coordinated their actions to fight off the vultures that were circling their weaker members but the ECB is not jumping into the bond market and buying those up at face - totally screwing over short speculators while our Fed piles on by restarting their own infinite emergency swaps for Europe but…. how long will it last?

While $1Tn buys you a very impressive looking scarecrow - it’s a scarecrow nonetheless and, after a while, the scavengers will get used to it and they will once again circle close and closer, looking to take a bite of flesh from the weakest targets. After all, it’s all relative - drop everyones rates back to 3.5% and, sooner or later, the PIIGS will still look riskier than Germany (and, once again, the arbs come into play) as the piggies still have $4Tn in debt and are running a combined $650Bn annual deficit. $1Tn will tide them over for about a year - and that’s assuming the UK doesn’t need any cash when their new government has a look at the books (which is what kicked off the Greek disaster).

Look, I don’t like pooping every party that comes along. I told the bears to take money and run last week, I told the bulls to take money and run 2 weeks ago and today I’m going to have to tell you, in good conscience, NOT to chase this move up. If we let the markets settle, there will be plenty of opportunities to identify strong companies and invest in them but the data has turned south recently and, just this morning, the OECD has finally admitted the global economy may be slowing down. As I have pointed out before, the OECD is like your local chamber of commerce so it’s a big deal when they are forced to admit that business sucks since it’s generally their job to tell you how great things are and what a marvelous day it is to come downtown and do some shopping.

While the 31 OECD member nations’ composite indicator rose from 103.3 to 103.9 in March (which we already know was a better month than April), China and Brazil, who are not members, fell slightly for the first time in over a year. "OECD composite leading indicators … point to a slowdown in the pace of economic activity," the think-tank said. "In most OECD countries signs of slowing growth are tentative, but stronger signals have appeared in France and Italy, and some evidence of a potential halt in expansion is emerging in China and Brazil." So caution, caution, caution (sorry).

While the 31 OECD member nations’ composite indicator rose from 103.3 to 103.9 in March (which we already know was a better month than April), China and Brazil, who are not members, fell slightly for the first time in over a year. "OECD composite leading indicators … point to a slowdown in the pace of economic activity," the think-tank said. "In most OECD countries signs of slowing growth are tentative, but stronger signals have appeared in France and Italy, and some evidence of a potential halt in expansion is emerging in China and Brazil." So caution, caution, caution (sorry).

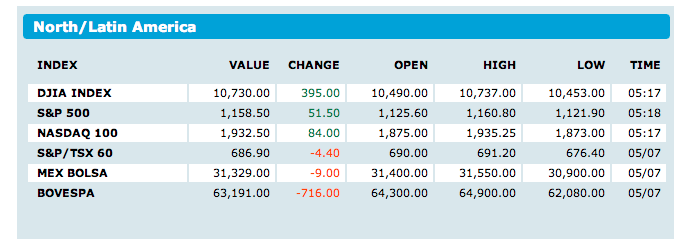

I wish I could be more bullish. Heck, we have naked DIA $107 calls from Friday that are possibly going to be triples at the open (although a falling VIX may limit us to doubles) and, if we get back to 11,200, we can all take the rest of the year off. But, what we are going to do is sensibly take our money and then we’re going to run and, IF the markets squeeze over the 5% Rule - THEN we’ll consider some new longs - most likely spreads, not naked options, which are going to be very risky as we zip back to the middle of our expected range (10,200 to 11,200). So far this morning (8am) the futures are looking very bright indeed:

Is this all you get for $1Tn??? If Greece is "fixed" (again) and the entire EU is out of trouble then why only 10,730 (and we’re fading those numbers a bit now)??? We’re going to be zooming right back to the 1,155 breakdown line we pegged for the S&P so all we have to do is go back to our last 5% Rule Review and use those charts today to see how "real" this rally is going to be. My comment to members last Tuesday on a possible S&P recovery still hold this week:

So what lies ahead? Most likely a retrace back to 1,100 (25% of our run) but if that holds and we consolidate a bit, I will be downright bullish. I will also be impressed if we hold 1,145, which was our last breakout line but, for now, we have a 3.75% drop from 1,218 but a poor bounce yesterday indicates we are likely to get down to a 5% pullback from 1,218 to 1,157 and not holding that is going to be nasty. For now, we have the rising 50 dma and the 2.5% line at 1,170 so VERY BAD if we can’t pull a bounce together here. We’ll call it a 50-point drop from 1,220 and figure a 10-point bounce to 1,180 would be lame (a very important 5% rule term) and 25 points, 1,195, has got to be retaken before we get all impressed with a "rally."

We got our retrace but NOT our consolidation so it’s a paper tiger of a straw man we’re building for $1Tn but you HAVE to respect $1,000,000,000,000 - you just have to… Our 5% Rule series for the S&P over the 1,155 breakdown line is the very critical 1,170, followed by 1,185, 1,200 (critical), 1,215 and 1,230 and THEN we are on the way to recovery. Below that, we’re not too impressed but it also won’t be very surprising if all $1Tn buys us these days is some moderate lift that isn’t strong enough to break our major technicals.

We got our retrace but NOT our consolidation so it’s a paper tiger of a straw man we’re building for $1Tn but you HAVE to respect $1,000,000,000,000 - you just have to… Our 5% Rule series for the S&P over the 1,155 breakdown line is the very critical 1,170, followed by 1,185, 1,200 (critical), 1,215 and 1,230 and THEN we are on the way to recovery. Below that, we’re not too impressed but it also won’t be very surprising if all $1Tn buys us these days is some moderate lift that isn’t strong enough to break our major technicals.

Can the Euro get back over $1.30 on this "great" news? Will the Pound hold $1.50? The Yen is back to 93 to the dollar, up from 90 on Friday so Japan will have something to celebrate tomorrow, despite their fairly wimpy 166 point gain (1.6%) this morning to "just" 10,530. EWJ ($10.20) is a good way to play Japan up if the Yen holds up and the S&P holds 1,155. The weakening dollar should give a boost to commodities so we’ll see how copper handles their breakdown line at $3.20 ($3.40 is bullish) and also oil should be slow out of the gate around $76.50 on continuing demand worries but ERX ($37.25) is still a good way to play them up. We’ll also keep an eye on how well gold holds 1,200 in the face of a dollar pullback - it’s really hard to see what keeps them afloat at this level.

Asian markets were all up with the Hang Seng gaining the expected 2.5%, back to 20,426 but the Shanghai is stuck in the mud at 2,698. The Nikkei, as I mentioned, gained 1.6% and needs to catch up while the BSE added 3.35% (561 points) to 17,330. Europe is going CRAZY with the FTSE and the DAX testing the 5% Rule for the day but the CAC is so thrilled that French banks just effectively got a bailout equaling 1/3 of the nations’ GDP that the National Index of French stocks is up 8.3%, led by "Le Banksters" but of course!

Keep in mind that, other than bailing out investors who led money to the PIIGS, this $1Tn taken from the taxpayers and given to the banks doesn’t do a thing for the people. It won’t create any jobs or build any roads or fix any bridges - this is $1Tn to service debt and allow the creation of additional debt - effectively a golden shovel so the EU can dig itself a deeper hole. We have our own Retail Sales Report for April on Friday and that should be a market mover (up 0.6% expected), especially if we miss so get ready for another wild week - business as usual…

And be careful out there!

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.