Stock Market Topping Action Start of the Great Reversal

Stock-Markets / Financial Markets 2010 Apr 27, 2010 - 02:43 AM GMT (MarketWatch) -- U.S. stocks wavered Monday, with upbeat results from Caterpillar Inc. and

Whirlpool Corp. boosting confidence, but with the government's plan to begin divesting itself of

Citigroup Inc. weighing on financials.

(MarketWatch) -- U.S. stocks wavered Monday, with upbeat results from Caterpillar Inc. and

Whirlpool Corp. boosting confidence, but with the government's plan to begin divesting itself of

Citigroup Inc. weighing on financials.

"The markets have been doing just about what they're supposed to do, which is if the economic numbers are better than forecast, or if earnings are better than forecast, then the market should go up," said Hugh Johnson, chairman of Johnson Illington Advisors. "Valuation is starting to become an issue. The going is getting tougher, although that doesn't mean we're not going to continue to go up," he added.

Somali Pirates say, "We are doing God's work.”

Eleven indicted Somali pirates dropped a bombshell in a U.S. court today, revealing that their entire piracy operation is a subsidiary of banking giant Goldman Sachs. There was an audible gasp in court when the leader of the pirates announced, "We are doing God's work. We work for Lloyd Blankfein."

The pirate, who said he earned a bonus of $48 million in dubloons last year, elaborated on the nature of the Somalis' work for Goldman, explaining that the pirates forcibly attacked ships that Goldman had already shorted. "We were functioning as investment bankers, only every day was casual Friday," the pirate said.

Janet Tavakoli: "President Obama - Bring Back Black"

William K. Black, a regulator during the dark days of the Savings & Loan Crisis, gave the most sensible testimony about the financial crisis heard in Washington so far.* Fraud thrives and spreads in a regulatory free, highly paid, criminogenic environment. Cheaters prosper driving honesty out of the market.

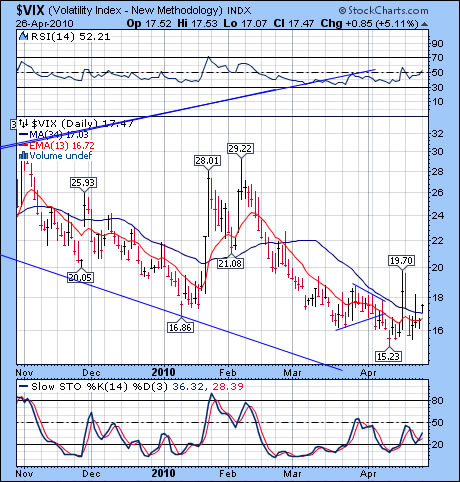

VIX broke above its intermediate-term Support.

-- The VIX staged a third breakout

above its intermediate-term Trend

Resistance at 17.03. A breakout

above its prior highs may confirm the

new uptrend in VIX.

-- The VIX staged a third breakout

above its intermediate-term Trend

Resistance at 17.03. A breakout

above its prior highs may confirm the

new uptrend in VIX.

The CBOE Put-Call Ratio for equities ($CPCE) rose to .54 today. Retail investors are still bullish, and today’s action didn’t dampen their enthusiasm for stocks yet. The pros, on the other hand, have elevated the $CPCI to 1.46 (bearish) at the end of the day. The 10-day average is still high at 1.47.

SPY tests its upper trendline.

Action: Sell/Short/Inverse

-- SPY made a new high this

morning before drifting downward

the rest of the day. It remained

above short-term Trend Support at

120.30. Friday’s pivot window

remained open today and it appears

that something of a reversal may

have taken place.

What might improve our chances of

a reversal would be steady selling

throughout the night. The futures

market is down as I write, so we have

the distinct possibility of a gap

through support in the morning.

Action: Sell/Short/Inverse

-- SPY made a new high this

morning before drifting downward

the rest of the day. It remained

above short-term Trend Support at

120.30. Friday’s pivot window

remained open today and it appears

that something of a reversal may

have taken place.

What might improve our chances of

a reversal would be steady selling

throughout the night. The futures

market is down as I write, so we have

the distinct possibility of a gap

through support in the morning.

