Why Are U.S. Stocks and The U.S. Dollar Rising?

Stock-Markets / Financial Markets 2010 Apr 23, 2010 - 06:33 AM GMT Is the US dollar fundamentally flawed? We think so.

Is the US dollar fundamentally flawed? We think so.

Is the US economy fundamentally in trouble? We think so.

So why are these markets rising day after day, month after month? Before we answer that question we want to address the following error that we think the typical investor makes. Turn on the news and an investor will hear the exact reason the market rose or dropped on any given day. How can this be possible? When we hear these explanations we ask ourselves:

- Is it that simple? With trillions of dollars floating around the global markets how can the local news or an analyst so simply “enlighten” us by explaining exactly why the Dow Jones rose or fell.

- If analysts can conclude simple ‘cause and effect’ relationships between daily events and market movements, why can’t this same logic provide better forecasting results?

- Does that information help investors or distract investors and cause them to look in the wrong places for market movement insight?

It is our opinion that the markets are too large and too complex to explain short term movements with basic, every day events that make the news. We feel that following this kind of short term analysis leaves an investor confused, and constantly chasing meaningless leads.

We believe the following:

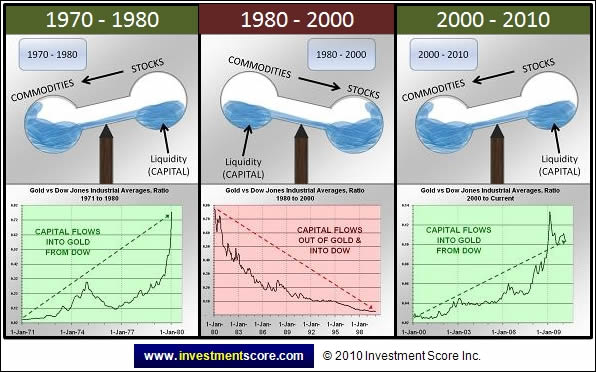

The investment markets move more like flowing water (capital) searching for lower ground (value). When a market has fallen out of favor and has fallen low enough, capital will flow in the direction of the undervalued market, causing it to rise.

FOR EXAMPLE:

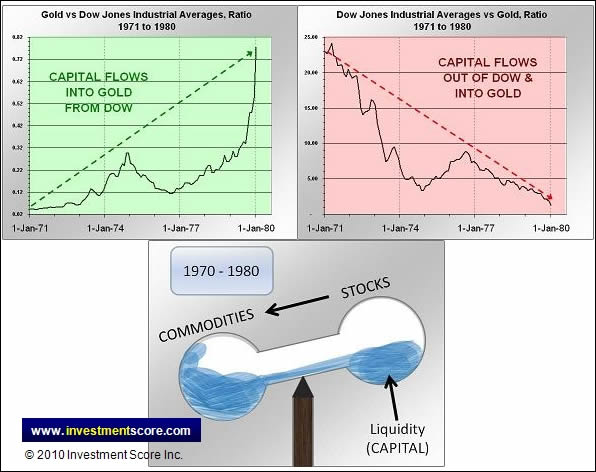

FROM 1970 – 1980:

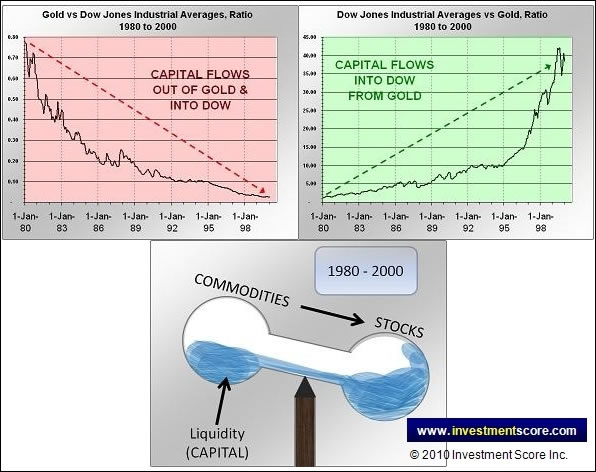

FROM 1980 – 2000:

