This is Important.. U.S. Treasury Bonds Reach Critical Level

Interest-Rates / US Bonds Apr 22, 2010 - 10:01 AM GMTBy: Marty_Chenard

If is wasn't so important, I wouldn't mention it a second time. But it is very important, and could be a "game changer" if we break above this long term resistance in the next few weeks ... so, please keep an eye on it.

If is wasn't so important, I wouldn't mention it a second time. But it is very important, and could be a "game changer" if we break above this long term resistance in the next few weeks ... so, please keep an eye on it.

What is it?

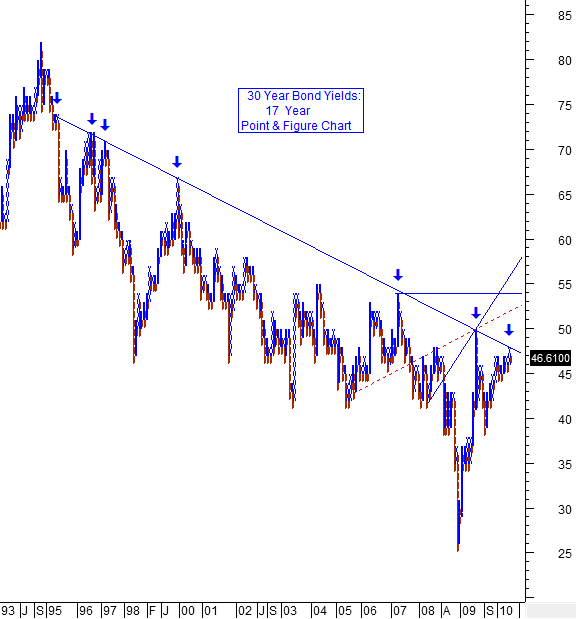

It is the 30 year bond yields ... symbol: TYX. Our comments are below ...

Bernanke and everyone in the White House will try to stop this from happening. If they can't, there will be real trouble ahead for the economy. Right now, the 30 year yields are at a MAJOR, 15 year testing point.

Below is an updated chart (as of 8:40 AM this morning) showing a 17 year down trend on 30 year bond yields. Its resistance line has had 7 touch points.

We are now at number 7, and international investors want to be paid higher interest for what they perceive to be an environment with much higher risks. That pressure makes this current test a MAJOR testing point.

Bernanke is sweating right now, because if he can't be successful at keeping interest rates down, the housing market will take another turn for the worse and foreclosures will keep rising. (Bernanke is trying to be very proactive in driving rates down right now. There is a lot of international pressure for higher rates coming in, so it will not be as easy as he thinks.)

If we break above the resistance line shown, we can expect interest rates to rise to a level that would increase monthly mortgage costs by 20% to 25% this year.

This could be one of the most significant events seen during the past few years.

** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.