Unemployment, Who Would Want to Inherit This?

Politics / US Politics Apr 29, 2010 - 09:56 AM GMTBy: Graham_Summers

They were wearing all black.

They were wearing all black.

She had a ring in her lip. His earrings were glints of metal amongst his oily and badly dyed hair. They couldn’t have been older than 18 and looked like they’d fit in outside a Hot Topic at the mall.

Instead they were standing on a corner outside of Wal-Mart holding a ragged piece of cardboard that read Homeless, need food, please help.

Over the last decade, Charlottesville has won countless awards for quality of life.

Kiplinger’s Magazine ranks Charlottesville as the fourth best place to live in the US. Forbes claims it’s the 11th best place to look for a job. Both of those rankings are from 2009.

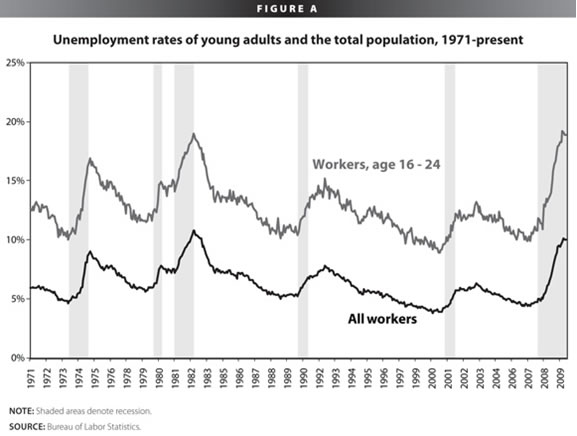

I doubt the lonesome pair by the road would buy into those stats. But then again, it sucks in general to be young right now. Nationwide the official unemployment numbers are holding strong at 9.7% (I’ve commented before that this is greatly downplaying the reality). However, even the official stats indicate that the “next” generation that has been the worst hit.

Unemployment for those between ages 16 and 24 peaked at 19% in September 2007 and currently hangs around 18% today. The Economic Policy Institute points out that typically unemployment is highest for this demographic even during times of economic expansion. However, these current levels are the highest since 1982:

You have to wonder what these kids are thinking. They’re screwed and they’ve barely even entered the job force. Thanks to previous generations they’ve got to foot the bill for tens of trillions in debt ($77 including social security and Medicare). Many of them will have debts of their own from school. And they’re entering a job force that is firmly contracting (unless they land a job in the public sector)

Then of course there is their frustration with the political system. According to US News, up to 54.5 percent of Americans ages 18 to 29 voted in the last election. Not only is that only one percentage point below this group’s all time high participation (in 1972), but young voters actually accounted for a higher proportion of total votes that those in the 65-and-older age category.

Having voted in a big way for the first time in years, the young were rewarded with a President who immediately surrounded himself with the same crackpot financial types as his predecessor. He reappoints Bernanke, the goof who failed to see this whole thing coming and who oversaw a massive transfer of the public’s wealth to Wall Street. The list goes on.

The market has many issues, but the next generation’s role in them is being overlooked. I’ve detailed age demographics and the impact they will have in the markets before. You can read my thoughts here.

Whatever the impact on the markets, this next generation is inheriting a mess of a financial system/ economy. The private sector hasn’t seen job growth in ten years. The country is more debt ridden than at any other point in its history. “Change” is looking a whole lot like what’s come before. And unemployment for their age demographic is at a multi-decade high.

This next election, if the young vote, is going to be “interesting.”

Good Investing!

Graham Summers

PS. I’ve put together a FREE Special Report detailing THREE investments that will explode when stocks start to collapse again. I call it Financial Crisis “Round Two” Survival Kit. These investments will not only help to protect your portfolio from the coming carnage, they’ll can also show you enormous profits.

Swing by www.gainspainscapital.com/roundtwo.html to pick up a FREE copy today!

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2010 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.