Stock Market Jitters, Correction and Support

Stock-Markets / Stock Markets 2010 Apr 28, 2010 - 03:21 AM GMTBy: Donald_W_Dony

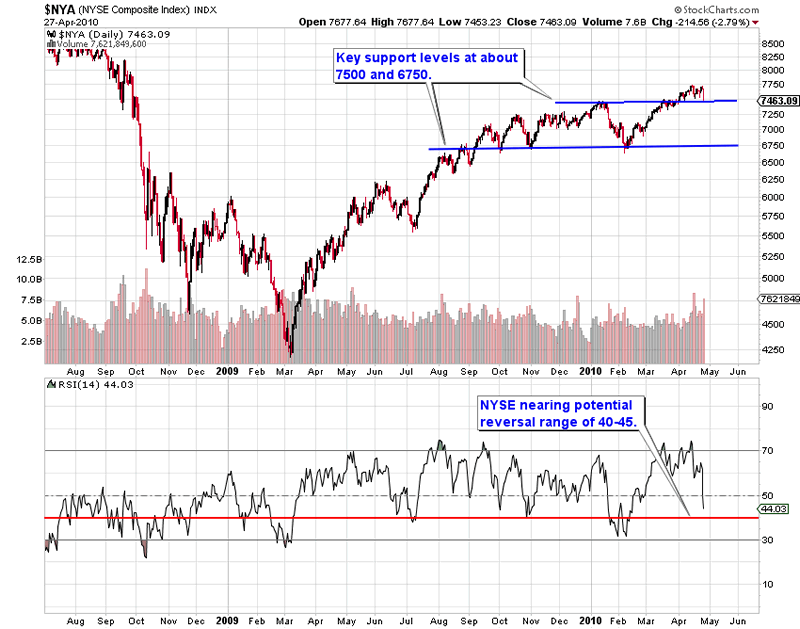

Tuesday's sharp sell-off in the NYSE is part of an extended market. Jitters about debt concerns in Greece and Portugal coupled with the Goldman Sachs hearing before the Senate has caused the broad-based index to correct. The NYSE is now on the first key support level of 7400-7500 (Chart 1).

Tuesday's sharp sell-off in the NYSE is part of an extended market. Jitters about debt concerns in Greece and Portugal coupled with the Goldman Sachs hearing before the Senate has caused the broad-based index to correct. The NYSE is now on the first key support level of 7400-7500 (Chart 1).

Though this short-term retracement may seem negative on the surface, there remains considerable underlying support. Long-term models indicate that over 85% of the stocks on the index are still trending up. Short-term models are equally as bullish with readings in the mid-80s.

The 134 point pullback on the TSX was less severe than on the NYSE. This was largely due to the stability of the energy and banking sectors (Chart 2). Canada's index is also near key support of 12,000. The high percentage of equities trending up (75%) bodes well for a continuation of the present consolidation verses a deeper correction.

Bottom line: Corrections of 20%-30% develop when there are less than 50% of the stocks in an index advancing. The current high percentage numbers on both indexes implies only a shallow and brief pullback.

Investment approach: Probability models (Monte Carlo) suggest that the next key low should arrive in the first half of June. This pullback is expected to be similar to the February 2010 trough. This would mean that some downward pressure should begin to build in the second half of May. Investors may wish to wait until this anticipated low in early June before adding additional positions to their portfolios.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2010 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.