Crude Oil Outlook: This Indicator Says Buy Now

Commodities / Crude Oil Apr 30, 2010 - 10:10 AM GMTBy: Q1_Publishing

Is oil’s run over? Is $85 too far, too fast for oil prices? Is too late to buy?

Is oil’s run over? Is $85 too far, too fast for oil prices? Is too late to buy?

Investors are faced with a lot of touch questions about oil now. However, one little-known indicator is flashing “buy.” And the last time two times it did that oil prices more than doubled each time. Here’s the set-up.

Oil traders are getting excited again. Oil prices have rebounded to above $85 a barrel – pennies away from their 18-month high. Wholesale gasoline prices did hit a new 18-month high. And all seems well in the oil sector.

The big driver of demand is naturally China. The country has invested heavily in its own domestic oil production, but it hasn’t been enough. China’s General Administration of Customs reported its oil production rose 6.9% in March. Meanwhile, to meet surging demand, the country’s oil imports climbed 29%.

The oil boom has been reborn. Many investors, however, are still waiting on the sidelines with oil prices setting fresh highs, stockpiles building in the United States, and the global economic recovery still limping along.

But if this indicator is right again, which it was in early 2009 when we looked at how politicians were going to push oil prices to $300 per barrel, it’s going to be a long and profitable road for investors looking into oil stocks. So today we’ll look into whether an oil price correction is near and where to find the safest and biggest gains in the oil sector.

Mr. Market Signals Full Speed Ahead for Oil Prices

The oil market is one of the most closely watched sectors in the world. Every bit of supply and demand data is scrutinized. The weekly oil supply report from the Energy Information can send oil prices climbing or falling seconds after it’s released. Every major new discovery or event that reduces production becomes global financial new noise.

There are very few surprises when it comes to oil. As a result, the market has a proven track record of forecasting short-term and long-term oil moves.

That’s why we watch the relative value of oil prices to oil service stocks closely to see how “sustainable” any rise in oil prices really is. They show us directly how much Mr. Market believes in any oil rally or correction.

The chart below, which shows the relative changes in Oil Prices and Oil Service Stocks (as tracked by the Oil Service HOLDRs ETF – NYSE:OIH) over the last three and a half years, shows how it works:

As you can see, oil service stocks have been a good indicator of where oil prices are headed. Every time oil service stocks crossed over oil prices, a big move in oil prices wasn't far behind.

For example, oil service stocks forecast the run-up in oil prices in late 2006. Oil ran from just over $50 per barrel to more than $100 over that time.

Then when oil surged past $100 per barrel, oil service stocks did not go along for the ride. Oil service stocks lagged well behind oil prices when oil spiked to nearly $150 per barrel in the summer of 2008. They were signaling “oil’s too high.” Shortly after that the credit crunch hit and oil prices collapsed.

But it wasn’t long until this indicator flashed “buy” again. There was a significant turning point at the start of 2009 when oil service stocks forecast a new uptrend in oil was about to begin. At that time oil was below $40 per barrel. Oil prices have more than doubled since.

Oil service stocks are 3-for-3 when it came to the big moves in oil prices over the last couple of years.

That’s why when oil service stocks are leading oil prices; we know it’s time to buy oil stocks.

Oil Stocks: Not All Created Equally

We know after riding the last oil wave for quite a few years that all oil stocks are not created equally. And there are good times and bad times to own different types of oil stocks.

There are four main sectors of oil stocks: upstream, downstream, fully-integrated, and service. They all have significantly different businesses and investment attributes. And there are good times and bad times to own them all. Here’s a quick breakdown:

Upstream: This is where you’ll find oil producers. Upstream oil stocks are the most highly leveraged to oil prices. If you want big gains and to place a big bet on rising oil prices, this is where you’ll do it.

Downstream: This is the oil refiners and gas stations. They have good times and bad times, but never seem to be doing great. During the good times their costs always seem to rise right along with the prices of their products so their margins are always squeezed. During tough times when oil prices are down, they’re products aren’t in high demand and their margins get squeezed again. These are tough, low-margin, competitive businesses. That’s never a good combination for a great investment.

Fully-integrated: This is where you’ll find the major oil producers like ExxonMobil (NYSE:XOM) and BP (NYSE:BP). If you’re looking for safety, consistency, and not much performance, fully-integrated oil companies may be for you.

