Greece's Bill Is Now Due - And Others Will Be Next, Debt Denial and the Five Stages of Greece

Economics / Global Debt Crisis Apr 28, 2010 - 03:39 PM GMTBy: Justice_Litle

The phenomenon of "debt denial" has gripped not only Greece and the eurozone, but the entire roster of rich Western nations. When the smoke finally clears, you'll want to own gold coins...

The phenomenon of "debt denial" has gripped not only Greece and the eurozone, but the entire roster of rich Western nations. When the smoke finally clears, you'll want to own gold coins...

The eurozone is slowly but surely imploding under an unsustainable debt load. Greece is still center stage, but the woes will soon spread. Ultimately, Greece is the first domino in a long chain of looming debt defaults... and at the end of that chain lies the United States.

You'll want to be paid up on "printing press insurance" before the final domino falls - and gold coins might fit the bill nicely in that regard. More on that at the end of today's piece...

Q: What's the difference between Greece and the rest of the OECD countries? A: Greece is small enough to be bailed out.

Ha ha. Funny stuff, right? Or maybe not. That sobering riddle is posed by Dylan Grice of Societe Generale. (OECD, which stands for "Organization for Economic Cooperation and Development," is simply shorthand for rich Western nations with democratic governments.)

As Grice writes to his SocGen clients (emphasis mine), "Back in January, when Greece's debt problems first surfaced, I thought it would be the first in a series of fiscally driven market seizures... I still think Greece is the beginning of a wave of government funding crises, not the end."

Your humble editor agrees. What's happening in Greece is a prelude to far larger troubles.

For months now, the Greek soap opera has played itself out on the world stage. During all this, the euro has lurched up and down - but mostly down - in concert with investor moods.

The optimists have put up a truly impressive fight. Over and over we have heard that "the situation will be solved"... that "Greece will not be allowed to fail"... that "a solution is just around the corner" and "Greece will be bailed out."

Yet every time, the supposed "solution" has been little more than hot air. Political fantasy keeps running aground on the hard shoals of reality. European pols have trashed their credibility so many times now, it's hard to keep count.

Fiscal Crisis and the Kübler-Ross Model

The Greek debt situation could ultimately prove fatal - not just for Greece, but for the entire eurozone. In their extended display of denial, one could thus argue investors are passing through the "five stages of grief."

(Or in this case, the five stages of Greece. Get it? Gallows humor, I know...)

The five stages of grief are central to the Kübler-Ross model, as first described by Dr. Elisabeth Kübler-Ross in her book On Death and Dying in 1969. Per Wikipedia, the stages look like this:

- Denial. "I feel fine... this can't be happening to me."

- Anger. "Why me? It's not fair! How can this happen to me?"

- Bargaining. "I'll do anything for a few more years..."

- Depression. "Oh, what's the point... why even bother going on?"

- Acceptance. "I can't fight it. I may as well prepare."

We can see all these stages at work with Greece. At first, outright denial was the order of the day. Then came the anger... and the hopeful bargaining... and now, as the euro nears a fresh test of 12-month lows, we are edging our way into the depression stage, in which reality can no longer be denied.

Not Just Greece

But again, as SocGen analyst Dylan Grice points out, denial ain't just a river in Egypt... and the sovereign debt problem is not just confined to Greece.

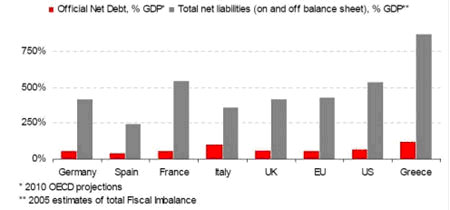

The above chart shows official net debt and total net liabilities for various OECD countries. The gray bar shows net liabilities - the total obligations both "on" and "off" the balance sheet - for each country shown.

When it comes to net liabilities, Greece is the runaway leader of the pack (the tall gray bar on the far right). From a whole country perspective, Greece's obligations are more than 750% of annual income (GDP), a truly staggering amount.

But Grice's key point is that "Greece isn't that different" from the other, bigger nations. The net liabilities of the United States - the gray bar next to Greece - are now more than 500% of GDP. The U.K., France, the EU as a whole, and even Germany are right in there too.

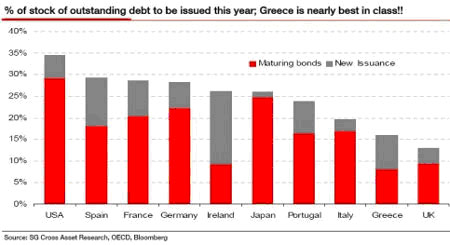

This next chart (also from Grice) is the real kicker...

