World Gold Council Q1 2010: Record Investment Demand for Gold

Commodities / Gold and Silver 2010 Apr 30, 2010 - 04:44 AM GMTBy: Fresbee

World Gold Council released their Q1 2010 report analyzing demand trends for gold in the first quarter of 2010.

World Gold Council released their Q1 2010 report analyzing demand trends for gold in the first quarter of 2010.

Noted below is an excerpt of the report. Happy Reading!

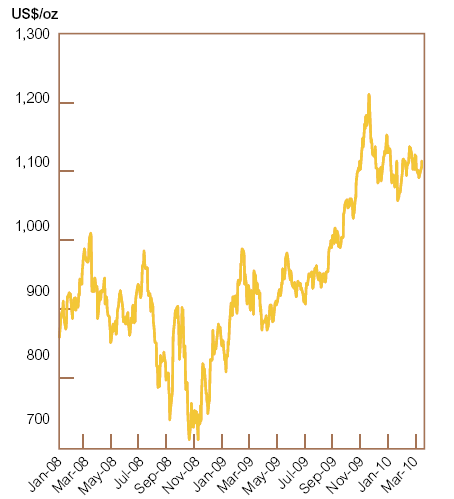

Gold Prices remained below their all time highs of $1225 / ounce but what was notable was that Gold struck all time highs in all other currencies including EURO,YEN,Pound. It is slowly moving into its ancestral role of being a currency of trade.

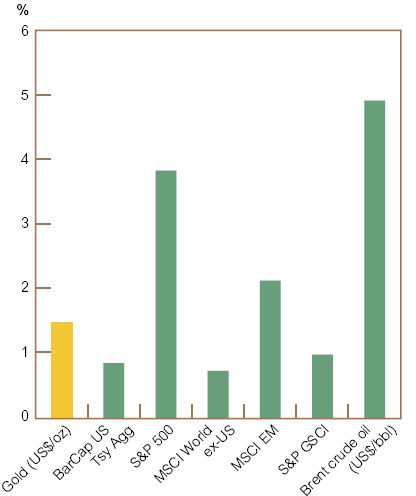

Relative Performance of Gold to Other Assets

On a risk-adjusted basis, the yellow metal outperformed compared with the broader commodity complex and

international equities, but underperformed against US and emerging market equities, as well as US Treasuries in the fi rst quarter of 2010. In particular, emerging markets benefi ted from economic growth and some currency appreciation. Whilst oil tends to be considerably more volatile than gold (almost twice as high on average), crude oil returns per unit of risk this quarter were better than that of the yellow metal.

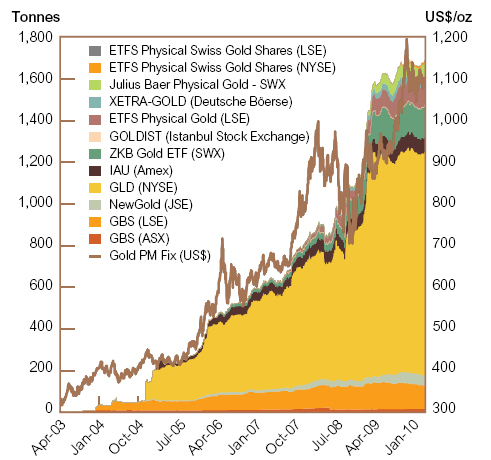

Investment Trends: Record holding

Investors bought 5.6 net tonnes of gold via exchange traded funds (ETFs) in Q1 2010, bringing the total amount of gold in the ETFs that we monitor to a new record of 1,768 tonnes, worth US$63.4 billion at the quarter-end gold price. ZKB Gold ETF and Julius Baer Physical Gold ETF, both listed on the Swiss Exchange (SWX), recorded the strongest infl ows during the fi rst quarter, adding 10.2 and 8.1 tonnes respectively, as interest in the Swissbased securities continued.

