Stock Market Trading Lessons From the 1998 Russian Debt Default

Stock-Markets / Stock Markets 2010 Apr 23, 2010 - 05:38 AM GMTBy: Steven_Vincent

I remember the 1998 Russian debt default crisis and the associated Long Term Capital Management collapse very well. I was a novice trader who found the bearish arguments of the time convincing. It was evident, they said, that the market was in a massive bubble based on debt and loose money and that it couldn't go on much longer before the whole thing blew up. All that was needed was the right catalyst. Not knowing yet that the trend is your friend, I lost money continually trying to short every rally.

I remember the 1998 Russian debt default crisis and the associated Long Term Capital Management collapse very well. I was a novice trader who found the bearish arguments of the time convincing. It was evident, they said, that the market was in a massive bubble based on debt and loose money and that it couldn't go on much longer before the whole thing blew up. All that was needed was the right catalyst. Not knowing yet that the trend is your friend, I lost money continually trying to short every rally.

When the Russian crisis struck I began to short heavily and made some remarkable gains for a time. In the end all my profits and my capital evaporated in the massive rally that came out of the shakeout.

The current situation surrounding Greece reminds me of the 1998 setup in many respects. Both events involve an extended, overbought bull run. Both involve scenarios that seemingly manifest the deflationist bear criteria for "the collapse". Both follow up scary financial panics (the 1998 affair was preceded by the 1997 Asian contagion crisis).

There are many differences of course. Today we are rallying against a 10 year bear trend after a historic financial panic and the move is only now being accepted as "real". In 1998 the market was well into a major, nearly continuous bull trend and it was broadly accepted with widespread public participation. And twelve years ago, Russia's debt troubles were primarily internal whereas Greece is much more involved in the international debt markets and the condition of global financial markets was not nearly as suspect then as it is today. Russia was clearly an isolated, primarily internal problem whereas the Greece troubles are part of a continent-wide European sovereign debt crisis.

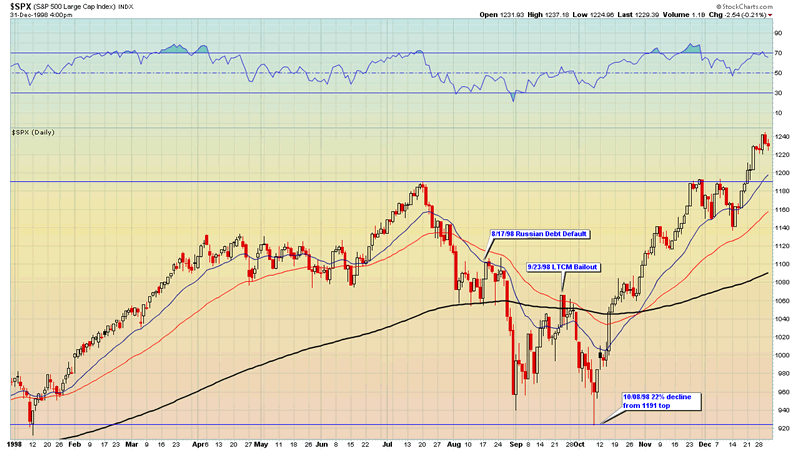

Interestingly, when the decline began in July the price of the S&P 500 was at nearly the same level that it finds itself today--1191.

The first indications of trouble in Russia came on March 23rd when a political crisis came to a head as Russian president Boris Yeltsin suddenly dismissed Prime Minister Viktor Chernomyrdin and his entire cabinet. After an extended, nearly continuous run off an early year bottom the first wave of fear rippled through the market and it began to falter.

On July 13, a $22.6 billion International Monetary Fund and World Bank financial package was approved on to support reforms and stabilize the Russian market by swapping out an enormous volume of the quickly maturing GKO short-term bills into long-term Eurobonds. As you can see from the chart, the market was not expecting IMF/World Bank intervention and was caught by surprise.

On August 17th, Russia announced the suspension of debt payments and other measures which amounted to sovereign debt default. A panic ensued, leading to a total 23% decline in under 2 months.

A month later, Long Term Capital Management collapsed as a result of the Russian crisis and was bailed out.

Does this scenario sound familiar? The Greek Tragedy unfolding on the world stage today has thus far followed the Russian script nearly to the letter.

In January the market topped as the Euro rolled over and the US Dollar surged on fears that Greece would default and trigger a European financial contagion. As in '98, the market quickly caught its footing and rallied nearly vertically to new highs. Are we now at a peak similar to that of July 1998?

This week the International Monetary Fund, the European Union and the Greek government are meeting to attempt to resolve the crisis. The consensus seems to be growing that there is no way for Greece to avoid using an IMF/EU bailout fund established last month, which would in effect be a sovereign debt default.

A default announcement could even come as soon as this weekend. Greek debt downgrades have become an almost daily event with the latest coming today from Moody's.

What can we expect when the news on Greece is announced? Will the analogy with the Russian crisis end there with a "buy the news" response? Indeed, there is potentially a setup which allows for this. In many ways the news is already out and may be priced in; this is in sharp contrast to the surprise of IMF/World Bank intervention in the Russian affair.

On the other hand, the markets are quite overextended and in all probability the only element missing from a good shakeout is an excuse. A Greece default would provide one, however anticipated. Most of the recent rise appears to be late, public money "piling on" and of course such positions are generally shaken out before the real move commences.

My guess as to a likely scenario: an initial mini-panic on the news which drives the SPX to a partial decline within the Ascending Broadening Wedge formation--a bullish setup for an quick reversal and breakout to new highs. Bulkowski's Encyclopedia of Chart Patterns estimates a 43% gain resulting from this setup. I would put a target of SPX 1150--the January high--on the partial decline. This would also retest the 38.2% Fibonacci retracement level from the February low as well as the 50 EMA. A more serious correction would take the SPX down to the 200 EMA and the 23.6% level from the entire bull run at the 1080-1090 zone.

In summation, I would not expect the fallout from a Greek default to result in a major trend reversal or shorting opportunity. Rather, it will more likely set up a good buying opportunity. I'm in cash.

Epilogue: Russia returned to the international debt market today for the first time since 1998 with the sale of $5.5 bln in bonds.

Generally these reports as well as twice weekly video reports are prepared for BullBear Trading Service members and then released to the general public on a time delayed basis. To get immediate access just become a member. It's easy and currently free of charge.

Disclosure: No current positions.

By Steve Vincent

The BullBear is the social network for market traders and investors. Here you will find a wide range of tools to discuss, debate, blog, post, chat and otherwise communicate with others who share your interest in the markets.

© 2010 Copyright Steven Vincent - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.