Greece Debt Crisis Storm Cripples Stock Market Rally Resulting Stock Price Churn

News_Letter / Financial Markets 2010 May 05, 2010 - 09:56 AM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

May 2nd, 2010 Issue #26 Vol. 4

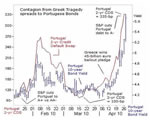

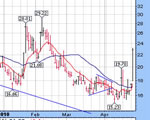

Greece Debt Crisis Storm Cripples Stock Market Rally Resulting Stock Price ChurnInflation Mega-Trend Ebook Direct Download Link (PDF 3.2m/b) Dear Reader The stock market rally on cruise control was hit head on by the Greek Debt Crisis throughout the week. First hit took the Dow down sharply on Tuesday to a low of 10974 which embolden the bears to see a potential meltdown in motion. On Wednesday the stock market bounced higher from the open that continued into Thursday taking the Dow to a high of 11,200 as the debt markets calmed (temporarily). On Friday the Greek debt ebola virus spread to neighbouring European states that were in the receipt of a string of rating downgrades from the culpable corrupt and discredited rating agencies. The dust partially settled by the end of the week in advance of a potential Euro 120 billion bailout, the buffeted stock market rally managed to cling on to its up trend though leaving the trend pattern in a much weakened state. As April turns to May the heat is being ramped up on the sovereign debt crisis as Greek Politicians feed the fires of civil unrest by blaming the financial markets for Greece's problems when in actual fact it is the Greeks who are responsible for living far beyond their means by way of defrauding bond market investors by pumping out phony debt statistics for many years that hid the true cost of their profligate life style which was masked by being in the EURO, for if Greece was not in the Euro then the level of fraud perpetrated upon bond holders would NOT have been able to be masked from the foreign exchange markets. The Greek population in uproar needs to blame the very politicians that in recent weeks have been blaming the bond investors and speculators who have been running for the financial life boats ahead of a Greek debt default. The European Unions solution to the Greek debt crisis is to finance the Greek budget deficit and maturing debt for the next 3 years which gives Greece a breathing space to bring the budget deficit under control by means of deep spending cuts and tax rises. The question is will Greece take this offer and actually implement what needs to be done ? The Bond Investors have been wiped out. Greece has defaulted in all but name, Greek Bonds have crashed by over 60% as bond investors face as much as 70% loss on the value of their holdings. Greek 2 year bonds are yielding 15% against German 2 year notes at just 0.78%. The only question is how much of these losses will be covered by Germany and France as both fear what would happen to their own imbecilic mega banks that hold over a $1 trillion of PIIGS debt. The Greek contagion is spreading, Portugal Spain and Ireland are gearing up to default on their debs to some degree which is resulting in a dash for relative safety, notable US, German and UK Bonds have benefited over the past week. My in depth analysis of near 3 weeks ago (13 Apr 2010 - Britain's Accelerating Trend Towards High Inflation and UK Debt Default Bankruptcy ) concluded : The bottom line is that Britain over the next 4 years is projected to borrow an ADDITIONAL £300 to £350 billion to be added to Britain's £870 billion official debt mountain. However this does not mean that Britain will go bankrupt either imminently or during the next 4 years because the bond markets on balance trust Britain's credit worthiness more than the likes of the PIIGS, which does give the country some breathing space to run higher deficits without Greece and Iceland style panics. But there is a limit, we are NOT the United States that has the benefit of having the worlds reserve currency and never having defaulted on its debts before (Britain has at least twice). This lack of imminent default risk is providing for a boost to Britain's ability to finance its own huge issuance of new debt which is short-term supportive of sterling as Euro bond holders seek a safe haven home in sterling and the dollar, more on the Greek debt crisis in my next article (later today) as the mainstream press and the blogosFear have MISSED a very important and unexpected manifestation of the crisis. Stock Market Quick Analysis The stock market ended the week weak at 11,008, barely clinging on to its uptrend as of February 2010. The SELL trigger is less than 40 points away at 10,970. The trend is choppy and volatile that looks likely to continue. Where analysis and projections are concerned. We are entering the time window for a correction, all of which suggests that the market is converging towards a lower high than that projected in in the 23rd March 2010 analysis (23 Mar 2010 - Stocks Stealth Bull Market Trend Forecast Into May 2010 ) : Dow (DJIA) March to May Stock Market Trend Forecast Conclusion - Therefore my specific conclusion is for a continuation of the uptrend into early to mid May, achieving the 12,000 target during this time period. Conclusion - At present the stock market uptrend remains in tact, time is running out for the rally which implies that it is not going to achieve Dow 12k by mid May. I will seek to update the March in depth analysis in about 10 days time, however a failure of the rally to reach 12k to me implies a WEAKER correction should be forthcoming i.e. the stock market has NOT accrued enough gain for it to induce as large a correction as would have transpired off of a 12k high, which is therefore suggestive of mostly a volatile SIDEWAYS to weak down trend targeting 10,750, but again more on this AFTER the UK General Election on Thursday 6th May. Useless BP Hit by Black Oil Drenched Swan The BP stock price was trundling along nicely, hitting a recent high of £6.53 when it was hit by a black oily swan that looks set to cause an ecological disaster in the U.S. coast of the Gulf of Mexico, plunging the BP share price down to £5.75, which is clearly discounting an hefty multi billion pound clean up and damages bill. Pardon my language but why is BP f-ing useless? It seems like BP has a major crisis in the U.S. nearly every other year! UK General Election Continues to Trend Towards Hung Parliament No one in Britain barely 3 weeks ago could have imagined that Labour would be coming third in the opinion polls, however that is where Gordon Brown has led his party where instead of the party of Government strengthening during an election campaign as is usually the case, Labour has been in meltdown mode to a decidedly third position in the polls, which effectively implies that the results of this election will mean the PERMANENT END of the TWO PARTY SYSTEM in Britain as the Electoral system WILL CHANGE. The Conservatives on an average of 35% are 5% short of achieving an overall majority, and there is little between Labour and Lib Dems who are both basically oscillating around 28%. My election forecast as of June 2009 (02 Jun 2009 - UK General Election Forecast 2010, Seats Per Political Party )is for a small Conservative majority which is against current mainstream view of a hung parliament, which does look increasingly probable. IFS on Government Spending Cuts and Politician's Dishonesty In reality whoever wins outright (if anyone), it is not going to make much difference as the IFS own belated study this week matched my own analysis at the start of the year (03 Jan 2010 - British Politicians Lying to the Electorate, NHS Budget 4% Cut (Minimum) ) that none of the politicians have been truthful on the degree of government spending cuts that will follow the election. The IFS effectively gave a % rating on the level of truthfulness of the parties as follows:

