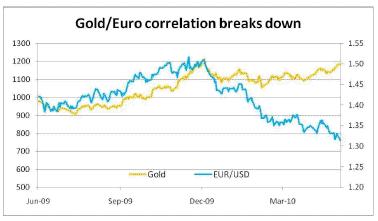

Gold Euro Correlation Breaks Down

Commodities / Gold and Silver 2010 May 05, 2010 - 01:30 AM GMTBy: Bob_Kirtley

Today we saw the broader markets take a battering with the European Stock Exchanges taking hits and the DOW dropping 225 points, silver lost $0.94 and gold prices were down $10.00 having flirted with $1190/oz earlier in the session.

Today we saw the broader markets take a battering with the European Stock Exchanges taking hits and the DOW dropping 225 points, silver lost $0.94 and gold prices were down $10.00 having flirted with $1190/oz earlier in the session.

As we checked out the various news agencies we found that the BBC World Service, Business bulletin used the phrase ‘blood bath’ in summing up the days activities, a tad strong for them.

The reasons for today's demise would appear to involve some of the following:

Australia intends to introduce a new tax on the mining industry, ouch! The oil spillage in the Gulf of Mexico and the ramifications emanating from this disaster, the Greek Debt crises which appears to be escalating as other countries are drawn into this mess.

This is a short excerpt from the Bullion Weekly:

We noted last week that, while activation of the €45-billion EU/IMF loan package to Greece may offer some temporary respite, the threat of default and further downgrades remained and would continue to undermine eurozone confidence. Indeed, the scale of the issues facing Greece increased over the week after IMF managing director Dominique Strauss-Kahn told German and ECB officials that the beleaguered country would need as much as €120 billion over the next three years, forcing another round of emergency meetings over the weekend at which EU and IMF officials agreed a new €110-billion rescue deal.

The chart above is also courtesy of the Bullion Weekly and depicts the divergence of the Euro and gold prices.

In fact, the only beneficiary today was the US Dollar which rose to 83.299 as investors look for a safe haven to weather this storm.

The Sydney Morning Herald had this to say on the proposed new taxes:

The Henry tax review has recommended scrapping the state-based royalty taxes applying to mining projects and replacing them with a uniform national resource rent tax set to raise billions more.

The tax, most likely to be set at 40 per cent, would be modelled on the existing petroleum resource rent tax levied on petroleum products including crude oil and natural gas mined in Commonwealth waters other than the North-West Shelf and the jointly developed area between Australia and East Timor.

Treasury calculations suggest that if the PRRT formula had been applied to resources such as iron ore and coal and to companies including BHP Billiton and Woodside Petroleum over the past three years it would have raised an extra $14 billion.

RTT News noted BHP Billiton’s disappointment as follows:

Australian mining giant BHP Billiton Ltd. (BHP: News ,BHP.AX: News , BBL, BLT.L) said Sunday that it is disappointed with the Australian Government’s proposal to impose new resource rent tax from July 1, 2012, which will make investments in Australia much less attractive. The proposal to impose 40% resources super profits tax would reportedly see a 19% cut in profits.

No doubt about it we have entered a period of volatility with turbulence in just about every market sector. However, we remain firm believers that both silver and gold and their associated stocks offer a sound basis for financial survival going forward. Australia’s mining industry has been dented but not destroyed, however the new tax proposals remind us of the possibility of political intervention, which can happen in any country in the world. The volatility aspect aspect will throw up opportunities for trading options in this sector for those who are on their toes.

Have a good one.

Over on our sister site, silver-prices.net we have been rather fortunate to close both the $15.00 and the $16.00 options trade on Silver Wheaton Corporation, with both returning a little over 100% profit.

Our premium options trading service, SK Options Trading, has closed the last 7 trades, with an average gain of 51.17% in an average of 37 days per trade, why not drop by and take a peak.

For those interested in getting a bit more bang for your buck and adding a touch more excitement to your portfolio, then check out our Options Trading Service please click here.

Got a comment then please add it to this article, all opinions are welcome and appreciated.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.