Your editor learned this lesson the hard way. I first bought Exxon when oil was $10 a barrel. Great idea, right? Wrong. I sold it when oil was above $100 per barrel for a total return of about 200% (including dividends reinvested). A total return of 200% just isn’t good enough when oil prices go up 900%.

Services: This sector includes drilling companies, rig operators, seismic data gathering companies, pipeline builders, and any company that helps oil companies get out of the ground. Demand for oil service companies’ services will remain very strong as long oil is above $40 per barrel. Oil services offer the right mix of safety and upside when oil prices are high and can absorb sharp corrections in energy price because their businesses are long-term focused.

Clearly, there’s a lot more to oil investing than just buying oil stocks or an ETF which cover the entire sector (besides, most oil ETF’s are dominated by low-performing fully-integrated oil companies). To determine the best oil sub-sector to buy now though, we have to look at the long-run outlook for oil prices.

Top Oil Stocks to Own Now

Right now, there’s no telling where oil prices are headed over the long run. There are too many wild cards like Iran and the Middle East, economic growth, technological innovations in alternatives, and production-halting regulation…just to name a few.

There’s no way to know for sure, but it’s a pretty safe bet that oil prices are going to stay much higher than the old “norm” of $30 per barrel.

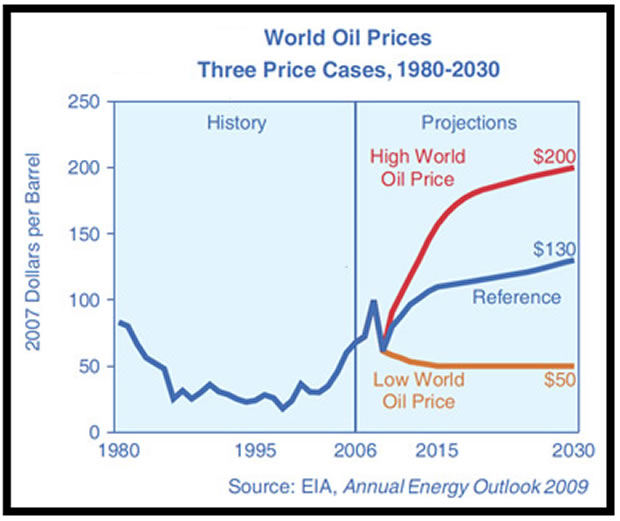

The U.S. Energy Information Administration (EIA) sees a wide variety of possibilities for oil prices:

The interesting thing is the new “worst-case” scenario for oil prices is $50 per barrel. That’s in 2007 constant dollars too. So inflation will put prices even higher in prices paid.

Putting it all together, we’ve got a situation where oil prices are going to stay high for decades, there may be a correction coming soon but it’s not likely, and the probability is high oil prices will stay in a range of $60 to $100 per barrel for the foreseeable future and the sky is the limit over the long run.

That means oil service stocks are great place to be now and in the future. Their services are going to be in high demand for the next few years with oil prices well above $40 per barrel. In fact, some of the highest quality oil service stocks are already booked up for years into the future.

Right now everything is in place for continued gains in oil. The oil vs. oil service stocks indicator is flashing a “buy” signal. And even the “worst-case” scenario has oil prices falling to a price that was almost unconscionable just a few years ago.

Buy oil now. Buy oil in the future. But make sure you stick to the right companies that will do the best as this bull market plays out. Because investing in oil and energy is just like any other sector – it all comes down to risk and reward.

In the next Prosperity Dispatch (sign-up here, it’s 100% free), we’ll be looking at one sub-sector of oil service stocks that’s essential to tapping into the largest oil discoveries of the past decade, which every company in the sector is facing backlogs of a year or more, and still offers plenty of upside potential left.

Good investing,

Andrew Mickey

Chief Investment Strategist, Q1 Publishing

Disclosure: Author currently holds a long position in Silvercorp Metals (SVM), physical silver, and no position in any of the other companies mentioned.

Q1 Publishing is committed to providing investors with well-researched, level-headed, no-nonsense, analysis and investment advice that will allow you to secure enduring wealth and independence.

© 2010 Copyright Q1 Publishing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.