Stock Market Sell Signals Abound, VIX Spikes Higher, XLF Says Good-bye to Support

Stock-Markets / Stock Markets 2010 Apr 28, 2010 - 02:28 AM GMT Again Today on Financial Overhaul Bill - The U.S. Senate will take a second vote today on Democrats’ effort to overcome Republican objections and begin debate on financial-overhaul legislation.

Again Today on Financial Overhaul Bill - The U.S. Senate will take a second vote today on Democrats’ effort to overcome Republican objections and begin debate on financial-overhaul legislation.

“What are you afraid of?” Majority Leader Harry Reid of Nevada said to Republicans on the Senate floor today, arguing that the proposal can be amended during debate. Senate Minority Leader Mitch McConnell, a Kentucky Republican, responded by saying, “This bill isn’t ready” and that more negotiations are needed.

Earnings Update: Ex-Financials There Are No Upside Revenue Surprises

Much has been said on TV about the "great" earnings season so far. The truth is that exfinancials the upside EPS factor is just 10%. This is driven purely by ongoing cost-cutting and layoffs. What is much more relevant is the top-line. And there again, ex-financials, the upside surprise, is... zero. As David Rosenberg puts it, "In other words, outside of financials, revenues are just meeting analyst expectations. In a nutshell, the impressive earnings surprises, thus far, is being driven by Financials cost surprises (including write offs)." And why are financials beating so heartily? Because they are all reducing loss allowances on their books, when their whole books are based on mark to myth.

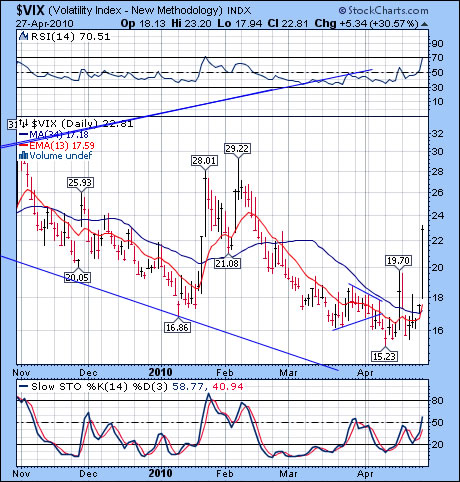

VIX broke above its prior high.

-- The VIX broke above its prior high

and stayed above short-term Trend

Support at 17.59. The new uptrend

in VIX is now confirmed.

The CBOE Put-Call Ratio for

equities ($CPCE) rose to .79 today.

Retail investors are facing today’s

stock decline like deer in the

headlights. Strangely enough, the

pros have cut back on the $CPCI

to 1.36 (less bearish) at the end of

the day. The 10-day average is still

high at 1.49. The NYSE Hi-Lo

index close down 476 today to 167,

putting it on a sell signal.

-- The VIX broke above its prior high

and stayed above short-term Trend

Support at 17.59. The new uptrend

in VIX is now confirmed.

The CBOE Put-Call Ratio for

equities ($CPCE) rose to .79 today.

Retail investors are facing today’s

stock decline like deer in the

headlights. Strangely enough, the

pros have cut back on the $CPCI

to 1.36 (less bearish) at the end of

the day. The 10-day average is still

high at 1.49. The NYSE Hi-Lo

index close down 476 today to 167,

putting it on a sell signal.

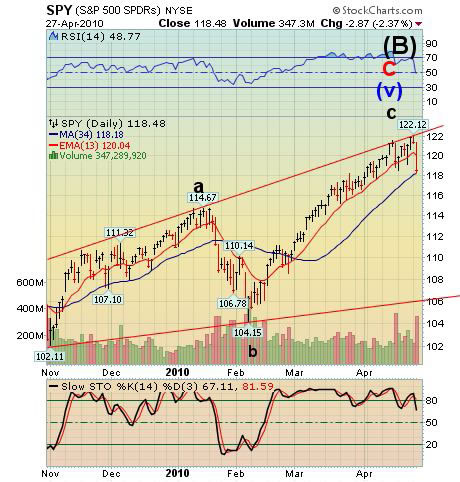

SPY now rests at intermediate-term Trend Support.

