Racing Stock Market Bulls, Shanghai vs. Wall Street

Stock-Markets / Stock Markets 2010 Apr 25, 2010 - 11:09 AM GMTBy: Dian_L_Chu

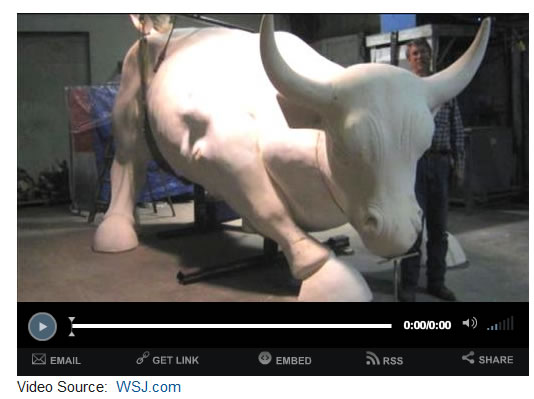

new symbol of China's market ambitions: It is getting its own charging bull sculpture for its Shanghai Stock Exchange, similar to the one in front of the New York Stock Exchange.

Determined to become the next world financial powerhouse, China has decided to install a symbol of the Western capitalism in the Shanghai Bund (外灘), a historic financial center of China.

The Bund (外灘) has dozens of historical buildings that once housed many international banks and trading houses from countries like the U.K., France, the U.S. Russia, and Germany.

The district was initially a British settlement; later the British and American settlements were combined in the International Settlement. A building boom at the end of 19th century and beginning of 20th century led to the Bund becoming a major financial hub of East Asia.

According to the Wall Street Journal, Arturo Di Modica, the original artist of the bronze "Charging Bull" at the front of the New York Stock Exchange in 1989, says his latest rendition is modeled for China:

"It must be strong. It's about a strong nation."

Although the new Chinese charging bull, made in Wyoming, is "exactly" the same length, height and weight at 5,000 pounds, it is bright-eyed, leaning to the right instead of the left and reddish compared with the original--"the color of China,"--Mr. Di Modica says. The Shanghai bull's tail also appears more "menacing", corkscrewing upward.

I personally would prefer Beijing commission one of the country's equally talented artists to come up with a fresh new version. Nevertheless, this is a milestone of China's progression so far and symbolic of the path forward. Wall Street should indeed be nervous about a rival shaping up across the Pacific.

For now, I would simply greet this historic event with "開張大吉" (May Fortune Come To Your Market.)

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.