Gold Again Rallies on Continuing Risk Aversion and Safe Haven Demand

Commodities / Gold and Silver 2010 May 07, 2010 - 06:14 PM GMTBy: GoldCore

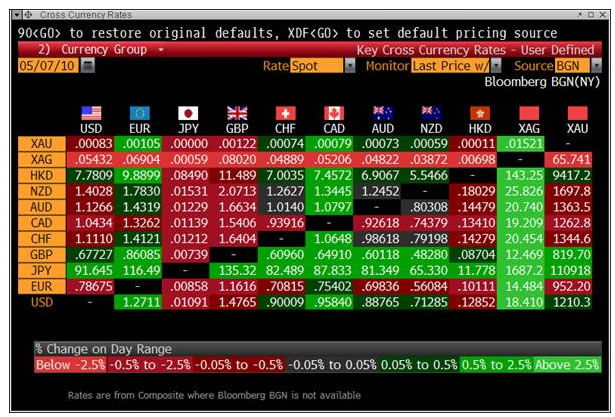

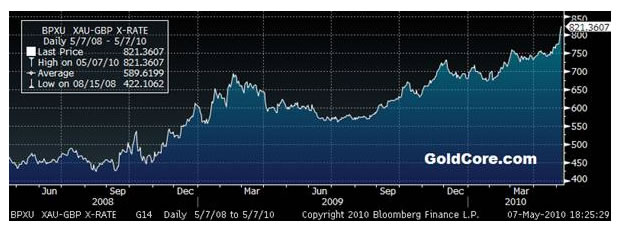

Gold has again rallied on continuing risk aversion and safe haven demand. With European equity markets again under pressure and Wall Street threading water with slight losses, traders are choosing to be long gold over the weekend. Gold has rallied in dollars and particularly in British pounds and Japanese yen (see Cross Currency Table). Speculation that the ECB may aid Greece have arrested the recent sharp declines in the euro.

Gold has again rallied on continuing risk aversion and safe haven demand. With European equity markets again under pressure and Wall Street threading water with slight losses, traders are choosing to be long gold over the weekend. Gold has rallied in dollars and particularly in British pounds and Japanese yen (see Cross Currency Table). Speculation that the ECB may aid Greece have arrested the recent sharp declines in the euro.

Cross Currency Rates at 1830 GMT – Silver’s Late 5% Surge Can Clearly Be Seen

Clear evidence that safe haven demand for gold remains robust was seen in the figures for the gold holdings in the SPDR Gold Trust, the biggest exchange-traded fund, which rose by the most in 15 months to the highest level ever. Assets held by the ETF jumped 19.78 metric tons, the most since Feb. 17, 2009, to 1,185.79 tons yesterday.

Equity markets are under pressure again due to the new concerns about trading systems and continuing concerns about European sovereign issues and the ECB’s response to it. Gold thrives on uncertainty and there is a lot of uncertainty going into this weekend. Gold is up 3% this week in dollars and by more in other currencies and looks set to target the December 2009 highs above $1,220/oz in the coming days.

SILVER

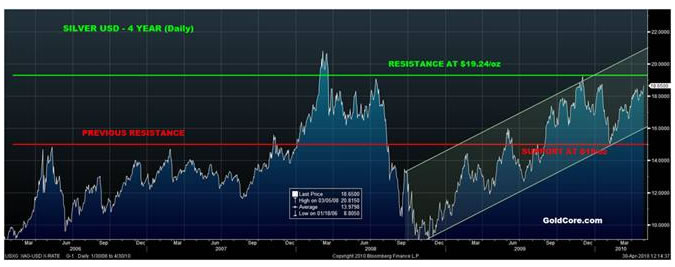

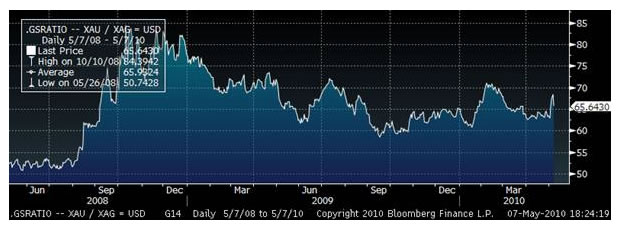

Silver has surged some 5% today as it reverses earlier sharp falls in the week – many investors see silver as very cheap versus gold as seen in the gold silver ratio which is back to 65.

Silver looks well technically and is in a rising trend channel with support at $15 and $16 per ounce (see chart above). Resistance is between $19.20 and $19.30 per ounce and a close above these levels should see rapid price moves to $20 per ounce. Above that the next level of resistance is at the March 2008 highs at $20.81 per ounce.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.