Action: Sell/Short/Inverse

-- SPY broke through short-term

Trend Support/Resistance at 120.04

and closed just above intermediateterm

Trend Support at 118.18. The

pivot has turned into a full-fledged

reversal.

The selling continues in the afterhours.

Action: Sell/Short/Inverse

-- SPY broke through short-term

Trend Support/Resistance at 120.04

and closed just above intermediateterm

Trend Support at 118.18. The

pivot has turned into a full-fledged

reversal.

The selling continues in the afterhours.

Normally we would see a bounce here at intermediate-term Trend Support. However, I would not rely on “normal” expectations to guide us here. I cannot predict what will happen overnight, so we must stay the course. What may surprise you is that the next cycle low is due by this coming Monday, so there is not a lot of time for this decline.

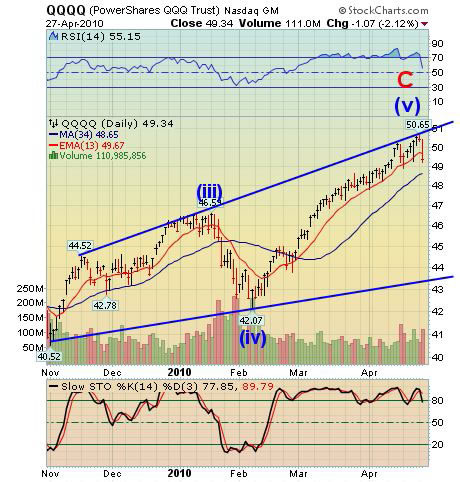

The QQQQ breaks short-term Trend Support/Resistance.

Action: Sell/Short/Inverse

-- This time it should stick. QQQQ

did not make it to intermediate-term

Trend Support at 48.65, but it is a lot

closer.

Volume came back as selling kicked

in. What I would be looking for is an

increase in volume in the coming

days, much like we saw in late

January. This time QQQQ must take

out the February low…and quickly.

Action: Sell/Short/Inverse

-- This time it should stick. QQQQ

did not make it to intermediate-term

Trend Support at 48.65, but it is a lot

closer.

Volume came back as selling kicked

in. What I would be looking for is an

increase in volume in the coming

days, much like we saw in late

January. This time QQQQ must take

out the February low…and quickly.

XLF says good-bye to all supports.

Action: Sell/Short/Inverse

-- XLF took out the intermediateterm

Trend Support/Resistance at

16.18.

The guidelines for the Broadening

Formation suggest that the lower

trendline is where we may expect the

next significant bounce. We may see

a swift decline to Model Support

(which agrees with the Broadening

Formation) at 13.24 or even lower.

We may also see selling volume

spike significantly higher.

Action: Sell/Short/Inverse

-- XLF took out the intermediateterm

Trend Support/Resistance at

16.18.

The guidelines for the Broadening

Formation suggest that the lower

trendline is where we may expect the

next significant bounce. We may see

a swift decline to Model Support

(which agrees with the Broadening

Formation) at 13.24 or even lower.

We may also see selling volume

spike significantly higher.

FXI falls clear of supports.

Action: Neutral

-- FXI declined below intermediateterm

Trend Resistance at 42.18.

Since February 5th, I had assumed

that FXI would track U.S. equities.

However, there are five distinct

waves up and FXI has only retraced

50% of its rally. FXI does not have a

triangle formation as does $SSEC,

but an impulse does not stand alone.

It may be nullified by a decline

below 36.65, but if the decline stops

higher, then FXI may also make new

highs. We may see the turn at the

same time that the domestic equities

make a bottom, so a low in FXI that

does not take out the previous low

suggests we go long FXI at the turn.

Action: Neutral

-- FXI declined below intermediateterm

Trend Resistance at 42.18.

