EXTEND and PRETEND, Is the U.S. Facing a Cash Crunch?

Interest-Rates / Credit Crisis 2010 Apr 24, 2010 - 12:49 AM GMTBy: Gordon_T_Long

The US Government is caught in a cash vise and is being squeezed between too slow a rebound in tax revenues and the limitations on how quickly it can realistically take its funding requirements to the US Treasury auction. The US Treasury was saved in March by what the government reports as “proprietary receipts”. Those receipts require an explanation that is not well publicized since it begs the question of what happens next month without the $117 BILLION journal entry.

The US Government is caught in a cash vise and is being squeezed between too slow a rebound in tax revenues and the limitations on how quickly it can realistically take its funding requirements to the US Treasury auction. The US Treasury was saved in March by what the government reports as “proprietary receipts”. Those receipts require an explanation that is not well publicized since it begs the question of what happens next month without the $117 BILLION journal entry.

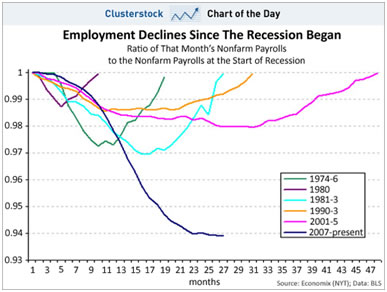

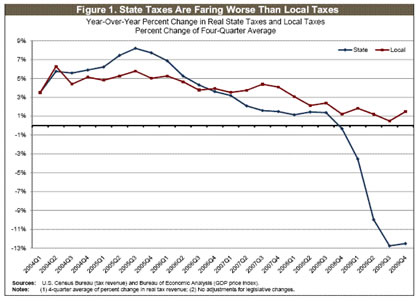

The March cash management numbers from the US Treasury’s Financial Management Service are alarming and in my estimation have become perilous. The economy is simply taking much too long to recover which is affecting urgently required tax receipts.

The March cash management numbers from the US Treasury’s Financial Management Service are alarming and in my estimation have become perilous. The economy is simply taking much too long to recover which is affecting urgently required tax receipts.

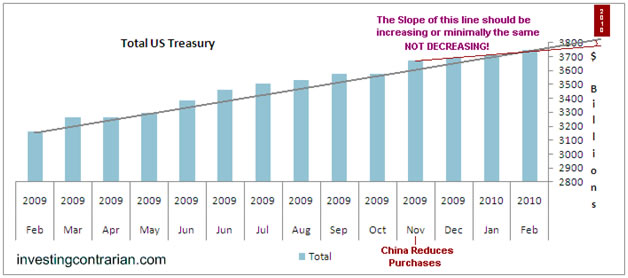

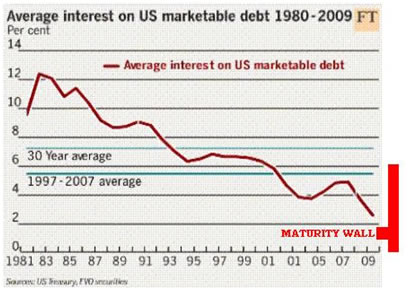

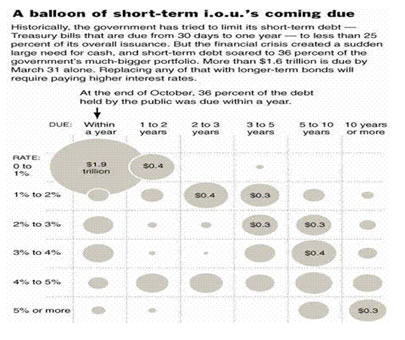

If the US Treasury issues even higher debt supply to the market too fast, it threatens driving up interest rates prematurely and thereby elevating already strained government financing costs despite already increased supply. Since the US government has steadily reduced maturity duration over the last few years to obfuscate a growing debt problem, the issue is compounded by the rapidly increasing levels of roll-over funding now additionally being required.

It is a tricky balance between gauging how fast tax receipts will return and what supply the monthly treasury auction is able to absorb. Cash flow is the primary reason small businesses fail unexpectedly. This is also why sovereign governments fail abruptly.

We witnessed in Greece what happens when investors get nervous. Yields not only spike but typically move to even higher levels than most originally thought possible.