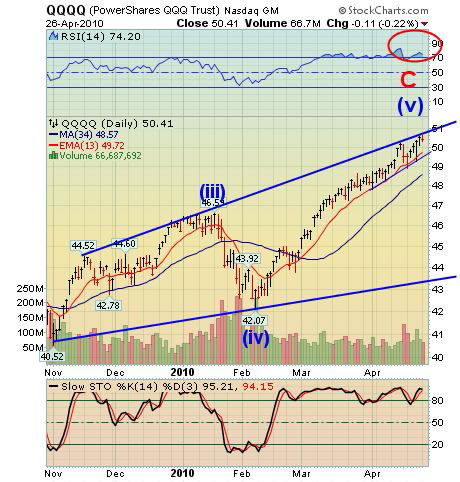

The QQQQ repelled by the Broadeining Wedge.

Action: Sell/Short/Inverse

-- QQQQ also briefly made a new

high this morning before easing

lower at the close. The Broadening

Wedge seems to be dictating the top

for this rally. The QQQQs closed

above short-term Trend Support at

49.72.

Considering all the liquidity that has

been pumped into the market on the

weekends, it is a surprise that QQQQ

didn’t go higher. The reality of the

weekend liquidity pump is one of the

reasons why I cautioned us to wait

until today for the pivot to reveal

itself. On a longer-term cycle

analysis, this week is a near-perfect

time for a turn.

Action: Sell/Short/Inverse

-- QQQQ also briefly made a new

high this morning before easing

lower at the close. The Broadening

Wedge seems to be dictating the top

for this rally. The QQQQs closed

above short-term Trend Support at

49.72.

Considering all the liquidity that has

been pumped into the market on the

weekends, it is a surprise that QQQQ

didn’t go higher. The reality of the

weekend liquidity pump is one of the

reasons why I cautioned us to wait

until today for the pivot to reveal

itself. On a longer-term cycle

analysis, this week is a near-perfect

time for a turn.

XLF rests at theopposite side of the Broadening Wedge.

Action: Sell/Short/Inverse

-- XLF stopped at the lower trendline

of its Broadening Wedge. In the

process, it also closed below shortterm

Trend Support at 16.58.

We may have seen the last rally for

XLF within its Broadening

Formation. Once the trendline (and

intermediate-term Support) is

broken, we should see a swift decline

to Model Support at 13.24. My

guess is that there may be an “event”

affecting one of our major banks,

perhaps Citigroup?

Action: Sell/Short/Inverse

-- XLF stopped at the lower trendline

of its Broadening Wedge. In the

process, it also closed below shortterm

Trend Support at 16.58.

We may have seen the last rally for

XLF within its Broadening

Formation. Once the trendline (and

intermediate-term Support) is

broken, we should see a swift decline

to Model Support at 13.24. My

guess is that there may be an “event”

affecting one of our major banks,

perhaps Citigroup?

FXI is still in neutral territory.

Action: Neutral

-- FXI tested intermediate-term

Trend Resistance at 42.21, but

couldn’t maintain the rally. I am

concerned about my analysis on FXI.

In order to follow the Shanghai

Index, it would only need a slight

decline before its next rally. Since

February5th, I had assumed that it

would track U.S. equities. The chart

may be wrong, however. The

Broadening Formation may not be

the governing pattern. Let’s wait for

it to clear up some more.

Action: Neutral

-- FXI tested intermediate-term

Trend Resistance at 42.21, but

couldn’t maintain the rally. I am

concerned about my analysis on FXI.

In order to follow the Shanghai

Index, it would only need a slight

decline before its next rally. Since

February5th, I had assumed that it

would track U.S. equities. The chart

may be wrong, however. The

Broadening Formation may not be

the governing pattern. Let’s wait for

it to clear up some more.

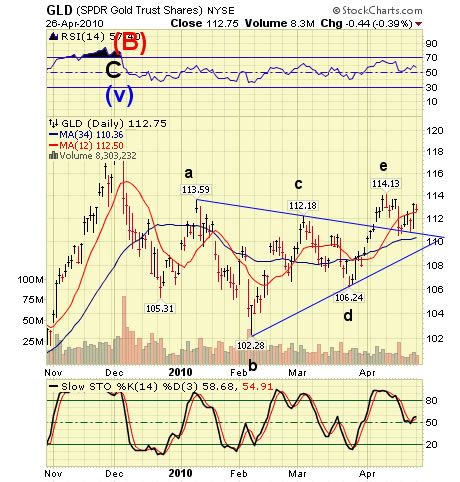

Action: Sell/Short/Inverse below

112.50

-- GLD declined slightly, but

remained above its short-term Trend

Support at 112.50.

