The Four Stages of Economic Collapse

Economics / Global Debt Crisis May 06, 2010 - 04:55 PM GMTBy: Graham_Summers

Are you still bullish?

Are you still bullish?

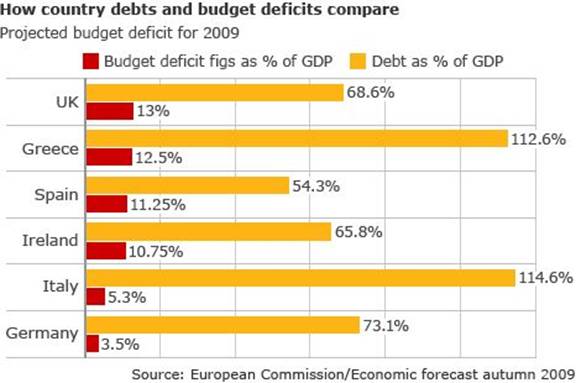

As I write, the notion of a unified Europe is literally going up in smoke. Greece has yet to confirm a bailout (four months into this ridiculous comedy), Spain and Portugal have both been slapped with credit downgrades. These problems are hardly unique as the below chart reveals:

Europe, particularly Greece, should be viewed as a “trial run” for what will eventually be hitting the US. The key items to note in Greece are:

- Obvious issues taking time to hit the market/ people

- “Extend and pretend” without doing anything/ affecting any change

- Civil unrest, political failure, the “blame game”

- Debt default/ currency devaluation

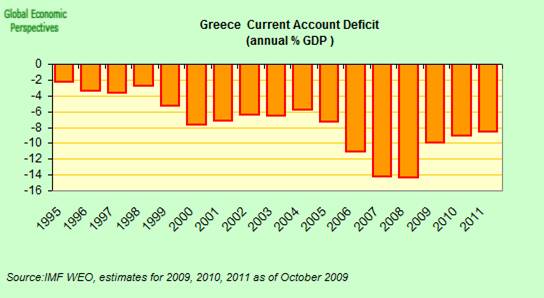

First off, I want to point out the Greece Crisis was staring everyone in the face for years. Greece’s debt did not suddenly become an issue overnight. As far back as 2006 the Greek deficit was out of control (and this was BEFORE we knew that Greece was using derivatives with Goldman Sachs to hide its true debt levels).

So this tells us right up front that those who actually look into the numbers were well aware that Greece had problems years ago. Again, the Greece Crisis was staring everyone in the face for years. It did not suddenly erupt overnight.

Secondly, the Greek Crisis tells us that once a Crisis erupts, it takes months to be resolved. Greece’s Crisis went “mainstream” in December/ January. Here we are nearing May and nothing has yet been resolved. At this point I can think of at least five or six times that we’ve had “rumors” of a bailout coming soon, only to find that they were all false. So we know that even when Crises go mainstream, the powers that be will do everything they can to simply “extend and pretend” without resolving anything.

This brings us to our next point: the Blame Game. Greece has not been bailed out yet. We’ve seen a lot of posturing, finger pointing, and rumors, but no concrete action has been taken yet. The politicians have blamed financial speculators (as if a short-seller is responsible for Greece running up deficits and absurd debts) and even their would-be saviors (the Germans). This will happen in the US too, and most likely financial speculators will bear the brunt of the blame.

Meanwhile the Greece populace is erupting into full-blown riots. A bomb went off at the JP Morgan office in Athens. All of this will occur on an even bigger scale when these issues hit the US’s shores. The end result here will be same as in Greece: ultimately default. You can bail out an issue for a time and play “extend and pretend” but ultimately you cannot solve a debt problem with more debt. The only real solution is default (hyperinflation is also possible but less likely if history is a guide).

This is why I’ve been telling everyone to prepare well in advance for what is to come. I realize I am quite early on all of this. It took more than three years for Greek’s obvious debt issues to hit the mainstream. I have no idea how long it will be before similar Crises hit the US’s shores (if not for QE it likely would have already happened).

Regardless, at some point these issues will hit the US. When they do, we’ll go through everything Greece is going through. The ultimate result will likely be default. However, until then, the Fed and other central bankers will attempt to inflate our issues away.

Which will lead to inflation taking hold. Indeed, it already is.

‘Super Easy’ BOE Policy May End to Curb Inflation

The U.K.’s inflation rate jumped to 3.4 percent in March, exceeding the government’s 3 percent limit, stoked by higher energy costs and the weakness of the pound. Bank of England officials pledged to monitor price expectations closely because the inflation outlook is a source of concern to some of them, according to the minutes of their April 8 meeting. Faster inflation “is starting to rub off on consumer and market expectations,” Kounis, an Amsterdambased economist who is a former U.K. Treasury official, said in a telephone interview. “This monetary policy stance that’s super, super easy is inappropriate. They will have to take some of that accommodation away.”

http://preview.bloomberg.com/..

Wholesale prices rise in March as food costs jump

Wholesale prices rose more than expected last month as food prices surged by the most in 26 years. But excluding food and energy, prices were nearly flat.

http://finance.yahoo.com/news/..

India Food Inflation Quickens; Rains May Cool Prices

India’s food inflation accelerated ahead of a report tomorrow that may show monsoon rains this year will be sufficient to cool farm prices.

An index measuring wholesale prices of agriculture products including lentils, rice and vegetables compiled by the commerce ministry rose 17.65 percent in the week ended April 10 from a year earlier. It gained 17.22 percent the previous week, according to a statement in New Delhi today.

Inflationary fears are gripping the markets. On that note, Gold has broken out of its trading range of the last four months:

This is a strong signal to buy. If Gold remains above $1,150, we’re likely going to see a re-test of the December highs. I’ve been bullish on Gold Since mid March. And my clients are already up double digits on our position.

Good Investing!

Graham Summers

PS. I’ve put together a FREE Special Report detailing THREE investments that will explode when stocks start to collapse again. I call it Financial Crisis “Round Two” Survival Kit. These investments will not only help to protect your portfolio from the coming carnage, they’ll can also show you enormous profits.

Swing by www.gainspainscapital.com/roundtwo.html to pick up a FREE copy today!

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2010 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.