US TREASURY CASH REQUIREMENTS

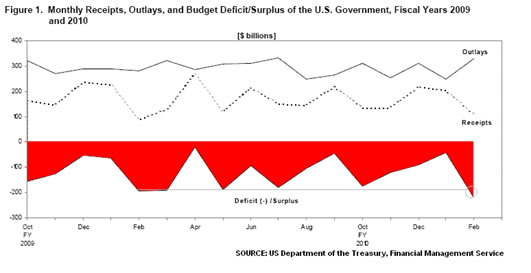

On April 14th the Financial Management Service, a bureau of the US Department of the Treasury released its Monthly Treasury Statement for March 2010. I was waiting for it because of what I saw in February - the gap between receipts and outlays was widening disturbingly.

I knew the US Treasury was going to have to pull a ‘rabbit out of a hat’ or we might see a similar scare in the US Treasury Auction, with a spike in treasury yields that occurred in Greece. What was reported was a mystery and for those that read Extend & Pretend: Gaming the US Tax Payer, I will call this Suspicious Clue #8.

SUSPICIOUS CLUE #8

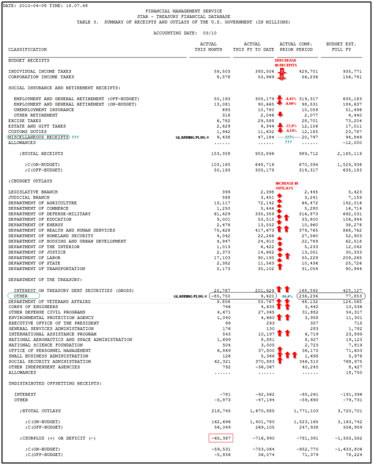

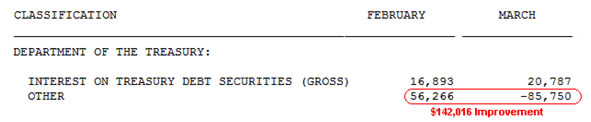

Click to Enlarge Link

The report shows US Treasury receipts were down disturbingly and almost all government outlays were up. I personally have had Profit & Loss responsibility on numerous occasions during my career and I would have been apprehensive facing the auditors or board of directors with such a blatant example of mismanagement. Absolutely no cuts in expenses, with falling revenues, all made to marginally appear better than the February report by a single line item called “other”. Executives get fired for such a report but governments just carry on until the inevitable crisis event finally occurs. Then the traditional blame game begins, blame is assigned and belated and poorly formulated policy responses are enacted.

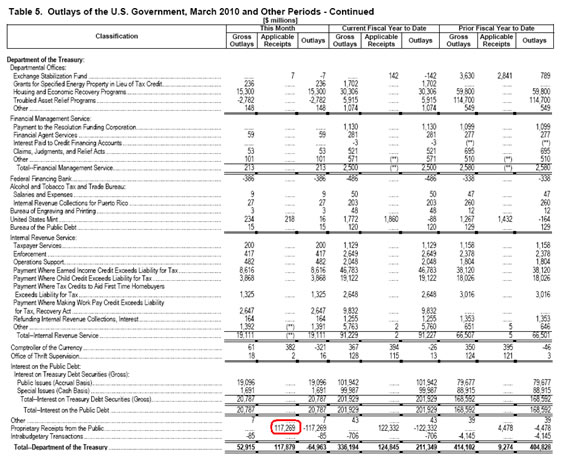

So what is this ‘other’? When you examine the Outlay Ledger of the Department of the Treasury for March 2010 (below) you see it to be a onetime item classified as a negative outlay. For the non accountants, this is a government receipt that is placed in the outlays as a negative amount, thereby showing government outlays to be smaller than they otherwise would have been. Though this is acceptable accounting it would lead to the wrong conclusions, unless you read the details buried in the back pages. This ‘other’ is referred to as a “Proprietary Receipt from the Public”.

An IRS document explains just what that means in an accounting context: "Proprietary Receipts from the Public are collections from outside the Government that are deposited in receipt accounts that arise as a result of the Government’s business-type or market-oriented activities. Among these are interest received, proceeds from the sale of property and products, charges for non-regulatory services, and rents and royalties."(2)

This is a $117.3 BILLION amount!! The total 2010 US Tax receipts for US Corporations is only budgeted to be $157 Billion!

My investigations suggest that it is likely TARP (Troubled Asset Relief Program) money being returned to the US Treasury, along with a slowdown in TARP issuance versus budget. Assuming this is the case, and not simply an aircraft carrier or two we have sold and are now leasing back, like California is doing with all state owned buildings, we still have a major problem. What happens next month? The TARP fund returns will stop or we will run out of aircraft carriers. Is unemployment going to surge or are corporate tax receipts going to expand by over $117B next month?