A rally above 114.13 would

invalidate the triangle formation, so

we must take care that GLD is not in

a larger rally than is allowed by the

triangle. The primary pattern is still

the triangle, but we should be sure

that GLD declines through the

pattern and below intermediate-term

support to confirm the bearish view.

Action: Sell/Short/Inverse below

112.50

-- GLD declined slightly, but

remained above its short-term Trend

Support at 112.50.

A rally above 114.13 would

invalidate the triangle formation, so

we must take care that GLD is not in

a larger rally than is allowed by the

triangle. The primary pattern is still

the triangle, but we should be sure

that GLD declines through the

pattern and below intermediate-term

support to confirm the bearish view.

USO declined to intermendiate-term Trend Support.

Action: Sell/Short/Inverse

-- USO may be beginning its next

relay lower. It closed near its

intermediate-term Trend

Support/Resistance at 40.32.

Once below support, USO has a

potential to decline to the lower

trendline or possibly lower.

Ultimately, it is due for a decline

back down to the Cycle Support area

at 34-35.00. The top view is that it

is probable that USO may continue

its decline to its next cycle low due

in early May.

Action: Sell/Short/Inverse

-- USO may be beginning its next

relay lower. It closed near its

intermediate-term Trend

Support/Resistance at 40.32.

Once below support, USO has a

potential to decline to the lower

trendline or possibly lower.

Ultimately, it is due for a decline

back down to the Cycle Support area

at 34-35.00. The top view is that it

is probable that USO may continue

its decline to its next cycle low due

in early May.

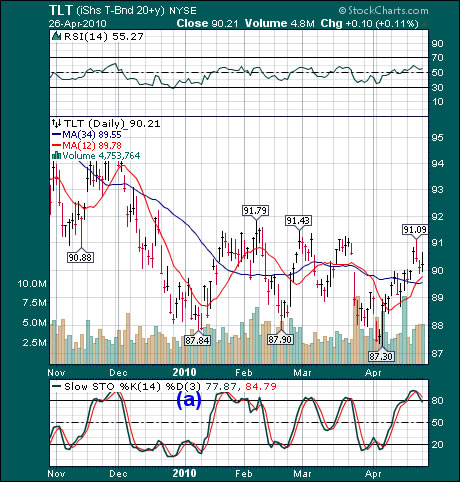

TLT pivots on a reversal pattern.

Action: Sell/Short/Inverse

--TLT completed its reversal pattern

today, also a pivot day for bonds. It

closed above short- term Trend

Support/Resistance at 89.78.

Contrary to most who believe that

bonds will rally in an equity decline,

this pattern shows potentially the

opposite behavior. TLT achieved its

swing high on Thursday and now

may decline into mid-May.

Action: Sell/Short/Inverse

--TLT completed its reversal pattern

today, also a pivot day for bonds. It

closed above short- term Trend

Support/Resistance at 89.78.

Contrary to most who believe that

bonds will rally in an equity decline,

this pattern shows potentially the

opposite behavior. TLT achieved its

swing high on Thursday and now

may decline into mid-May.

UUP gains momentum.

Action: Buy/Long

-- UUP has not been able to rally

higher, although it is still above

short- and intermediate-term Trend

Support at 23.70-23.72.

The cycles call for a potential lower

low by mid-May in UUP and I

believe that the inability to rally is

warning us of its coming. That

means the rally to 24.14 is complete

and a pullback to one of the Fib

retracements is now in order.

Action: Buy/Long

-- UUP has not been able to rally

higher, although it is still above

short- and intermediate-term Trend

Support at 23.70-23.72.

The cycles call for a potential lower

low by mid-May in UUP and I

believe that the inability to rally is

warning us of its coming. That

means the rally to 24.14 is complete

and a pullback to one of the Fib

retracements is now in order.

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.