Since February 5th, I had assumed

that FXI would track U.S. equities.

However, there are five distinct

waves up and FXI has only retraced

50% of its rally. FXI does not have a

triangle formation as does $SSEC,

but an impulse does not stand alone.

It may be nullified by a decline

below 36.65, but if the decline stops

higher, then FXI may also make new

highs. We may see the turn at the

same time that the domestic equities

make a bottom, so a low in FXI that

does not take out the previous low

suggests we go long FXI at the turn.

GLD breaks above all but the December high.

Action: Neutral

-- GLD rallied to a new high above

its short-term Trend Support at

112.58.

The triangle formation has been

invalidated and replaced by a simple

zig-zag. The rally may be over, but

there is no clear evidence of that yet.

The dollar and bonds also rallied

today. What strange bedfellows!

Action: Neutral

-- GLD rallied to a new high above

its short-term Trend Support at

112.58.

The triangle formation has been

invalidated and replaced by a simple

zig-zag. The rally may be over, but

there is no clear evidence of that yet.

The dollar and bonds also rallied

today. What strange bedfellows!

USO breaks through all support.

Action: Sell/Short/Inverse

-- USO declined below its

intermediate-term Trend

Support/Resistance at 40.31.

USO has a line of support at 38.90

which may induce a bounce, but is

still due for a decline back down to

the Cycle Support area at 34-35.00.

The top view is that it is probable

that USO may continue its decline

through any near supports to its next

cycle low due in early May.

Action: Sell/Short/Inverse

-- USO declined below its

intermediate-term Trend

Support/Resistance at 40.31.

USO has a line of support at 38.90

which may induce a bounce, but is

still due for a decline back down to

the Cycle Support area at 34-35.00.

The top view is that it is probable

that USO may continue its decline

through any near supports to its next

cycle low due in early May.

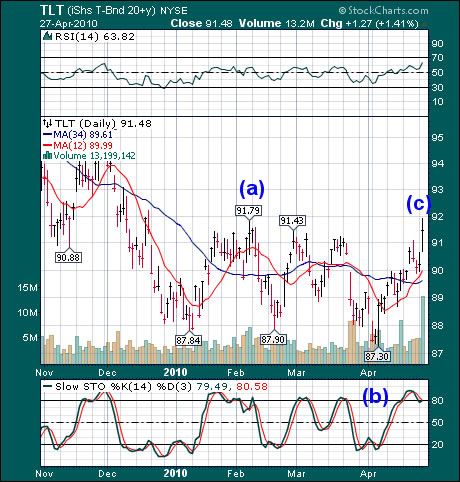

TLT may have completed its correction.

Action: Neutral, possibly a Short

--TLT negated its reversal pattern

today, and closed at a new high. It

remained above short- term Trend

Support/Resistance at 89.99.

If TLT does not rally beyond 92.25,

it remains a good short candidate.

There is a distinct impulse from the

lows, after a corrective decline. The

Elliott labels and cycles suggest a

tradable decline may follow a

reversal here.

Action: Neutral, possibly a Short

--TLT negated its reversal pattern

today, and closed at a new high. It

remained above short- term Trend

Support/Resistance at 89.99.

If TLT does not rally beyond 92.25,

it remains a good short candidate.

There is a distinct impulse from the

lows, after a corrective decline. The

Elliott labels and cycles suggest a

tradable decline may follow a

reversal here.

UUP goes back to the old wave count.

Action: Buy/Long

-- Just as I was giving up on a

breakout in UUP it rallies to the

breakout point. It is still above shortand

intermediate-term Trend Support

at 23.73.

Action: Buy/Long

-- Just as I was giving up on a

breakout in UUP it rallies to the

breakout point. It is still above shortand

intermediate-term Trend Support

at 23.73.

The cycles call for a potential low by mid-May but a quick breakout in UUP may match the breakdown looming in equities. What a change one day makes!

Have a great evening!

Tony

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.