In case it's hard to see, the print at the top reads: "% of stock of outstanding debt to be issued this year; Greece is nearly best in class!"

The red portion of each bar represents maturing bonds - debt that will need to be "rolled over" soon. The gray portion is new issuance. And who is the big kahuna by this measure? That would be the USA (the tall bar on the far left).

It is still an open question as to who will supply Uncle Sam with the many trillions he needs to borrow, just to keep the whole scheme afloat.

A Borrowed Recovery

This goes back to a central problem of the "economic recovery" narrative. We have managed to "buy" a broad perception of recovery in the same manner that a gambler in a casino buys a little more time at the tables by drawing down his line of credit.

With a fat enough pipeline of credit, any businessman can look like a genius - for a little while at least. All one has to do is borrow hand over fist... invest the borrowed dollars in at least a semi-sensible way... and then proudly point to the profits accrued, without bothering to mention the ballooning debt side of the ledger.

Like the classic credit card "kiting" scheme, in which one credit card is used to pay off another, this modus operandi can work for a long time... until the revolving credit lines max out or the lender finally balks, at which point the music suddenly stops.

Greece's Bill Is Now Due - And Others Will Be Next

In fact, the credit card analogy may be the simplest means of understanding what's happening in Greece.

Monetary union in the eurozone was the equivalent of a joint-issued credit card for all 16 countries that signed up. With its ability to borrow in euros - and the implied promise of eurozone solidarity - Greece was given the ability to tap Germany's credit rating.

Over the course of a decade or so, Greece used this newfound line of credit irresponsibly. The country borrowed much more, at a much lower rate of interest, than it ever could have done without the eurozone imprimatur. Now the bill is coming due... and Greece can't pay.

Market jitters suggest that Portugal is up next. "Portuguese bonds fell," Bloomberg recently reported, "pushing yields to the highest relative to German bunds in 13 months, on mounting concern that governments in the euro region will struggle to control their budget deficits."

First Greece, then Portugal. (Latvia has already imploded, but it is too small to register - no offense intended to Latvian readers.) After Portugal, the small countries start to get bigger. Who will be next in line? Italy? Spain?

In debt crisis terms, we are looking at a chain of dominoes here. That chain starts with Greece... wends its way around the eurozone... stops off in Asia at the doorstep of Japan... and ends with the United States.

Gold Coins as Printing Press Insurance

Few things in life are guaranteed, other than death and taxes. One thing we can say with certainty, though, is that human nature does not change. The average politician, if not the average man in the street, is in love with the easy solution - the painless path, the quick fix.

Politicians do not manage for the long term. They manage for the next election cycle. And that means borrowing in ever-greater amounts to keep perceptions of recovery intact. When that strategy fails, the "five stages of Greece" will be writ large. And the printing press will be the final answer to the West's looming "debt denial" problem.

In other words, when all other measures fail - and they will - the West will inflate and debase its way out. The playbook is centuries old, millennia old even. It is nature's inevitable way, just as rivers run to the sea.

The above is why you should consider gold coins for a portion of your investment portfolio (if you haven't done so already). The final act of this tragicomic play will be big... it will be ugly... and it will be all encompassing. Fiat currencies across the board could be reduced to confetti.

That is the type of environment where a stash of coins - gold you can keep in your possession, rather than own at arm's length through a trading account - might come in handy.

I bring up this final point because my publisher, Sandy Franks, tells me that $5 Gold Eagles (a popular coin issued by the U.S. Mint) are, quite literally, disappearing. They are flying off the shelves, and the Mint can't meet demand. Given the long-term troubles we face - and the reality of Greece as prelude to something bigger - this doesn't surprise me one bit.

You can find out more about Gold Eagles by clicking on this link.

Source: http://www.taipanpublishinggroup.com/taipan-daily-042310.html

By Justice Litle

http://www.taipanpublishinggroup.com/

Justice Litle is the Editorial Director of Taipan Publishing Group, Editor of Justice Litle’s Macro Trader and Managing Editor to the free investing and trading e-letter Taipan Daily. Justice began his career by pursuing a Ph.D. in literature and philosophy at Oxford University in England, and continued his education at Pulacki University in Olomouc, Czech Republic, and Macquarie University in Sydney, Australia.

Aside from his career in the financial industry, Justice enjoys playing chess and poker; he enjoys scuba diving, snowboarding, hiking and traveling. The Cliffs of Moher in Ireland and Fox Glacier in New Zealand are two of his favorite places in the world, especially for hiking. What he loves most about traveling is the scenery and the friendly locals.

Copyright © 2010, Taipan Publishing Group

Justice_Litle Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.