Futures

COMEX total non-commercial and non-reportable net long positions, a proxy for the more speculative end

of investment demand, gradually fell over the quarter. The net long ultimately shed 7.1 million ounces to 20.8

million ounces by the end of Q1 2010, compared to the end of Q4 2009. On average, net long positions in

the fi rst quarter of 2010 decreased by 13.8% from 29.2 million ounces in Q4 2009. The net long fell for most of January and February, to later spike up back to 25.2 million ounces in March, as the trade-weighted dollar lost some ground from its peak in late February.

Gold Physical Investments: Bars, Coins

The latest available data on coin and bar sales corresponds to Q4 2009 (comprehensive Q1 2010 data will be released in mid-May). Net retail demand for gold, which includes demand for coins, small bars, medals and imitation coins and other retail investment, remained strong during the fourth quarter. It rose by 14.0 tonnes to 187.9 tonnes in Q4 2009, an increase of 8.0% on the previous quarter. This largely reflected a recovery in investment demand primarily in the US— which experienced the single biggest infl ow during the quarter from 19.0 tonnes in Q3 to 37.3 tonnes in Q4 2009—followed closely by India, which increased by 15.6

tonnes. Overall, European investment fl ows also enjoyed solid gains during Q4 2009 adding 7.2 tonnes

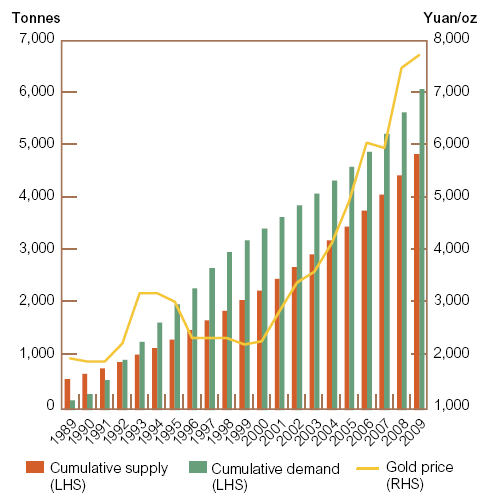

The Chinese and Golden Love

total gold investment demand in China has grown in line with the country’s GDP and population since the establishment of the Shanghai Gold Exchange in 2002 and, more importantly, WGC expects this trend to continue going forward. In 2009, for

example, China’s net retail investment in gold reached 80.5 tonnes, up 22% on 2008. It also notes that Chinese consumers are high savers and gold investment amongst private individuals in China is developing rapidly. Gold’s role as a monetary asset, a global currency and an insurance policy providing protection against the unknown, certainly seem to be working in its favour. Chinese gold mining producers have stepped up gold production by 84%, but its known reserves account for just 4% of total known global gold reserves.

Jewelery Demand

Global jewellery demand picked up in the fourth quarter of 2009 relative to the previous quarter, despite the international gold price hitting record levels during the period. In fact, jewellery demand enjoyed three consecutive quarter-onquarter gains on the back of a rebound in the Indian market. Fourth quarter demand of 500.4 tonnes in 2009 was 8% below year-earlier levels, the smallest decline since Q4 2008.

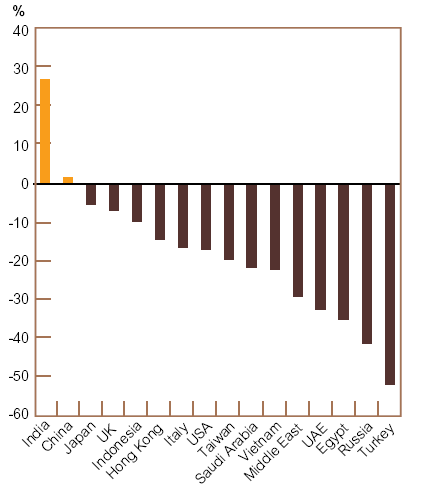

By Country, only India seems to be only country which is leading the jewelery demand.