Timothy Geithner and the US Treasury somehow dodged the bullet because of ‘other’ this month. How does it look for next month for cash management? Let’s consider tax receipts to see if there is a possible ‘rabbit in the hat’ there.

TAX RECEIPTS

You personally met your April 15th tax filing deadline and you likely took some consolation in your tax frustrations by knowing you weren’t alone. The quiet truth is you are becoming more alone each year if you haven’t understood the new realities of the US Tax game. 47% of Americans (3) and two-thirds of US corporations (4) will pay no taxes in 2010. Where do you fit? These are pretty startling revelations to most of us and don’t bode well to fixing the monthly Treasury cash requirements quickly, especially with unemployment still stubbornly elevated.

PERSONAL INCOME TAX

The Associated Press reported on April 7th, 2010.

About 47 percent will pay no federal income taxes at all for 2009. Either their incomes were too low, or they qualified for enough credits, deductions and exemptions to eliminate their liability. That's according to projections by the Tax Policy Center, a Washington research organization.

In recent years, credits for low- and middle-income families have grown so much that a family of four making as much as $50,000 will owe no federal income tax for 2009, as long as there are two children younger than 17, according to a separate analysis by the consulting firm Deloitte Tax.

In recent years, credits for low- and middle-income families have grown so much that a family of four making as much as $50,000 will owe no federal income tax for 2009, as long as there are two children younger than 17, according to a separate analysis by the consulting firm Deloitte Tax.

Tax cuts enacted in the past decade have been generous to wealthy taxpayers, too, making them a target for President Barack Obama and Democrats in Congress. Less noticed were tax cuts for low- and middle-income families, which were expanded when Obama signed the massive economic recovery package last year.

The result is a tax system that exempts almost half the country from paying for programs that benefit everyone, including national defense, public safety, infrastructure and education. It is a system in which the top 10 percent of earners — households making an average of $366,400 in 2006 — paid about 73 percent of the income taxes collected by the federal government.

EXAMPLE

The family was entitled to a standard deduction of $11,400 and four personal exemptions of $3,650 apiece, leaving a taxable income of $24,000. The federal income tax on $24,000 is $2,769. With two children younger than 17, the family qualified for two $1,000 child tax credits. Its Making Work Pay credit was $800 because the parents were married filing jointly. The $2,800 in credits exceeds the $2,769 in taxes, so the family makes a $31 profit from the federal income tax. That ought to take the sting out of April 15.

With the government presently talking about once again extending unemployment benefits, it appears we have more downside than upside on the income tax revenue receipt line item going forward.

CORPORATE TAX

The Center for American Progress reported in 2004, while fighting President George W Bush’s further cuts in corporate taxation:

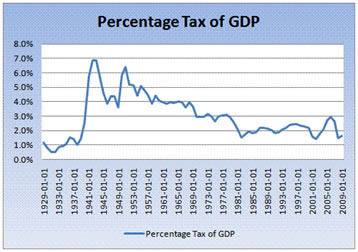

The news that more than 60 percent of U.S. corporations failed to pay any federal taxes from 1996 through 2000 when corporate profits were soaring and that corporate tax receipts had fallen to just 7.4 percent of overall federal tax revenue in 2003 – the lowest since 1983 and the second-lowest rate since 1934 – is an outrage. But it should come as no surprise to anyone who has been paying attention to national tax policy over the past few years. The General Accounting Office (GAO) report also found that an astonishing 94 percent of corporations reported tax liability of less than 5 percent of their total income during the same time period.

The last special General Accounting Office (GAO) study concerning corporate taxation was in 2004 and it showed:

The corporate income tax rate is ostensibly 35 percent, but companies are able to reduce their effective burden by claiming various deductions and credits. US companies paid an average of $11.88 (1.19 percent) in corporate taxes for every $1,000 in gross receipts, the study said.

The corporate income tax rate is ostensibly 35 percent, but companies are able to reduce their effective burden by claiming various deductions and credits. US companies paid an average of $11.88 (1.19 percent) in corporate taxes for every $1,000 in gross receipts, the study said.

Foreign-owned companies fared better in some respects than their US-based competitors. The report found that 71 percent of foreign-controlled corporations paid no taxes on their US income, while 89 percent had liabilities of less than 5 percent of their income.

