Gold Will Emerge as the Only Safe Haven

Commodities / Gold and Silver 2010 May 05, 2010 - 09:35 AM GMTBy: Jordan_Roy_Byrne

In the wake of continuing global financial turmoil, we hear quite a bit about “safe havens.” Ask someone today and they’d tell you that the US Treasuries are a safe haven and probably Gold also. On a day-to-day basis, certainly the US Dollar and US Treasuries are safe havens. The financial media loves to point that out while noting big single day losses in Gold. In today’s world, it seems that few people are aware of Gold’s status as a safe haven for 5,000 years or even only for the last ten years.

In the wake of continuing global financial turmoil, we hear quite a bit about “safe havens.” Ask someone today and they’d tell you that the US Treasuries are a safe haven and probably Gold also. On a day-to-day basis, certainly the US Dollar and US Treasuries are safe havens. The financial media loves to point that out while noting big single day losses in Gold. In today’s world, it seems that few people are aware of Gold’s status as a safe haven for 5,000 years or even only for the last ten years.

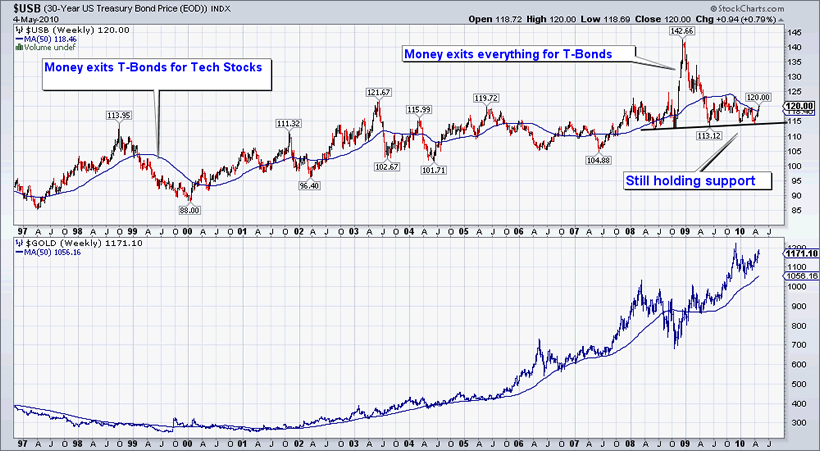

For a few years at a time or longer, precious metals and Treasury Bonds together can act as safe-havens at the same time. According to John Murphy, during the Depression the only two assets to rise were gold stocks and Treasury Bonds. Remember the price of Gold was fixed. Interestingly, we have seen the same correlation since 1999. Both Treasuries and Gold have moved higher. Note that during the last two recessions and bear markets, both Treasuries and Gold were the only assets to rise.

In a deflationary environment, people want their money to be secure and earn a small return if possible. Gold is a viable option as it is real money and government bonds are an option if that government’s finances are secure.

The difference between deflation and severe inflation rests on the market’s faith in the government. If the market has faith in the government and its finances then the market will finance the expansion in government that occurs to counter persistent weakness in the private sector. The domestic savings picture also plays an important role. In the US in the 1930s and Japan in the 1990s, the level of domestic savings was enough so that government expansion could be financed internally. That is why there was no hyperinflation.

Unfortunately, things are much different today in the US, the UK and Japan. These governments will have to monetize deficits in order to prevent interest rates from rising too fast and too aggressively. Given the amount of debt and the interest burden, rising rates would inevitably lead to bankruptcy or default.

US Treasury bonds are still holding up, not due to secure US Government finances but due to the problems in Europe. At present, the same can be said for UK Gilts and Japanese Government Bonds. However, check the charts of these bonds and you will see massive topping formations that have dangerous implications over the next several years.

Numerous baby boomers in the US, Japan and the UK have been fortunate that government bonds have yet to enter a true nasty bear market. While the various bonds haven’t performed as well as Gold, they have proven to be a safe haven. However unlike Gold, government bonds are not a hedge for what is coming. I sincerely hope that baby boomers and others consider a move from bonds and cash into Gold while they still have time.

Moreover, just because one currency is appreciating against another doesn’t render it a store of value or a strong currency. Will a strong US Dollar visa vi the Euro, Yen and Pound lead to stable or lower costs of food, healthcare and education in the US? I don’t think so.

If you’d like professional assistance riding the coming acceleration and eventual mania in the Gold and Silver market, then visit our website and consider a free 14-day trial to our premium newsletter.

Good luck ahead!

Jordan Roy-Byrne, CMT

http://www.trendsman.com

http://www.thedailygold.com

trendsmanresearch@gmail.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.