Leading Stocks Go Vertical In Go-Go Market

Stock-Markets / Stock Markets 2010 Apr 25, 2010 - 11:04 AM GMTBy: David_Grandey

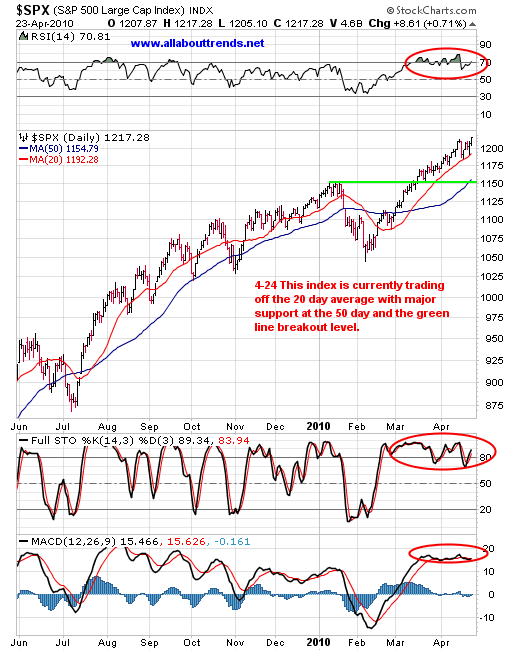

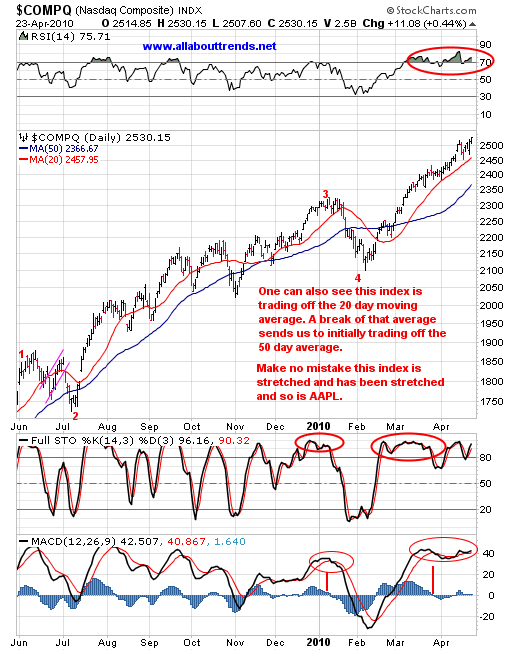

For the last month or so the markets have been overbought technical indicator after technical indicator wise, yet they have refused to give up the ghost so to speak. We've also been talking about what to do with a pullback and how to buy the leaders in an extended market. That still holds true today. We would love to buy some of the go-go stocks on pullbacks to support and/or the 50-day average however as we've said time and time again in this space the market is the boss.

For the last month or so the markets have been overbought technical indicator after technical indicator wise, yet they have refused to give up the ghost so to speak. We've also been talking about what to do with a pullback and how to buy the leaders in an extended market. That still holds true today. We would love to buy some of the go-go stocks on pullbacks to support and/or the 50-day average however as we've said time and time again in this space the market is the boss.

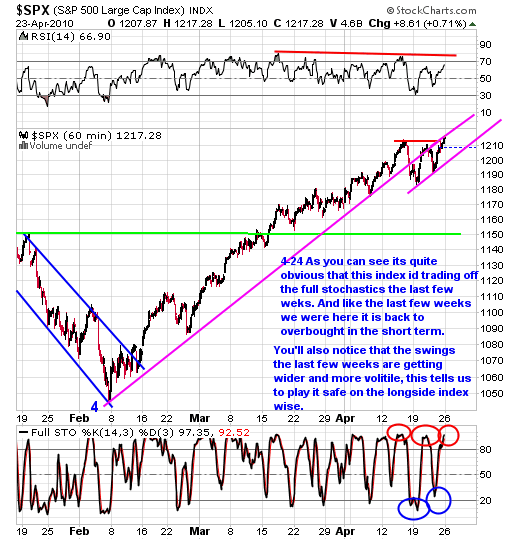

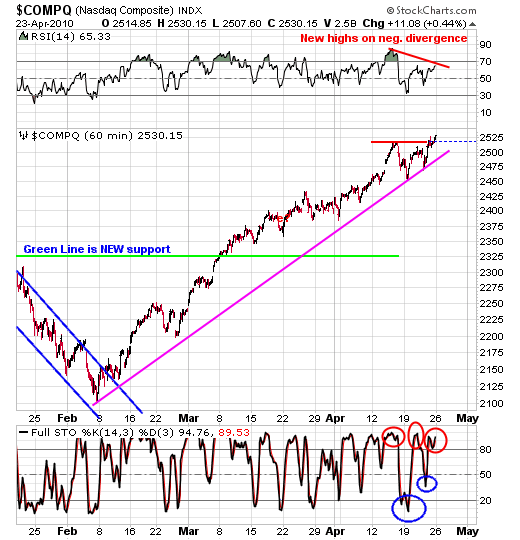

We started to get a pullback last week that really could have been the start of a nice pullback in order to buy off of from a low risk entry point vs. chasing them. However the indexes and many of the go-go (leaders) only pulled back to the 20 day average before taking off again.

