Euro Crisis Could Trigger Stocks, Dollar, Commodity and Bond Markets Drop

Stock-Markets / Financial Markets 2010 Apr 25, 2010 - 01:32 AM GMT FDIC Friday is open for business. The FDIC Failed Bank List announced seven new bank closures for the week thus far. FDIC Friday lives!

FDIC Friday is open for business. The FDIC Failed Bank List announced seven new bank closures for the week thus far. FDIC Friday lives!

U.S. Stocks Advance on Growth in Home Sales, Earnings Outlook

U.S. stocks advanced, wiping out losses spurred by the government’s lawsuit against Goldman Sachs Group Inc., as the biggest jump in new home sales in almost five decades bolstered optimism the economy is improving.

The Standard & Poor’s 500 Index rose 0.3 percent to 1,212.46 at 2:28 p.m. in New York, heading for its seventh weekly advance in the past eight. The index fell as much as 0.3 percent earlier today. The Dow Jones Industrial Average gained 28.65 points, or 0.3 percent, to 11,162.94.

Weakness Begets Weakness

As we write this, the European Union has recently announced new lending terms to support the Greek government, with great efforts made to assure the markets that these new terms do not constitute a ‘bailout’. The problem with the Greek situation is that an actual bailout would involve an almost impossible coordination among all the major powers within the EU. It would require the unanimous pre-approval of all the EU heads of state. It would involve the European Commission, the European Central Bank and the International Monetary Fund (IMF) all visiting

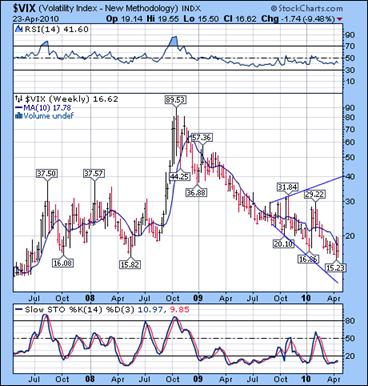

The VIX has an inside week while stocks rally higher.

--The VIX attempted again to stay above its 10-week moving average but closed short of its goal.

--The VIX attempted again to stay above its 10-week moving average but closed short of its goal.

A weekly close above the 10-week moving average confirms a change in trend. The fact that it did not make new lows is a non-confirmation of the (final) move in stocks. The NYSE (weekly) Hi-Lo index has made a new high in April. This may be an indication of yet another climax week in stocks.

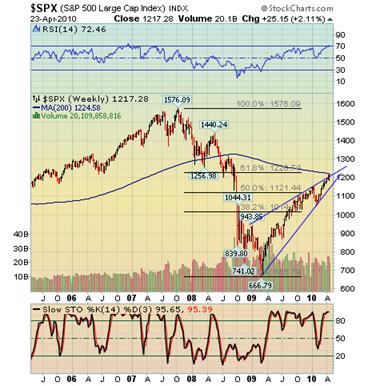

The SPX is only 7 points away from its 200-day moving average.

--The SPX has made a throw-over of its wedge formation towards its 200-day moving average. In all likelihood, it may make a final surge on Monday to hit its 200 d.m.a. at 1224.58 or its 61.8% retracement at 1228.74. The wave pattern appears complete, but extensions may appear when common retracements are nearby. On the other hand, it could reverse in the Pre-market and be on its way down at the open. Be prepared for either event.

--The SPX has made a throw-over of its wedge formation towards its 200-day moving average. In all likelihood, it may make a final surge on Monday to hit its 200 d.m.a. at 1224.58 or its 61.8% retracement at 1228.74. The wave pattern appears complete, but extensions may appear when common retracements are nearby. On the other hand, it could reverse in the Pre-market and be on its way down at the open. Be prepared for either event.

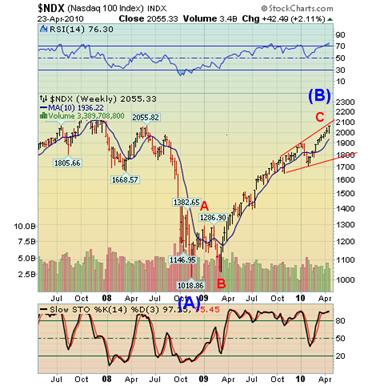

The NDX closes at a new high.

--The climactic surge in the NDX continued through the close on Friday. Friday also happened to be a pivot day. The window for the pivot remains open until Monday. The NDX had three buying climaxes in four weeks, which are rare and a bit disconcerting. The three climax weeks in the NDX occurred in the last week of March, last week and this week. This is typical of a broadening top formation, which shows an increase of bullish sentiment at each new daily peak.