Industrial Applications

Gold demand for industrial and dental applications recorded its third consecutive quarter-on-quarter improvement during Q4 2009 and its fi rst year-over-year gain in more than two years. Demand totalled 99.7 tonnes, 11% higher than Q4 2008. Demand in 2009, however, was down 16% on 2008 levels. Electronics demand (usually 70% of total industrial off-take) rebounded strongly in Q4 2009 jumping 25% relative to year-earlier levels. Elsewhere, the other industrial and decorative sector fell by 13%, as well as gold used in dental applications which fell by 5% relative to Q4 2008. With the outlook for the global economy improving, industrial demand is expected to recover further in 2010.

Official Sales

European net central bank sales ground to a complete halt in the fi rst quarter of this year. Between September 2009, when the third Central Bank Gold Agreement (CBGA3) began and the end of Q1 2010, signatories sold a cumulative 1.6 tonnes of gold, unchanged from the level at the end of last year.

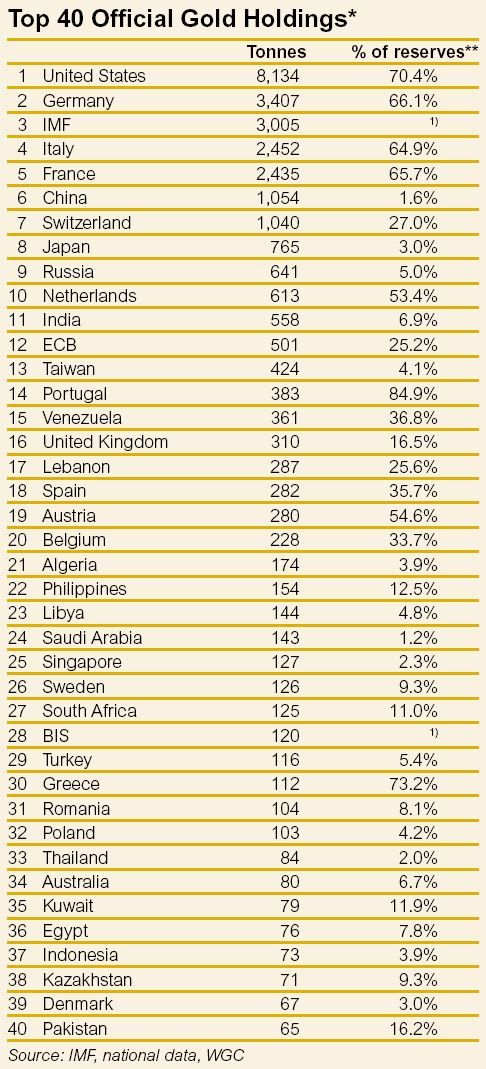

Official Holding

The IMF’s Executive Board announced in September 2009 that it intended to sell 403 tonnes of gold, the proceeds of which would be used to set up an endowment fund. The IMF indicated its preference would be for a series of off-market deals, failing which it would conduct phased on-market sales via CBGA3 so as not to disrupt the market. The Fund initially reached three off-market deals: 200 tonnes of gold was sold to the Reserve Bank of India, 10 tonnes to the Central Bank of Sri Lanka and 2 tonnes to the Central Bank of Mauritius. It has now commenced phased on-market sales, selling 5.6 tonnes of gold during February 2010. It should be noted that the fact that the IMF has started on-market sales does not preclude further off-market deals being reached at a later date.

Russia bought a total of 8.3 tonnes of gold in January and February 2010, continuing its now wellestablished gold purchasing programme, and bringing its total gold holdings to 645.5 tonnes or 5.1% of total reserves. Separately, Jose Khan, a director of the Central Bank of Venezuela, was quoted by Bloomberg saying that the bank would buy more than half the country’s estimated 20 tonnes of domestic production this year.

Source :http://www.investingcontrarian.com/global/..

Fresbee

http://investingcontrarian.com/

Fresbee is Editor at Investing Contrarian. He has over 5 year experience working with a leading Hedge fund and Private Equity fund based out of Zurich. He now writes for Investing Contrarian analyzing the emerging new world order.

© 2010 Copyright Fresbee - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.