The GAO didn't attempt to determine why so many companies were able to avoid paying taxes. It said possible explanations included legitimate deductions for current-year operating losses, losses carried forward from previous years, and sufficient credits to offset any tax liabilities. In addition, it said improper pricing of transactions between US and foreign operations could contribute to tax avoidance.

The percentage of federal tax collections paid by corporations has tumbled from a high of 39.8 percent in 1943 to a low of 7.4 percent last year. It ranged from 10 percent to 11 percent in 1996-2000, the period studied by the GAO.

Boston Globe 04-11-04

In 2005 the GAO issued another report. The Washington Post’s analysis in Many Firms didn’t pay Taxes highlighted:

About two-thirds of corporations operating in the United States did not pay taxes annually from 1998 to 2005. In 2005, after collectively making $2.5 trillion in sales, corporations gave a variety of reasons on their tax returns to account for the absence of taxable revenue. The most frequently listed included the cost of producing their goods, salary expenses and interest payments on their debt, the report said. The GAO did not analyze whether the firms had profits that should have been taxed.

Sen. Byron L. Dorgan (D-N.D.) called the findings "a shocking indictment of the current tax system."

"It's shameful that so many corporations make big profits and pay nothing to support our country," he said. "The tax system that allows this wholesale tax avoidance is an embarrassment and unfair to hardworking Americans who pay their fair share of taxes. We need to plug these tax loopholes and put these corporations back on the tax rolls."

Eric Toder, a senior fellow at the Urban Institute, said the vast majority of corporations are small businesses and start-ups that have adopted a corporate structure that allows them to lower their tax bills.

"I'm not trying to imply that there aren't tax-compliance issues among small corporations," he said. "But when you are talking about businesses that size, I would suspect the norm would be to not pay taxes, and there's nothing nefarious about that." Toder had not yet seen the GAO study.

A greater proportion of large corporations pay taxes, according to the GAO. In 2005, about 28 percent of large corporations paid no taxes. Of the 1.3 million corporations included in the study, 998 were categorized as "large."

Dorgan and Sen. Carl M. Levin (D-Mich.) requested the report out of concern that some corporations were using "transfer pricing" to reduce their tax bills. The practice allows multi-national companies to transfer goods and assets between internal divisions so they can record income in a jurisdiction with low tax rates.

The GAO said data on transfer pricing were scarce. Instead, it compared the percentages of foreign- and U.S.-controlled corporations that are paying taxes.

In general, the GAO found that slightly more foreign firms paid no taxes. From 1998 to 2005, 68 percent of foreign-controlled corporations sent nothing to the Internal Revenue Service, compared with 66 percent of U.S. companies. The report noted in an opening paragraph, however, that the GAO did not study whether the foreign companies were using transfer pricing.

Still, Levin said: "This report makes clear that too many corporations are using tax trickery to send their profits overseas and avoid paying their fair share in the United States."

It has only become worse, with President George W Bush tax cuts and corporate friendly tax policy. President Barack Obama has been preoccupied with spending to consider revenue receipts as a priority.

Additionally, offshore tax accounting is completely un-policed and highly secretive with approximately 30 countries serving as tax havens to help corporations avoid taxes. The addition of $605T derivatives market now makes it almost impossible to police global corporations from tax avoidance.

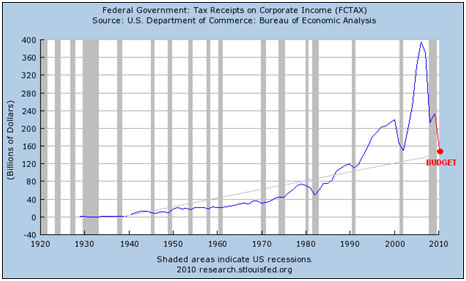

Below is the current Federal Reserve’s Tax Receipts on Corporate Income where I have added the budget expectation for 2010 of $156.7B. As you have already seen, we are presently falling behind last year’s rate of tax receipts.

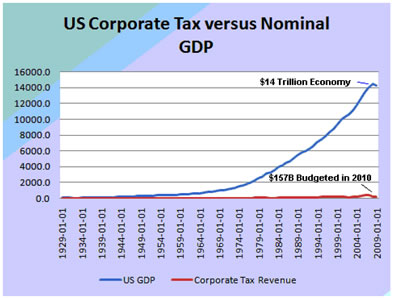

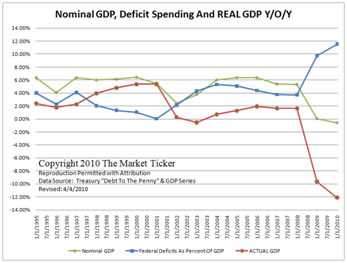

When we compare corporate tax receipts to Nominal GDP we see huge disparities that are now built into the US Corporate Taxation policy. When GDP was growing, US Taxation was not. The effective rates after loopholes and offshore accounting created the following results.

