America At The Crossroads And The War On Gold

Politics / US Politics May 04, 2010 - 05:30 AM GMTBy: Darryl_R_Schoon

Every so often a philosophical dilemma becomes real. So it is today. For two thousand years, the message of Christ Jesus influenced and informed the West, if not in deed, then in word. Today, that is no longer so. Today, godless capitalism is threatening to supplant the two millennia reign of Christ’s message of brotherly love—if not in word, then, certainly, in deed.

Every so often a philosophical dilemma becomes real. So it is today. For two thousand years, the message of Christ Jesus influenced and informed the West, if not in deed, then in word. Today, that is no longer so. Today, godless capitalism is threatening to supplant the two millennia reign of Christ’s message of brotherly love—if not in word, then, certainly, in deed.

In times of great change, art reflects social and philosophical undercurrents. The movie, Avatar, is an example of this phenomenon as was the movie, Wall Street, in 1987. Gordon Gekko, Oliver Stone’s protagonist in Wall Street probably didn’t read much; but, if he did, a book such as A Utopia of Greed: Ayn Rand's Moral Defense of Capitalism could have been on his reading list.

One of Gordon Gekko’s more memorable lines is Greed, for want of a better word, is good. Greed is good is also one of Ayn Rand’s fundamental beliefs; and, if Karl Marx is the father of godless communism, Ayn Rand, America’s premier doyenne of selfishness, is the patron saint of its antagonist, godless capitalism.

Alisa Rosenbaum was born in Russia in 1905 where she would later change her name to Ayn Rand. In her youth, she would become an atheist, a belief she would hold for the rest of her life. No other self-proclaimed atheist would achieve such a large following—except perhaps Karl Marx; additionally, no other writer would be as responsible for giving philosophical cover to the selfishness and greed that would later characterize American-style “laissez-faire” capitalism.

Ayn Rand saw selfishness and greed as virtues; and, to their later disgrace, so, too, did many others.

Ba’al: the Golden Calf of Capitalism Grows Up

When Ayn Rand died in 1982, a six foot floral wreath in the shape of a US dollar was laid by her casket; a symbol that was to be ironically appropriate as Ayn Rand’s death would precede the demise of the US dollar by only a few short decades.

Nothing exemplified the effect that Ayn Rand’s philosophy would have on America as much as the movie, Wall Street. Released in 1987, it reflected the values that would be responsible for America’s moral decline over the next 30 years. This 45 second clip from Wall Street is chillingly revelatory:

http://www.youtube.com/watch?v=7upG01-XWbY

In September 2010, Oliver Stone’s sequel to Wall Street, Money Never Sleeps, is scheduled for release with an older but still unrepentant Gordon Gekko. After the 1980s, greed did not go away in America—it flourished.

AYN RAND, GOLDMAN SACHS & GOD

Nowhere was Ayn Rand’s influence felt more than on Wall Street. The selfishness and greed that Ayn Rand exalted found a natural home among Wall Street banks, especially Goldman Sachs where Senior Partner Gus Levy succinctly summed up Goldman’s strategy as long term greed. It was a mission statement Ayn Rand could be proud of.

It is incorrect, however, to attribute Wall Street’s greed solely to Ayn Rand. Greed and selfishness existed long before she posited the two vices as virtues, just as free markets existed long before capitalism was illegitimately birthed in a manger of paper money at the Bank of England in 1694.

Ayn Rand’s writings are nonetheless responsible for giving greed and selfishness the sheen of respectability they previously lacked, especially among the bespoke jackals that serve our currencies back to us in the form of loans.

In defense of today’s bankers, Goldman Sachs CEO Lloyd Blankfein recently stated, We are doing God’s work; and, so, they are, if capitalism’s culling of the trusting, vulnerable and less fortunate is included in Blankfein’s novel definition of God’s calling.

[I] managed to sell a few [worthless] abacus bonds to widows and orphans that I ran into at the airport.. not feeling too guilty about this, the real purpose of my job is to make capital markets more efficient. email, 6/13/2007, Fabrice Tourre, vice-president Goldman Sachs

If it is God for whom Blankfein toils—at enormous compensation, i.e. $68 million in 2007—it is not the God of the New Testament where Christ Jesus admonishes us to be our brother’s keeper. It is the Hindu God, Shiva, the destroyer and transformer for whom Blankfein puts in overtime; and in that capacity he has done yeoman’s work for which he is to be congratulated.

Goldman Sachs, more than any other bank, under Blankfein’s leadership has played a central role in destroying capitalism, i.e. economies based on bankers’ debt-based capital, a parasitoidal system bankers designed to indebt productivity and commerce for profit until society collapses.

