Economic Green Shoots Taking Root in Labor Market for Sustained Recovery

Economics / Economic Recovery May 08, 2010 - 06:01 AM GMTBy: Paul_L_Kasriel

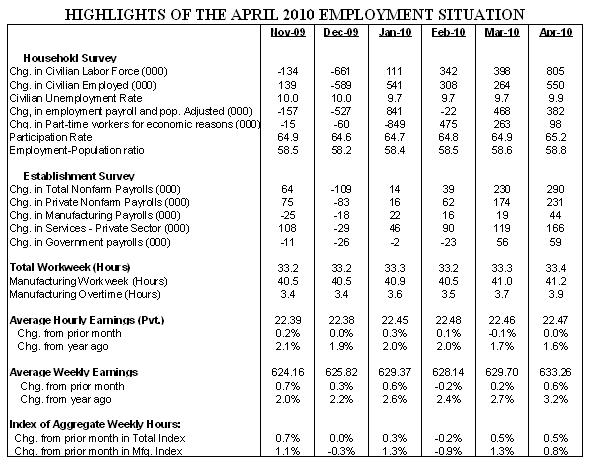

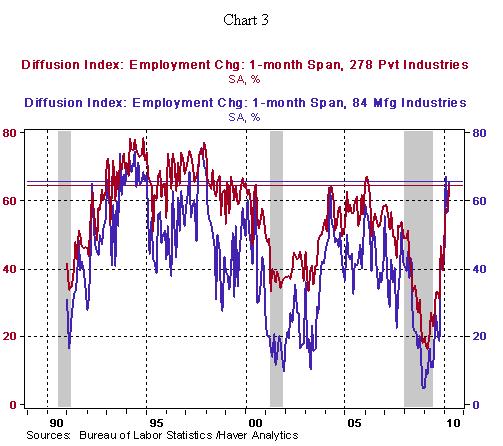

Civilian Unemployment Rate: 9.9% in April vs. 9.7% in each of the first three months of the first quarter. The unemployment rate was 5.0% in December 2007 when the recession commenced. Cycle high for recession is 10.1% in October 2009 and the cycle low for the expansion that ended in December 2007 is 4.4% in March 2007. Payroll Employment: +290,000 in April vs. +230,000 in March, net gain of 121,000 jobs after revisions of payroll estimates for February and March. Private sector hourly earnings: $22.47 in April vs. $22.46 in March, 1.6% yoy increase, slightly lower than 1.7% gain of March.

Civilian Unemployment Rate: 9.9% in April vs. 9.7% in each of the first three months of the first quarter. The unemployment rate was 5.0% in December 2007 when the recession commenced. Cycle high for recession is 10.1% in October 2009 and the cycle low for the expansion that ended in December 2007 is 4.4% in March 2007. Payroll Employment: +290,000 in April vs. +230,000 in March, net gain of 121,000 jobs after revisions of payroll estimates for February and March. Private sector hourly earnings: $22.47 in April vs. $22.46 in March, 1.6% yoy increase, slightly lower than 1.7% gain of March.

Household Survey - The unemployment rate rose to 9.9% in April after a string of three monthly readings of 9.7%. The sharp expansion of the labor force (+805,000) exceeded the growth in employment (+550,000) during April. In the early stages of a moderate economic recovery, gains in employment, although robust, will fall short of the growth in the labor force and send signals that are contradictory to the message from the expansion of payrolls. The participation rate has risen 0.6 percentage points since December, putting the April reading of 65.2% at the highest mark since August 2009. The broader measure of unemployment moved up to 17.1% in April from 16.9% in March.

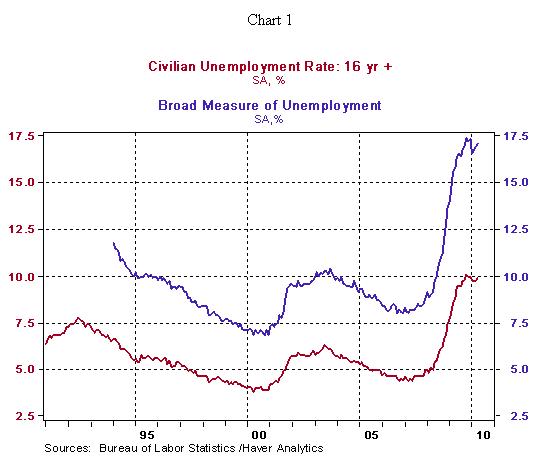

Establishment Survey - Nonfarm payrolls increased 290,000 in April, after a revised gain of 230,000 in the prior month. In the first four months of the year, a total of 573,000 jobs have been created of which 483,000 jobs were in the private sector. Census 2010 accounted for an increase of 66,000 temporary jobs in the federal government during April. Four consecutive months of private nonfarm payroll gains with each successive month showing larger gains should dispel notions that this is not a sustainable economic recovery.