A HORRIFIC CHART

Corporate and Personal taxes are not going to materially fix the US Cash Crunch short term.

This alarming chart suggests one or more of three possibilities:

1- There is no relationship between corporate taxes and GDP.

2- Corporate pretax profits have seen near exponential growth over the last 30 years without being reflected in US taxes receipts.

3- Pretax corporate profits have become more and more an offshore phenomone.

In an analysis of taxes paid by 275 of the largest U.S. corporations, the liberal watchdog group Citizens for Tax Justice found that effective corporate tax rates have fallen by 20 percent since 2001, even as pretax profits jumped 26 percent. Between 2001 and 2003, the 275 companies paid taxes totaling 18.4 percent on their total profits, about half the 35 percent corporate income tax rate. Of the 275, 82 either paid no taxes or received large refunds in at least one of the past three years.

The Washington Post 12-26-04

Investors are operating under the notion that an improvement in the economy and employment will alleviate the pressures on the Treasury Auction. This notion I believe is misplaced. Though I am skeptical about significant improvements in either the economy or employment, this view is mute in comparison to what will actually be required to make a material difference to tax receipts. The problems described above are intractable without major congressional policy initiatives. Congress is presently doing nothing to address them. In fact they are headed in absolutely the opposite direction.

Investors are operating under the notion that an improvement in the economy and employment will alleviate the pressures on the Treasury Auction. This notion I believe is misplaced. Though I am skeptical about significant improvements in either the economy or employment, this view is mute in comparison to what will actually be required to make a material difference to tax receipts. The problems described above are intractable without major congressional policy initiatives. Congress is presently doing nothing to address them. In fact they are headed in absolutely the opposite direction.

So the question is even more difficult to answer. Where will tax receipts come from to keep the US Treasury from being forced to place accelerating supply on the monthly Treasury Auction?

DEBT ISSUANCE

I know many of you are saying we will just be forced to place more supply on the Treasury Auction and accept higher rates. As I mentioned earlier, the US has already moved down the duration curve steadily over the last few years to make increasing debt levels less onerous. It obviously comes with huge risk, considering interest rates are at all time historic lows.

If we were forced to refinance the national debt at 5.5% versus the average maturity of just over 2% shown above, we would have a serious problem. We need to place corporate tax receipts versus interest payment rate charges in perspective

$14T National Debt at 5.5% |

$770B |

$14 T National Debt @ a 3% difference |

$420B |

Total US Corporate Income Tax Budget for 2010 |

$157B |

This is too far out to be critical to our monthly cash management concerns, but is still a major strategic consideration affecting short term US Treasury Auction options. Closer in however, the US Treasury is obviously caught in a vise about not pushing rates up any faster than absolutely necessary for concern that in the not too distant future the very existence of the US and its ability to service its debt may be at stake.

CONCLUSION

The US cash management challenge is significant. Taking out this month’s ‘plug’ number, any surprises or further delays in economic rebound will likely trigger serious market reactions.

This story is not going to stop at the end of the year. There is inertia in the deterioration of credit metrics.” Moody’s Investor Services

SOURCES:

(1) 04-14-10 March 2010t Issue: Monthly Treasury Statement: Publications & Guidance: Financial Management Service

(2) 04-13-10 The incredible shrinking deficit Salon.com

(3) 04-07-10 Nearly half of US households escape fed income tax AP

(4) 04-11-04 Most US firms paid no income taxes in '90s Boston Globe

(5) 12-26-04 Corporate Taxes: Going, Going The Washington Post

For the complete research report go to: Extend & Pretend

Sign Up for the next release in the Extend & Pretend series: Commentary

The last Extend & Pretend article: EXTEND & PRETEND - Gaming the US Tax Payer

Gordon T Long gtlong@comcast.net Web: Tipping Points

Mr. Long is a former executive with IBM & Motorola, a principle in a high tech start-up and founder of a private Venture Capital fund. He is presently involved in Private Equity Placements Internationally in addition to proprietary trading that involves the development & application of Chaos Theory and Mandelbrot Generator algorithms.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that, we encourage you confirm the facts on your own before making important investment commitments.

© Copyright 2010 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or recommendation you receive from him.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.