--The climactic surge in the NDX continued through the close on Friday. Friday also happened to be a pivot day. The window for the pivot remains open until Monday. The NDX had three buying climaxes in four weeks, which are rare and a bit disconcerting. The three climax weeks in the NDX occurred in the last week of March, last week and this week. This is typical of a broadening top formation, which shows an increase of bullish sentiment at each new daily peak.

Gold’s consolidates for a third week.

-- Gold has been teasing traders by staying essentially in place for two weeks. Since it works from the same pivots as equities, it may be waiting for the turn in stocks to join the decline. It has made a corrective rally on Friday and appears ready to resume its decline shortly.

-- Gold has been teasing traders by staying essentially in place for two weeks. Since it works from the same pivots as equities, it may be waiting for the turn in stocks to join the decline. It has made a corrective rally on Friday and appears ready to resume its decline shortly.

Oil spends a second week at its broadening top.

West Texas Light Crude has declined to its 10-week moving average, then partially retraced to the trendline of its Orthodox Broadening Top. Despite the fact that it reversed at the April 6th pivot, it too appears to be waiting for the equities to turn.

West Texas Light Crude has declined to its 10-week moving average, then partially retraced to the trendline of its Orthodox Broadening Top. Despite the fact that it reversed at the April 6th pivot, it too appears to be waiting for the equities to turn.

The commodities complex seems to have the ability to turn at the pivot tops just before equities make their turn. Since they are on the same cycle path as equities, it may be possible to continue to use them as an early warning for equities. That is, until they stop leading the market.

The Bank Index remains “cornered” for a second week.

The $BKX remains technically “cornered” by its multi-year resistance and its broadening top. The broadening top suggests a decline to the lower 30s, a potential 50% decline.

The $BKX remains technically “cornered” by its multi-year resistance and its broadening top. The broadening top suggests a decline to the lower 30s, a potential 50% decline.

The mega-banks are also being cornered by the press. USA Today points out:

Banks that received federal assistance during the financial crisis reduced lending more aggressively and gave bigger pay raises to employees than institutions that didn't get aid, a USA TODAY/American University review found.

The Shanghai Index falls to the triangle trendline.

--The Shanghai Index fell below its 10-week moving average and challenges its lower triangle trendline. If this is a true triangle formation the Shanghai Index may reverse back up through the triangle to a new high at any time.

--The Shanghai Index fell below its 10-week moving average and challenges its lower triangle trendline. If this is a true triangle formation the Shanghai Index may reverse back up through the triangle to a new high at any time.

FXI has no triangle formation, so I have no position in the Shanghai market at this time. Shanghai appears to have had its pivot today with the domestic equities. The interesting thing is that, while our domestic equities are making a high, the Shanghai index is making a low. Could it be that some event may trigger a flow of money from the U.S. to China?

$USB may be on the brink of a big move.

-- $USB tested its 10-week moving average and fell back this week, making absolutely no gain.

-- $USB tested its 10-week moving average and fell back this week, making absolutely no gain.

The 10-week moving average suggests the decline is not over. $USB will have to break through that resistance before I would proclaim a rally is at hand. Otherwise, it is simply making a retracement of its prior decline. Beneath it is a head and shoulders neckline. Should it be broken, things could turn ugly for bonds.

I have removed most of my Elliot Wave analysis for the time being, pending resolution of this pivot. The cycles suggest a further decline into mid-May.

Is it time to take profits in $USD?

-- $USD has made what appears to be a clear impulse to 82.24. It has made a shallow pullback, but the subsequent rally failed to pierce the neckline. A re-examination of the cycles leaves the real possibility of a decline lasting into mid-May. A probable target may be the area near 78.00. An examination of the Euro suggests a likely rally for the same time period. Is there an event awaiting us that could cause the dollar and equities to decline while the Euro rallies? Inquiring minds want to know.

-- $USD has made what appears to be a clear impulse to 82.24. It has made a shallow pullback, but the subsequent rally failed to pierce the neckline. A re-examination of the cycles leaves the real possibility of a decline lasting into mid-May. A probable target may be the area near 78.00. An examination of the Euro suggests a likely rally for the same time period. Is there an event awaiting us that could cause the dollar and equities to decline while the Euro rallies? Inquiring minds want to know.

I hope you all have a wonderful weekend!

Regards,

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.