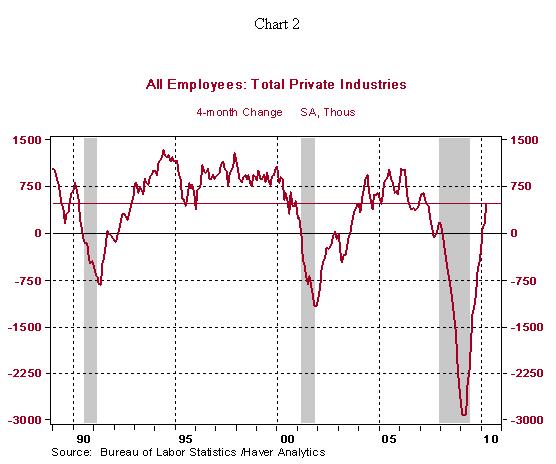

Highlights of Job Losses/Gains in March: Construction: +14,000 vs. +26,000 in March Manufacturing: +44,000 vs. +19,000 in March Autos: +4,400 vs. +3,000 in March Private sector service employment: +166,000 vs. +119,000 in March Retail employment: +12,000 vs. +15,000 in March Professional and business services: +80,000 vs. +13,000 in March Temporary help: +26,200 vs. +32,400 in March Financial activities: +3,000 vs. -20,000 in March Health care employment: +20,100 vs. +32,900 in March The extent of the improvement in the labor market is visible in the diffusion indexes. The overall private sector diffusion index rose to 64.3%, while the factory diffusion index advanced to 65.9%, both of which are noteworthy. The factory sector diffusion index exceeds the high posted in the previous expansion (see chart 3).

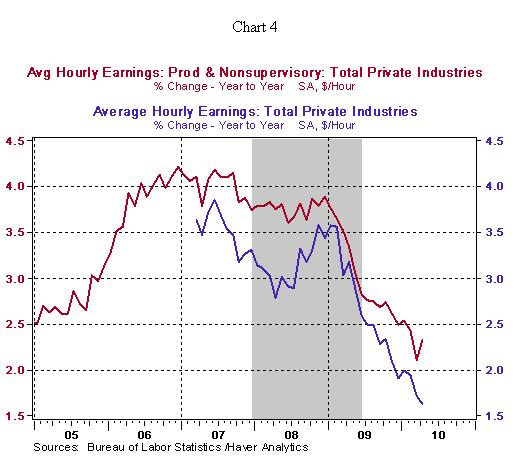

Hourly earnings in the private sector ($22.47) were nearly steady in April vs. the March reading ($22.46). The year-over-year change of hourly earnings shows a decelerating trend (see chart 4) which implies the absence of inflationary pressures from the labor market and allows the Fed to focus on promoting economic growth. The 0.6% jump weekly earnings points to an impressive increase in personal income during April after a 0.3% increase in March. The 0.8% gain in the factory man-hours index suggests strong growth in industrial production during April but probably less than the 0.9% increase recorded in March.

Conclusion - The overall tone of the employment report is significantly bullish and reinforces the view that the economy has entered a self-sustaining recovery. The unemployment rate is a lagging indicator, which could rise even higher as more people reenter the labor force. In April, nearly 25% of the unemployed were reentrants, the highest in the current recovery. The increases in private sector nonfarm employment in the past four months are unlikely to bring about a near-term tightening in Fed policy. With the unemployment rate still high and growth in labor compensation low and trending lower, the Fed is not concerned about wage-push inflation. Moreover, Fed Chairman Bernanke, although sounding more optimistic of late about the economy's prospect's, appears to be concerned about the continued contraction in bank lending. In addition, apparent renewed weakness in consumer spending in April, all of the financial market turmoil regarding Greece and concerns about the Chinese economy will keep Fed policy on hold "for an extended period."

by Paul Kasriel and Asha Bangalore

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2010 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.