PAPER MONEY – GOLD = PAPER

SHIVA’S DANCE OF CAPITAL DESTRUCTION

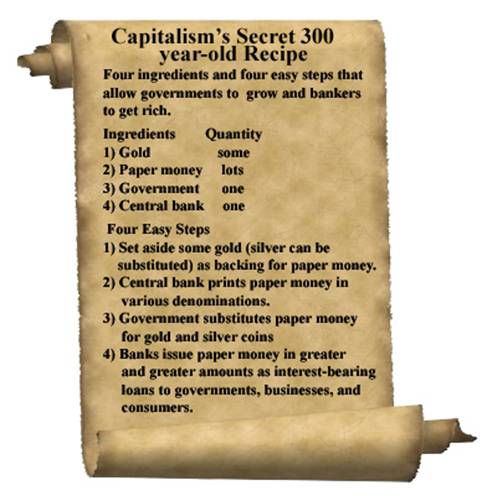

While Lloyd Blankfein’s contribution to capitalism’s demise should not be minimized, capitalism’s current problems actually began in 1971 when gold, one of the four essential ingredients in the bankers’ brew of debt-based money, was eliminated from the classic formula that had served bankers and governments so well for so long.

Capitalism’s recipe insures government’s infinite growth as government access to central bank credit is unlimited and bankers will profit from loaning paper money into perpetuity.

When gold was removed from paper money in 1971, this simple yet powerful recipe for capitalism’s success was fundamentally altered and so, too, would be capitalism. It would only be a matter of time until capitalism sans gold would falter.

Lloyd Blankfein, Robert Rubin, Lawrence Summers and Alan Greenspan et. al., individually and collectively, would only hasten the process. Lord Shiva’s dance of capital destruction was already underway; because without gold, the illusion of paper money as money is only an illusion. Without gold, paper currencies are only coupons with expiration dates written in invisible ink

To call capitalism a monetary system is a misnomer. It’s a financial shakedown, a scheme whereby bankers profit by inserting debt into every aspect of human activity. Eventually, everyone becomes indebted beyond their capacity to repay and the system collapses.

The bankers’ indebting of others eventually will end in their own demise, with governments, businesses, and consumers drowning in debt and banks insolvent. Capitalism is an economic parasitoid, a parasitic system where parasite and host both expire.

A parasitoid is an organism that spends a significant portion of its life history attached to or within a single host organism, which it ultimately kills (and often consumes) in the process. Thus they are similar to typical parasites except in the certain fate of the host.

http://en.wikipedia.org/wiki/Parasitoid

As with all life-forms, parasitoids will do everything to insure their survival while blind to the fact it is their actions that will destroy them. Until its self-inflicted end, capitalism will struggle to survive and expand—and a part of that struggle is the bankers’ war on gold.

THE WAR ON GOLD

The IMF.. explicitly states in its Articles of Agreement that member countries are prohibited from tying their currencies to gold.

Gold Wars, Ferdinand Lips, The Foundation for the Advancement of Monetary Education, New York

In 2001, Ferdinand Lips published Gold Wars, his book that describes the bankers’ ongoing war on gold. That Lips, a Swiss banker, would write such a book is to our benefit as the Swiss have a unique, historical, and deep respect for the monetary metal.

Curiously, Lips had earlier been an agent for the infamous Rothschild banking family. In 1968 he was co-founder and Managing Director of Rothschild Bank AG Zurich. As such, Lips had an insight into the world of gold that few had and some believe it would later cost him his life.

One story in Gold Wars is of particular interest as it involves John Exter, the extraordinary central banker (formerly vice-president in charge of international banking and gold and silver operations at the New York Federal Reserve), and Paul Volker, later Fed chairman and erroneously believed by many to be a hero.

Exter’s story shows Volker in entirely different light, not as a hero but as the one responsible for the removal of gold from the monetary system. Volker, according to Exter, played a central role in the decision to do so.

In Gold Wars (pp.76-77) John Exter tells Ferdinand Lips how the decision to demonetize gold was made: On August 10, 1971, a group of bankers, economists and monetary experts held an informal meeting..to discuss the monetary crisis. Around 3 o’clock in the afternoon, a big car rolled up with Paul Volker in it. He was then Under-secretary of the Treasury for Monetary Affairs.

We discussed various possible solutions. As you would expect, I was for tight money – raising interest rates – but that was overwhelmingly rejected…As for raising the gold price, as I suggested, Volker said it made sense, but he didn’t think he could get it through Congress.

At one point, Volker turned to me and asked what I would do. I told him that since he wouldn’t raise interest rates and wouldn’t raise the price of gold, he only had one option..he’d have to close the Gold Window…Five days later Nixon closed the Gold Window.

The final link between the dollar and gold was broken. The dollar became nothing more than a fiat currency and the Fed [and especially the banks] were then free to continue monetary expansion at will. The result..was a massive explosion of debt

Paul Volker, then, is the one who eliminated gold from capitalism’s 300 year-old recipe for power and wealth. Karl Marx was right when he predicted that capitalism would destroy itself. We just didn’t know it would be Paul Volker who would pull the plug.