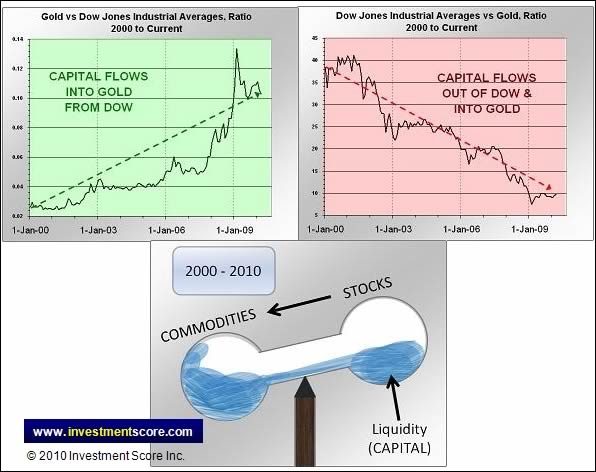

FROM 2000 – CURRENT:

CAPITAL FLOW SUMMARY:

So what does this mean and how can we profit from this understanding?

We are interested in where money is flowing from a long term and intermediate term perspective. Focusing on the big picture helps us to add capital to our positions near lower risk opportunities and it also helps prevent getting caught up in the short term, day to day “noise”.

So why are the US dollar and the various US stock markets rising?

In our opinion capital flows in and out of various markets similar to water splashing around in a pan. For example, the markets just experienced a massive, historic drop in 2008. The wave of capital rushing out of the market moved too far, too quickly. The result was a massive “splash back” as capital flooded back into the market, creating a sharp rise. Similarly the US dollar had been falling in value relative to nearly all currencies and assets for many years. Markets are cyclical and even the US dollar will not drop in a straight line. The result is a rebounding dollar that bounces higher as the Euro and other currencies take their cyclical turn lower. In the long term, fundamentals do drive the markets; however capital is constantly sloshing in and out of the markets on a short, intermediate and long term perspective.

It is our opinion that it is more important to watch where the money is flowing on a macro scale than what the next “Unemployment” or “CPI” figures are. We believe the commodities long term bull market is well in tact but that does not mean it will be heading up in a straight line; as markets never do. We have designed a series of proprietary indicators that are designed to help determine lower risk and higher reward opportunities from a long and intermediate term perspective.

To learn more about our service and to sign up for our free newsletter please visit us at www.investmentscore.com.

By Michael Kilback

Investmentscore.com

Investmentscore.com is the home of the Investment Scoring & Timing Newsletter. Through our custom built, Scoring and Timing Charts , we offer a one of a kind perspective on the markets.

Our newsletter service was founded on revolutionary insight yet simple principles. Our contrarian views help us remain focused on locating undervalued assets based on major macro market moves. Instead of comparing a single market to a continuously moving currency, we directly compare multiple major markets to one another. We expect this direct market to market comparison will help us locate the beginning and end of major bull markets and thereby capitalize on the largest, most profitable trades. We pride ourselves on cutting through the "noise" of popular opinion, media hype, investing myths, standard over used analysis tools and other distractions and try to offer a unique, clear perspective for investing.

Disclaimer: No content provided as part of the Investment Score Inc. information constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. None of the information providers, including the staff of Investment Score Inc. or their affiliates will advise you personally concerning the nature, potential, value or suitability or any particular security, portfolio of securities, transaction, investment strategy or other matter. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents may or may not own precious metals investments at any given time. To the extent any of the content published as part of the Investment Score Inc. information may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Investment Score Inc. does not claim any of the information provided is complete, absolute and/or exact. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents are not qualified investment advisers. It is recommended investors conduct their own due diligence on any investment including seeking professional advice from a certified investment adviser before entering into any transaction. The performance data is supplied by sources believed to be reliable, that the calculations herein are made using such data, and that such calculations are not guaranteed by these sources, the information providers, or any other person or entity, and may not be complete. From time to time, reference may be made in our information materials to prior articles and opinions we have provided. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously provided information and data may not be current and should not be relied upon.

Investmentscore.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.