The electorate is sleep walking towards a level of austerity not seen since the 1970's which will likely be accompanied by a great deal of civil unrest. UK Housing Market Forecast Ebook The UK Housing market forecast and ebook is at least 2 months away. I have just not been able to take my attention away from analysis of the general election probabilities and consequences. That coupled with underlying focus on the stock market and economy. Election Protection - Regardless of the base interest rate being artificially kept at 0.5%, market interest rates are rising and will rise much higher following the next election so mortgage holders may be better suited to fix now if they can get a good deal. Your election watching analyst. Comments and Source here : http://www.marketoracle.co.uk/Article19133.html By Nadeem Walayat Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

By: Nicholas C. Arguimbau What Is Going To Happen And Why Weren't We Forewarned? Look at this graph and be afraid. It does not come from Earth First. It does not come from the Sierra Club. It was not drawn by Socialists or Nazis or Osama Bin Laden or anyone from Goldman-Sachs. If you are a Republican Tea-Partier, rest assured it does not come from a progressive Democrat. And vice versa. It was drawn by the United States Department of Energy, and the United States military's Joint Forces Command concurs with the overall picture.

By: John_Mauldin Back and recovering from my Strategic Investment Conference this weekend (where I decided to give myself permission not to write my usual letter, but I promise I will be back at it this next Friday!) I have spent some time pondering what we learned. It was a fabulous conference. Lacy Hunt, Dr. Gary Shilling, David Rosenberg, Niall Ferguson, Paul McCulley, George Friedman, former Fed Senior Economist Jason Cummins (who is now Chief Economist for Brevan Howard, the largest European hedge fund, and who was quite impressive), Jon Sundt of Altegris, and your humble analyst were all in top form. I must admit with a little pride that I think this is the finest speaker lineup for ANY investment conference anywhere. We were given a lot to think about.

By: Anthony_Cherniawski FDIC Friday is open for business. The FDIC Failed Bank List announced seven new bank closures for the week thus far. FDIC Friday lives!

By: Mike_Stathis Overview - Washington, Wall Street and their partners in crime, the media, have continued to spread the myths of an economic recovery since late summer 2009.

By: Hiram Lee A series of recent studies conducted by the Pew Research Center shed new light on the scope of the economic crisis in the US and the level of hostility the majority of the American population holds for the US government.

By: Gary_Dorsch In an eerie sense of déjà vu, German finance minister Wolfgang Schauble pleaded with his country’s citizens on April 20th, to back a joint EU-IMF bail out for Greece worth up to €45-billion, warning that failure to act would risk another global financial meltdown. “We cannot allow the bankruptcy of a Euro member state like Greece to turn into a second Lehman Brothers,” he told Der Spiegel. “Greece’s debts are all in Euros, and it isn’t clear who holds how much of those debts. The consequences of a national bankruptcy would be incalculable. Greece is just as systemically important as a major bank,” Schauble warned.

This is a special Outside the Box. I got this letter from my good friend Greg Weldon last night and got permission to pass it on to you. I think it illustrates the problems that the world is facing from the sovereign debt crisis that is building in Europe.

By: Mike_Shedlock With Thursday's admission that Greece's budget gap is worse than expected, CDS rates on Greek debt rose to new highs, and Greek bond crashed.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.