60 minute charts

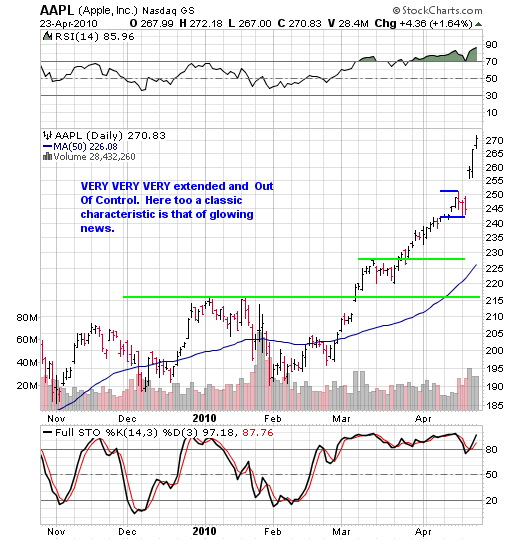

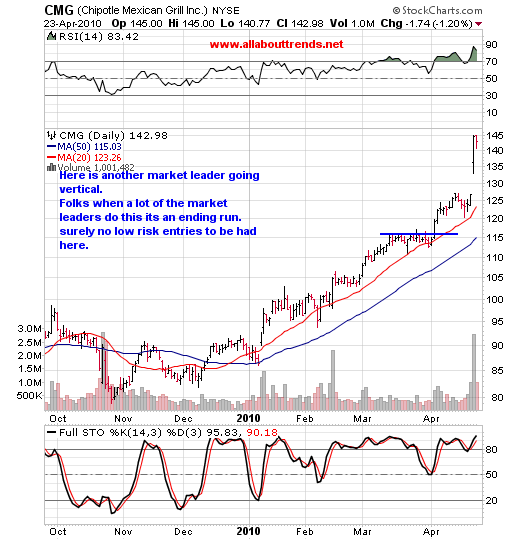

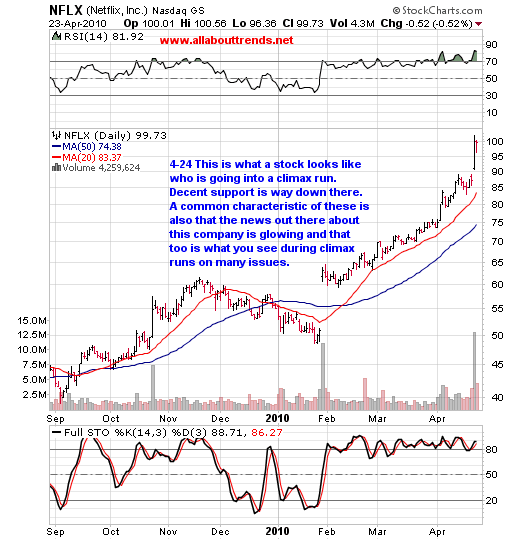

Go-Go Leaders

See what we mean? All of these stocks started to pullback however that pullback was contained to the 20-day average. Now look at them again, see how abnormal they look right now compared to their overall trend? Up Up and Out Of Control.

In Summary: Given that the market has been up for 8 consecutive weeks there is no way we can feel comfortable going hog wild here on the long side. Instead, it's all about the managing of putting new money to work risk wise and we are not going to stray and get sucked into that kind of chasing buses mentality.

There will be a time soon and that is when we will feel good about going into some of the current leaders for a trade at the least. In the meantime those of you who own some of those extended go go names mentioned above feel free to do a little pruning and locking in gains on some of the vertical names. We are not saying to sell 'em all off but say you own 200 shares of AAPL (yes we know what they say "but its going to 400-500" etc. We say ya right just like they said QCOM in 2000 was going to 1200 and that WAS the top when everyone started saying that), if you were to lock in some gains right up here if it keeps going you've still got some, if it pulls back at least you sold some at a higher price, call it the happy medium if you will. It's just good business sense to consider that. Remember bulls make money bears make money and pigs get slaughtered.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.