THE SLEDGEHAMMER THAT BROKE THE CAMEL’S BACK

The explosion of debt allowed by Volker’s removal of gold in 1971 has now reached extraordinary levels. In 1971, US debt was $436 billion. Today, US government obligations exceed one hundred trillion dollars. Tethering the dollar to gold was the one constraint on US spending. Volker eliminated that constraint thus enabling the US to indebt itself ad infinitum—and it did.

Debt, the inevitable effluvia of credit, is Shiva’s final shiv in capitalism’s back. But it is not the indebtedness of those the bankers indebted that are now causing capitalism’s final paroxysms. It’s the debts of the banker’s themselves.

When US banking and financial interests repealed the Glass-Steagall Act, it reopened the doors to another depression, doors that had been sealed since the 1930s. Prior to its repeal in 1999, Congressman John Dingall (D-Mich) whose father helped write Glass-Steagall in 1933 warned:

What we are creating now is a group of institutions which are too big to fail... Taxpayers are going to be called upon to cure the failures we are creating tonight, and it is going to cost a lot of money, and it is coming.

Congressman Dingall’s warnings were ignored by both republicans and democrats. The republican-sponsored bill to repeal Glass-Steagall was passed overwhelmingly in the House by both parties (362-57) and in the Senate (90-8) effectively enslaving America’s future generations, gratis of a $300 million lobbying effort by banks and insurance companies.

The beauty of paper money is that it buys real power

Once again, both republicans and democrats sold out the nation’s future and allowed banks to bet the savings of America, this time with obscene leverage of 40:1 and more. Not surprisingly when the banks bet the house and lost, the house collapsed.

Politicians can’t be bought. They can only be leased.

When bankers couldn’t cover their losses, governments came to their rescue and indemnified them with taxpayer money. But the trillions of dollars spent to rescue banks and restart capitalism’s broken engine is not being levied on the banks. It’s being levied on those who saved them. The current upsurge in sovereign debt is the cost of the bankers’ crisis subsumed into national ledgers.

Recently, President Barack Obama went to Wall Street to ask for help in reforming the financial system. Asking Wall Street’s help with financial reform is akin to Neville Chamberlain asking Hitler to assist in redrawing Europe’s borders. The current effort is designed not to fix the system, but to continue it.

Avarice is never appeased. Greed is never satisfied and the fires that Ayn Rand inflamed will not subside until the house that fanned them and gave them shelter burns to the ground. The bankers have come too far to go back. There is only the road ahead—and it’s a cliff.

SHIVA’S COMING MAKEOVER

I end my articles with the words: buy gold, buy silver, have faith. Of the three, I believe faith to be the most important, the most valuable and the least understood. A strong and unwavering belief in an intellectual construct is not faith, though many believe it to be.

Faith is a knowing that we are one with our Source, despite all appearances to the contrary. Finding faith in a tautological matrix that creates its own reflection is not easy. Faith exists despite the world of appearances; despite maya; despite—and not because of—human ignorance.

In March 2007, I delivered my paper predicting a severe economic collapse to Marshall Thurber’s Positive Deviant Network (the PDN) and the reaction was disbelief and anger except for the very few already invested in gold.

In 2008, one year later, after $6 trillion of worth had been stripped from global markets, the Positive Deviant Network was more predisposed to hear what I had to say. That February, I gave a talk to the PDN on what I believed to be the real reasons for the crisis. My talk, America at the Crossroads, can now be viewed on YouTube in four parts: http://www.youtube.com/watch?v=4xjKnATlxMY.

At its birth, America embodied the highest hopes of mankind but is now a tragic caricature of those great ideals. As it enters the 21st century, America finds itself bankrupt morally as well as financially. Its ideals stood the test of time but America did not.

Two hundred years ago, Thomas Jefferson warned America about the dangers of private bankers and standing, i.e. permanent, armies. Fifty years ago, President Eisenhower warned America about the dangers posed by the emerging military-industrial complex; and ten years ago, Congressman Dingall warned America about the danger of repealing Glass-Steagall.

America was warned and America didn’t listen. Now, the price must be paid. Shiva’s dance of destruction and transformation is underway. The destruction comes first, the transformation comes next—but only if America first changes its ways.

It's coming to America first,

the cradle of the best and of the worst.

It's here they got the range

and the machinery for change

and it's here they got the spiritual thirst.

It's here the family's broken

and it's here the lonely say

that the heart has got to open

in a fundamental way

Democracy is coming... to the USA

Leonard Cohen, 1984

Leonard Cohen’s simply-stated truth—that the heart has got to open in a fundamental way—is the crucial prerequisite for America’s transformation. During America’s drive for self-aggrandizement, world dominion, corporate profits and billion-dollar bonuses, America lost its way—and lost touch with its heart in the process.

America is at a crossroads. It has already chosen. It’d best do so again.

What’s the difference between a pendulum and a wrecking ball?

Sometimes nothing

Buy gold, buy silver, have faith.

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.