Gold in British Pounds Near Record Highs on Hung Parliament and Budget Deficit Concerns

Commodities / Gold and Silver 2010 Apr 27, 2010 - 06:15 AM GMTBy: GoldCore

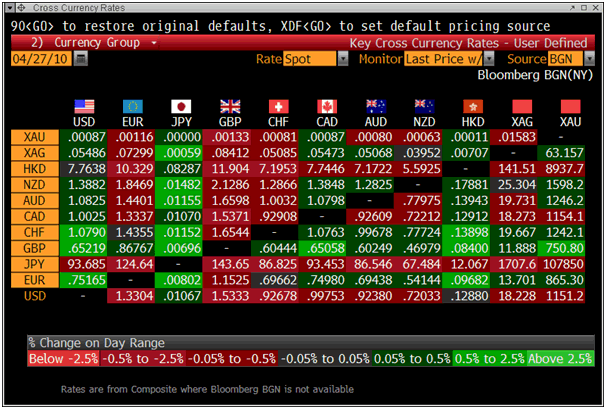

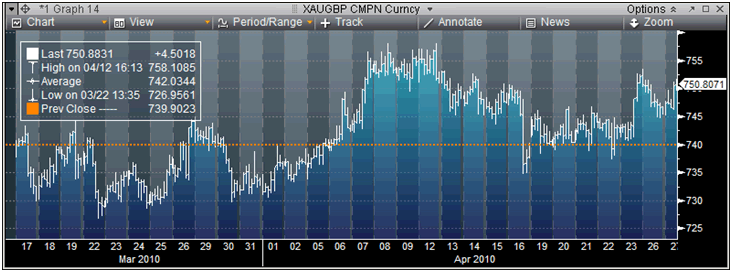

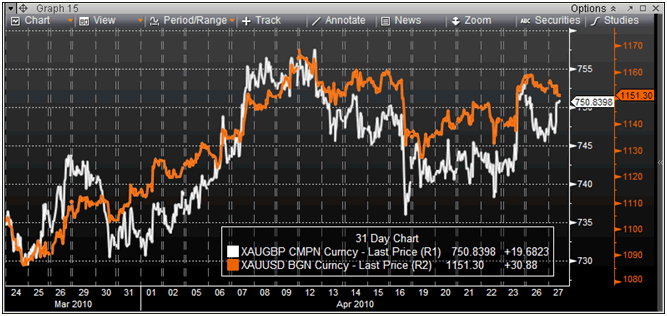

Gold dipped to $1,150/oz after lunch in New York before recovering to close with a gain of 0.03%. It has range traded from $1,150/oz to $1,157/oz in late Asian and European trading this morning. Gold is currently trading at $1,155/oz and in euro and GBP terms, at €865/oz and £749/oz respectively. Gold remains near record highs in euros and Swiss francs. Gold in sterling has rallied today by more 2% today as sterling has fallen on hung parliament and UK fiscal deficit concerns.

Gold dipped to $1,150/oz after lunch in New York before recovering to close with a gain of 0.03%. It has range traded from $1,150/oz to $1,157/oz in late Asian and European trading this morning. Gold is currently trading at $1,155/oz and in euro and GBP terms, at €865/oz and £749/oz respectively. Gold remains near record highs in euros and Swiss francs. Gold in sterling has rallied today by more 2% today as sterling has fallen on hung parliament and UK fiscal deficit concerns.

Gold remains near record (nominal) highs in sterling on growing evidence next week's UK election will produce a government without the parliamentary support needed to trim a large and growing budget deficit - the biggest among the Group of Seven nations. There is increasing likelihood of this being the first Parliament since 1974 in which no party holds a majority. The UK deficit jumped 76 percent in the year through March to 152.8 billion pounds, the largest since World War II. In March, it was 23.5 billion pounds, the most for any month since records began in 1993. Ratings agencies have warned that the UK's important AAA rating is under threat if the next government fails to produce a credible plan to reduce the deficit.

Gold and silver options on the COMEX and OTC markets will expire on Tuesday and Wednesday. In recent months this has been accompanied by falling precious metal prices and this pattern may well be seen again today and tomorrow.

The Greek debt crisis remains at the forefront of investors' minds. Greek bond and share prices continued to remain under severe pressure with the Greek stock market falling sharply and ten-year bond yields remaining near 12-year highs. There is a growing belief among market participants that even if a bailout happens it will not be enough to prevent a restructuring of the country's debt. Investors increasingly think that the end-game will be a restructuring or a change to the terms of the debt that may involve payment extensions or payment reductions.

Thoughts are now turning to who will be next after Greece - with Portugal, Ireland and Spain all in the firing line. Portugal may become the next Greece as it has a higher debt burden than Greece. Portugal's credit default swaps show investors rank its debt as the eighth riskiest in the world, lower than for Lebanon and Guatemala.

Silver

Silver has range traded from $18.20/oz to $18.32/oz this morning in Asia. Silver is currently trading at $18.27/oz, €13.68/oz and £11.85/oz.

Platinum Group Metals

Platinum is trading at $1,748/oz and palladium is currently trading at $567/oz. Rhodium is at $2,950/oz.

News

The International Monetary Fund (IMF) sold 5.6 tonnes of gold in February under the second phase of its gold sales programme, the World Gold Council said yesterday. The IMF's sales are taking place under the umbrella of the third Central Bank Gold Agreement, which began in September 2009. Signatories of the CBGA are largely eurozone central banks, the largest gold holder of which is Germany. Total sales under the pact, which limits signatories' gold sales to 400 tonnes a year, were just 7.2 tonnes to April 20. The IMF began its planned sales of 403.3 tonnes of gold last year. After the sales reported by the WGC, plus those of 200 tonnes to India and smaller amounts to Sri Lanka and Mauritius last year, it has a further 185.7 tonnes of gold to sell. Among signatories of the CGBA, Germany has sold 0.9 tonnes of gold so far under the third CBGA, Malta has sold 0.3 tonnes, and unknown countries a further 0.4 tonnes, the WGC said. China, India and other large creditor nations are expected to attempt to buy any gold sold by the IMF.

Saudi Arabia's surging energy demand may significantly reduce its ability to export oil to the rest of the world in the next two decades, the head of the country's national oil company has warned. Khalid al-Falih, chief executive officer of Saudi Aramco, said domestic energy demand was expected to increase nearly 250 per cent, from about 3.4m barrels a day of oil equivalent last year to about 8.3m b/d by 2028.

Oil use will probably peak in emerging markets by early next decade, a senior adviser to Saudi Arabia's oil minister said on Thursday in a further sign the concept of peak demand has crept into the industry mainstream. Interest in the view oil demand may soon reach a high point and then fall back has grown following a drop in global oil use last year caused by the economic crisis, as well as efforts to combat climate change and use fuel more efficiently. "I think that peak demand will come before peak of supply," said Ibrahim Al-Muhanna, advisor to Saudi Oil Minister Ali al-Naimi, in answer to questions at a conference in Paris.

Cocoa futures surged yesterday on signs of a shortage. Cocoa prices on Monday hit a 33-year high on the back of improving demand from the chocolate industry and a disappointing crop in Ivory Coast, the world's largest grower. The combination sent the benchmark Liffe July cocoa contract to £2,365 a tonne, the highest level for the second front-month contract since October 1977. Cocoa demand has outstripped supply for the fourth consecutive year in the 2009-10 season, marking the longest shortage period since 1965-69, due to declining production in Ivory Coast. The west African country accounts for nearly 40 per cent of the world's cocoa output.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.